FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

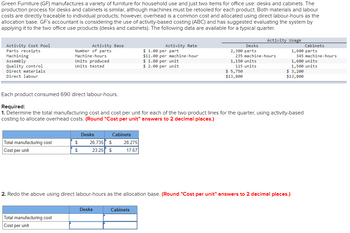

Transcribed Image Text:Green Furniture (GF) manufactures a variety of furniture for household use and just two items for office use: desks and cabinets. The

production process for desks and cabinets is similar, although machines must be retooled for each product. Both materials and labour

costs are directly traceable to individual products; however, overhead is a common cost and allocated using direct labour-hours as the

allocation base. GF's accountant is considering the use of activity-based costing (ABC) and has suggested evaluating the system by

applying it to the two office use products (desks and cabinets). The following data are available for a typical quarter.

Activity Cost Pool

Parts receipts

Machining

Assembly

Quality control

Direct materials

Direct labour

Total manufacturing cost

Cost per unit

Activity Base

Number of parts

Machine-hours

Units produced

Units tested

Total manufacturing cost

Cost per unit

$

$

Desks

26,735 $

23.25 $

Cabinets

Desks

28,275

17.67

Activity Rate

$1.00 per part

$11.00 per machine-hour

Each product consumed 690 direct labour-hours.

Required:

1. Determine the total manufacturing cost and cost per unit for each of the two product lines for the quarter, using activity-based

costing to allocate overhead costs. (Round "Cost per unit" answers to 2 decimal places.)

$ 1.80 per unit

$ 2.00 per unit

Cabinets

Desks

2,300 parts

235 machine-hours.

1,150 units

115 units

Activity Usage

$ 5,750

$13,800

2. Redo the above using direct labour-hours as the allocation base. (Round "Cost per unit" answers to 2 decimal places.)

Cabinets

1,600 parts

345 machine-hours

1,600 units

1,500 units

$3,200

$13,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system Driver and guard wages Vehicle operating expense Vehicle depreciation. Customer representative salaries and i expenses office expenses Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses Administrative expenses Total cost The distribution of resource consumption across the activity cost pools is as follows. Pickup and Delivery 35% 5% $1,000,000 510,000 390,000 Driver and guard wages Vehicle…arrow_forwardNobel Ltd adopts process costing rather than job costing. Which of the following statement could explain why? a. Nobel Ltd produces units according to customer specifications. b. Nobel Ltd wants to track the cost of material, labour and overhead to specific customers. c. Nobel Ltd wants to assign overhead using machine hours as the allocation base. d. Nobel Ltd manufactures virtually identical products using a series of continuous processes.arrow_forwardWhich of the following statements is true? O The first step in activity-based costing is to assign overhead costs to products using cost drivers ABC usually results in less appropriate management decisions Activity-based costing allocates overhead to multiple activity cost pools and assigns the cost pools to products using cost drivers O Traditional costing systems use multiple predetermined overhead ratesarrow_forward

- Which of the three methods (Single Plant wide factory overhead rate, Multiple production department rate, and Activity based costing method) for allocating factory overhead cost to products is better?arrow_forwardMirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing Supervising Other Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data appear below: Product MO Product M5 Total $ 3,800 $ 23,800 $ 10,400 MHs (Processing) 9,700 300 10,000 Sales (total) Direct materials (total) Direct labor (total) Batches (Supervising) 500 500 1,000 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product Mº $ 74,100 $ 28,500 $ 27,800 Product M5 $ 89,900 $ 31,400 $ 41,700arrow_forwardWhen a company implements activity-based costing, manufacturing overhead cost is often shifted from low volume products to high volume products, with a higher unit cost resulting for the high volume products. Please explain (True or False) thoroughly.arrow_forward

- Activity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forwardActivity-based costing (ABC) is a costing technique that uses a two-stage allocation process. Which of the following statements best describes these two stages? Multiple Choice Direct costs are allocated to the production departments based on a predetermined overhead rate. The costs are assigned to departments, and then to the products based upon their use of activity resources. The costs are assigned to activities, and then to the products based upon their use of the activities. Indirect costs are assigned to activities, and then to the products based upon the direct cost resources used by the activities.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education