Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 21.27E

Payback and

- 1. Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects.

Required

- a. What are the benefits and limitations of using the payback method to choose between projects?

- b. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose?

- 2. Bart thinks that projects should be selected based on their NPVs. Assume all

cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes. - 3. Which projects, if any, would you recommend funding? Briefly explain why.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(Ignore income taxes in this problem.) The management of Rose Corporation is investigating the purchase of a

new satellite routing system with a useful life of 7 years. The company uses a discount rate of 8% in its capital

budgeting. The net present value of the investment, excluding its intangible benefits, is -$607,020.

Required:

How large would the additional cash flow per year from the intangible benefits have to be to make the

investment in the automated equipment financially attractive?

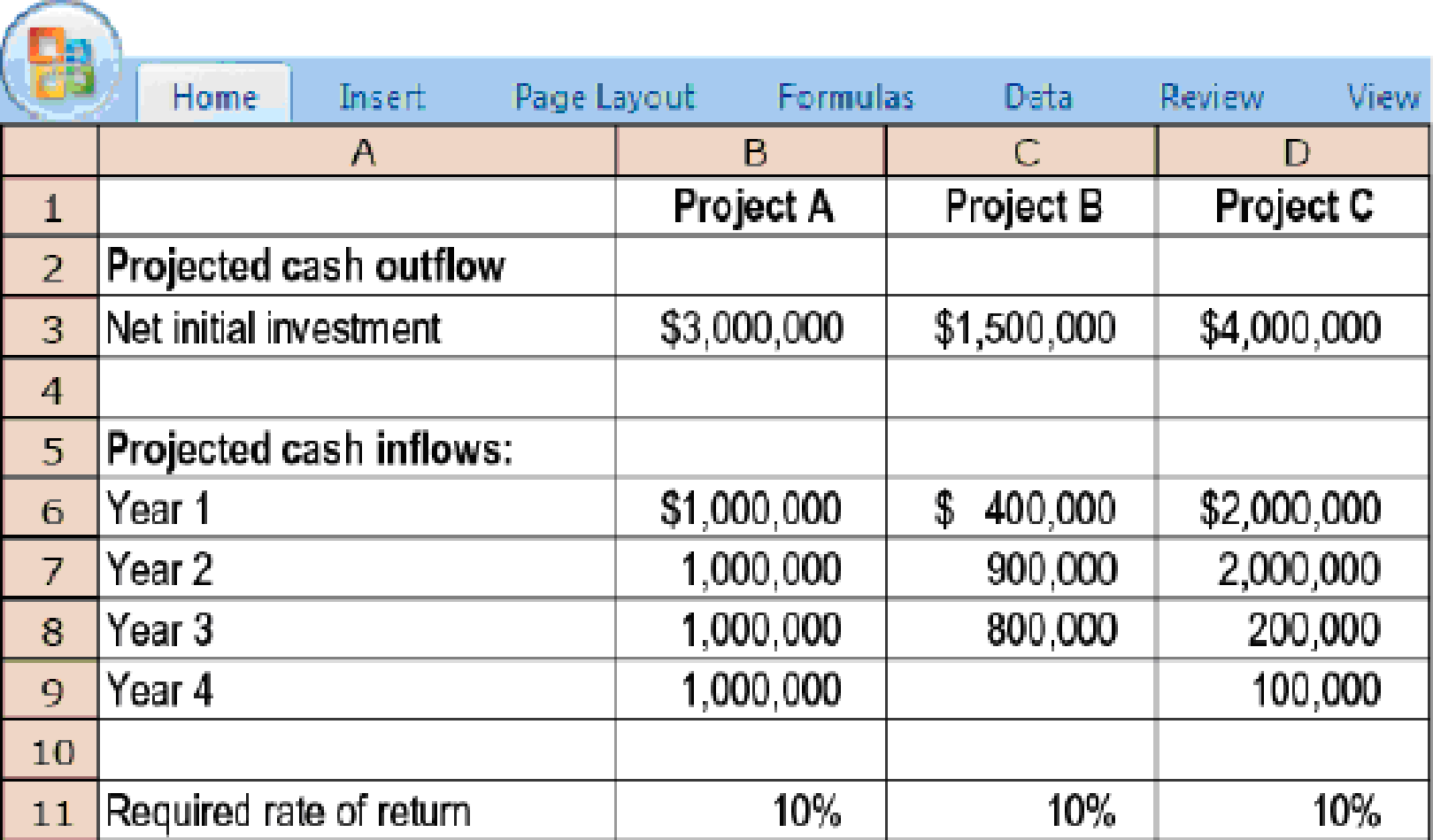

Halls Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Lisa Bickerson, staff analyst at Halls, is preparing an analysis of the three projects unde

consideration by Conan Halls, the company's owner.

(Click the icon to view the data for the three projects.)

(Click the icon to view the Future Value of $1 factors.)

(Click the icon to view the Future Value of Annuity of $1 factors.)

(Click the icon to view the Present Value of $1 factors.)

(Click the icon to view the Present Value of Annuity of $1 factors.)

Read the requirements.

Requirement 1. Because the company's cash is limited, Halls thinks the payback method should be used to choose between the capital budgeting projects.

Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.)

i

Data Table

Project A

years

Project B

years

Project C

years

Project A…

Halls Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited

$5,000,000 for the year. Lisa Bickerson, staff analyst at Halls, is preparing an analysis of the three projects under consideration by Conan Halls,

the company's owner.

(Click the icon to view the data for the three projects.)

(Click the icon to view the Future Value of $1 factors.)

(Click the icon to view the Future Value of Annuity of $1 factors.)

(Click the icon to view the Present Value of $1 factors.)

(Click the icon to view the Present Value of Annuity of $1 factors.)

Read the requirements.

Requirement 1. Because the company's cash is limited, Halls thinks the payback method should be used to choose between the capital budget

projects.

Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.)

Project A

years

Project B

years

Project C

years

Using the payback method,…

Chapter 21 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 21 - Capital budgeting has the same focus as accrual...Ch. 21 - List and briefly describe each of the five stages...Ch. 21 - Prob. 21.3QCh. 21 - Only quantitative outcomes are relevant in capital...Ch. 21 - How can sensitivity analysis be incorporated in...Ch. 21 - Prob. 21.6QCh. 21 - Describe the accrual accounting rate-of-return...Ch. 21 - Prob. 21.8QCh. 21 - Lets be more practical. DCF is not the gospel....Ch. 21 - All overhead costs are relevant in NPV analysis....

Ch. 21 - Prob. 21.11QCh. 21 - Distinguish different categories of cash flows to...Ch. 21 - Prob. 21.13QCh. 21 - How can capital budgeting tools assist in...Ch. 21 - Distinguish the nominal rate of return from the...Ch. 21 - A company should accept for investment all...Ch. 21 - Prob. 21.17MCQCh. 21 - Which of the following statements is true if the...Ch. 21 - Prob. 21.19MCQCh. 21 - Nicks Enterprises has purchased a new machine tool...Ch. 21 - Prob. 21.21ECh. 21 - Capital budgeting methods, no income taxes. Yummy...Ch. 21 - Capital budgeting methods, no income taxes. City...Ch. 21 - Prob. 21.24ECh. 21 - Capital budgeting with uneven cash flows, no...Ch. 21 - Comparison of projects, no income taxes. (CMA,...Ch. 21 - Payback and NPV methods, no income taxes. (CMA,...Ch. 21 - DCF, accrual accounting rate of return, working...Ch. 21 - Prob. 21.29ECh. 21 - Prob. 21.30ECh. 21 - Project choice, taxes. Klein Dermatology is...Ch. 21 - Prob. 21.32ECh. 21 - Selling a plant, income taxes. (CMA, adapted) The...Ch. 21 - Prob. 21.36PCh. 21 - NPV and AARR, goal-congruence issues. Liam...Ch. 21 - Payback methods, even and uneven cash flows. Sage...Ch. 21 - Replacement of a machine, income taxes,...Ch. 21 - Recognizing cash flows for capital investment...Ch. 21 - NPV, inflation and taxes. Fancy Foods is...Ch. 21 - NPV of information system, income taxes. Saina...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of a special equipment for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: 1. How much is the after tax cash flows of Project 1? 2. How much is the net benefit of investing in Project 2?arrow_forwardThe senior VP in charge has asked that you make a recommendation for the purchase of new equipment.Ideally, the company wants to limit its capital investment to $500,000. However, if an asset meritsspending more, an investment exceeding this limit may be considered. You assemble a team to helpyou. Your goal is to determine which option will result in the best investment for the company. Toencourage capital investments, the government has exempted taxes on profits from new investments.This legislation is to be in effect for the foreseeable future.The average reported operating income for the company is $1,430,500.The company uses an 11% discount rate in evaluating capital investments.The team is considering the following optionsOption 1:The asset cost is $300,000.The asset is expected to have an 8-year useful life with no salvage value.Straight-line depreciation is used.The net cash inflow is expected to be $62,000 each year for 8 years.A significant portion of this asset is made from…arrow_forwardEach of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $1,650,000 and will last 10 years. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $230,000. She estimates that the return from owning her own shop will be $55,000 per year. She estimates that the shop will have a useful life of 6 years. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a…arrow_forward

- Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,700,000 and will last 10 years. Evee Cardenas is interested in investing in a women’s specialty shop. The cost of the investment is $270,000. She estimates that the return from owning her own shop will be $52,500 per year. She estimates that the shop will have a useful life of 6 years. Barker Company calculated the NPV of a project and found it to be $63,900. The project’s life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. 2. Conceptual Connection: Assuming a required rate of return of 8%, calculate the NPV for Evee Cardenas' investment. Round to the nearest dollar. If required, round all present value calculations to the…arrow_forwardEach of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,700,000 and will last 10 years. Evee Cardenas is interested in investing in a women’s specialty shop. The cost of the investment is $270,000. She estimates that the return from owning her own shop will be $52,500 per year. She estimates that the shop will have a useful life of 6 years. Barker Company calculated the NPV of a project and found it to be $63,900. The project’s life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar.$ Should the company buy the new welding…arrow_forwardAnderson Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales Revenue: 5 million Operating Cost: 4 million Interest Expense: 3 million The company has a 25% tax rate, and its WACC is 11%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 1. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. 2. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $arrow_forward

- Dalrymple Inc. is considering production of a new product. In evaluating whether to go ahead with the project, which of the following items should be considered when cash flows are estimated? If the item should not be included, explain why not.A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.B) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.C) The company has spent for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.D) The new product will cut into sales of some of the firm's other products.E) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million…arrow_forwardRequired information [The following information applies to the questions displayed below.] Metro Car Washes, Inc. is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 0 1 2 3 4 5 Initial Cost and Book Value $345,000 230,000 138,000 69,000 23,000 0 Annual Net After-Tax Cash Flows $162,000 141,000 120,000 99,000 78,000 Annual Net Income $47,000 49,000 51,000 53,000 55,000 Management uses a 14 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the project's payback period. Assume that the cash flows in…arrow_forward! Required information [The following information applies to the questions displayed below.] Metro Car Washes, Inc. is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 0 1 2 3 4 5 Initial Cost and Book Value $315,000 210,000 126,000 63,000 21,000 0 Annual Net After-Tax Cash Flows $138,000 119,000 100,000 81,000 62,000 3. Compute the proposal's net present value. Annual Net Income Management uses a 12 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Answer is complete but not entirely correct. Net present $ 70,475 X…arrow_forward

- Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues Operating costs Interest expense The company has a 25% tax rate, and its WACC is 12%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ $20 million 16 million 1 million b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $arrow_forwardMitchell Company is considering an investment in a new machine. Managers at the company are uncertain about the economic life of the machine, because of the speed of innovation in the technology. The machine requires an investment of $1.60 million. After-tax cash flows are estimated to be $455,711 each year the machine is operating (and not obsolete). The company uses a 14 percent discount rate in evaluating capital investments. Use Exhibit A.9. Required: What is the minimum economic life of the machine (in whole years) that would be required for it to have a positive net present value? Required: What is the minimum economic life of the machine (in whole years) that would be required for it to have a positive net present value?arrow_forwardEdelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License