Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 8P

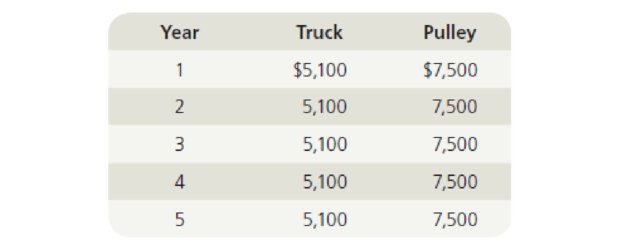

Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including

Calculate the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the

pulley system is $22,430. The firm's cost of capital is 14%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1.

$5,100

$7,500

5,100

7,500

5,100

7,500

5,100

7,500

5

5,100

7,500

Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to

two decimal places. Use a minus sign to enter negative values, if any.

Truck

Pulley

Value

Decision

Value

Decision

IRR

%

Аcсept

%

Reject

%24

$

NPV

-Select- V

|-Select- v

MIRR

-Select- v

%

|-Select- v

Jacob’s Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $39,500, and that for the pulley system is $94,800. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1

$12,500

$31,000

2

12,500

31,000

3

12,500

31,000

4

12,500

31,000

5

12,500

31,000

Requirements:

Calculate the IRR, the NPV, Payback and Discounted Payback Periods for each project and indicate the correct accept/reject decision for each.

2. You are the project manager for Becker Enterprises, LTD. and have been asked to analyze two alternatives for the company’s newest plastics The two alternatives, A and B, will perform the same task, but Alternative A will cost $80,000 to purchase while Alternative B will cost only $55,000. Moreover, the two alternatives…

Jason Corporation is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is Rs 17.1 million, and that for the pulley system is Rs 22.43 million. The firm’s cost of capital is 15 percent. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1

Rs in million

5.1

Rs in million

$6.5

2

5.5

7.0

3

5.0

7.5

4

6.0

8.0

5

7.0

8.5

Required:

Calculate for each:

a) Internal Rate of Return,

b) Net Present Value,

c) Modified Internal Rate of Return, reinvestment rate is 10%

d) Payback Period,

e) Discounted Payback Period

f) Indicate the correct accept/reject decision for each project.

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Postman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Required: Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forward

- Manzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?arrow_forwardAnderson Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales Revenue: 5 million Operating Cost: 4 million Interest Expense: 3 million The company has a 25% tax rate, and its WACC is 11%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 1. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. 2. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $arrow_forwardCalculate the NPV for the following project, assuming that the cost of capital is 15 percent and that the initial after tax cost of starting the project is $5,000,000. Assume that it will provide after-tax operating cash inflows as shown below:Year 1: $1,800,000 Year 2: $1,900,000 Year 3: $1,700,000 Year 4: $1,300,000 Calculate the IRR for the following project. The initial after tax cost is $5,000,000. The project is expected to provide after-tax operating cash inflows of $1,800,000 in year 1, $1,900,000 in year 2, $1,700,000 in year 3 and $1,300,000 in year 4? Calculate the IRR for the following project. Assume that its initial after tax cost is $5,000,000 and it is expected to provide after-tax operating cash flows of ($1,800,000) in year 1, $2,900,000 in year 2, $2,700,000 in year 3 and $2,300,000 in year 4?arrow_forward

- Kansas furniture Corporation (KFC) is evaluating a capital budgeting project that costs $34,000 and is expected to generate after-tax cash flows equal to $14,150 per year for three years. KFC's required rate of return is 12 percent. Compute the projects (a) net present value (NPV) and (b) internal rate of return (IRR). (c) Should the project be purchased?arrow_forwardBellinger Industries is considlening two projects. for inclusion in its capital budget, and you have been asked to do the analysis. both projects' after-tax- cash flows are shown on the time line below. Doppreciation, Salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both Projects have 4- year lives, and they have risk characteristics Similar to the firm's average project. Bellinger's WACC is 7% B O 1 + 600 415 -1,050 -1,050 200 What 2 + 3 280 430 350 4 ㅓ 330 Project A -780 Project B is Project A's pay back? years What is Project A's discaunted payback? years wie What is Project B's payback years What is Project B's discaunted pasback? yearsarrow_forwardColsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 1 million The company has a 25% tax rate, and its WACC is 14%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $arrow_forward

- Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 2 million The company has a 25% tax rate, and its WACC is 14%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar.$ If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $ .arrow_forwardColsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 13%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 1. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ 2. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $.arrow_forwardNicholson Roofing Materials, Inc., is considering two mutually exclusive projects, that both cost $170,000. The company's board of directors has set a 4-year payback requirement the cost of capital is 11%. The project cash flows are shown in the following table attached. a. Calculate the payback period for each project. Rank the projects by payback period. b. Calculate the NPV of each project. Rank the project by NPV. c. Calculate the IRR of each project. Rank the project by IRR. d. Make a recommendation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License