Fundamentals of Financial Accounting

5th Edition

ISBN: 9780078025914

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.9E

Inferring Investing and Financing Transactions and Preparing a

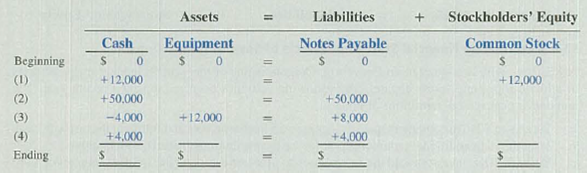

Home Comfort Furniture Company completed four transactions with the dollar effects indicated in the following schedule:

Required:

- 1. Write a brief explanation of transactions (1) through (4). Explain any assumptions that you made.

- 2. Compute the ending balance in each account.

- 3. Has most of the financing for Home Comfort’s investments in assets come from liabilities or stockholders’ equity?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the tax liability that appears on the balance sheet for this year of this financial accounting question?

A company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made. Need answer

What is the yield to maturity of the bond on these financial accounting question?

Chapter 2 Solutions

Fundamentals of Financial Accounting

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 2.1MECh. 2 - Prob. 2.2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 2.4MECh. 2 - Prob. 2.5MECh. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 2.13MECh. 2 - Prob. 2.14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 2.16MECh. 2 - Prob. 2.17MECh. 2 - Prob. 2.18MECh. 2 - Prob. 2.19MECh. 2 - Prob. 2.20MECh. 2 - Prob. 2.21MECh. 2 - Prob. 2.22MECh. 2 - Prob. 2.23MECh. 2 - Prob. 2.24MECh. 2 - Prob. 2.25MECh. 2 - Prob. 2.1ECh. 2 - Prob. 2.2ECh. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.5ECh. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 2.7ECh. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.2PBCh. 2 - Prob. 2.3PBCh. 2 - Prob. 2.1SDCCh. 2 - Prob. 2.2SDCCh. 2 - Prob. 2.4SDCCh. 2 - Prob. 2.5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting 5.2arrow_forwardMorgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.arrow_forwardSolve this financial accounting problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License