Fundamentals of Financial Accounting

5th Edition

ISBN: 9780078025914

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.12E

Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet

Laser Delivery Services. Inc. (LDS) was incorporated January 1. The following transactions occurred during the year:

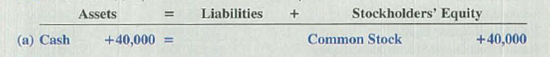

- a. Received $40,000 cash from the company’s founders in exchange for common stock.

- b. Purchased land for $12,000, signing a two-year note (ignore interest).

- c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest).

- d. Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks.

- e. Stockholder Jonah Lee paid $300,000 cash for a house for his personal use.

Required:

- 1. Analyze each item for its effects on the

accounting equation of LDS for the year ended December 31.

TIP: Transaction (a) is presented below as an example.

TIP: The new motor in transaction (d) is treated as an increase to the cost of the truck.

- 2. Record the effects of each item using a

journal entry .

TIP: Use the simplified journal entry format shown in the demonstration case on page 69.

- 3. Summarize the effects of the journal entries by account, using the T-account format shown in the chapter.

- 4. Prepare a classified balance sheet for LDS at December 31.

- 5. Using the balance sheet, indicate whether LDS’s assets at the end of the year were financed primarily by liabilities or stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions apply to Pecan Co. for Year 1, its first year of operations:

1. Received $40,000 cash in exchange for issuance of common stock.

2. Secured a $111,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $15,081.

3. Purchased land for $25,000.

4. Provided services for $80,000.

5. Paid other operating expenses of $49,000.

6. Paid the annual payment on the loan.

Required

a. Organize the transaction data in accounts under an accounting equation.

b. Prepare an income statement and balance sheet for Year 1.

c. What is the interest expense for Year 2? Year 3?

Complete this question by entering your answers in the tabs below.

Req B Inc

Stmt

Req B Bal

Sheet

Req A

Reg C

Prepare a balance sheet for Year 1.

PECAN COMPANY

Balance Sheet

As of December 31, Year 1

Assets

Determine the dollar effect on the accounting equation (increase or decrease assets, liabilities, or stockholders’ equity) from the following separate transactions.

a. Dillon contributes $4,000 of cash to his corporation in exchange for common stock.

b. Cowboy Corporation purchases equipment with a 10-year note payable for $1,600.

c. Queen Bee pays off $1,300 of accounts payable.

The following transactions apply to Pecan Co. for Year 1, its first year of operations:

1. Received $33,000 cash in exchange for issuance of common stock.

2. Secured a $101,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $13,723.

3. Purchased land for $27,000.

4. Provided services for $95,000.

5. Paid other operating expenses of $49.000.

6. Paid the annual payment on the loan.

Required

a. Organize the transaction data in accounts under an accounting equation.

b. Prepare an income statement and balance sheet for Year 1.

c. What is the interest expense for Year 2? Year 3?

Complete this question by entering your answers in the tabs below.

Req A

Req B Inc

Stmt

Req B Bal

Sheet

Req C

Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there

is no effect on the Account Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.)

Chapter 2 Solutions

Fundamentals of Financial Accounting

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 2.1MECh. 2 - Prob. 2.2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 2.4MECh. 2 - Prob. 2.5MECh. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 2.13MECh. 2 - Prob. 2.14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 2.16MECh. 2 - Prob. 2.17MECh. 2 - Prob. 2.18MECh. 2 - Prob. 2.19MECh. 2 - Prob. 2.20MECh. 2 - Prob. 2.21MECh. 2 - Prob. 2.22MECh. 2 - Prob. 2.23MECh. 2 - Prob. 2.24MECh. 2 - Prob. 2.25MECh. 2 - Prob. 2.1ECh. 2 - Prob. 2.2ECh. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.5ECh. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 2.7ECh. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.2PBCh. 2 - Prob. 2.3PBCh. 2 - Prob. 2.1SDCCh. 2 - Prob. 2.2SDCCh. 2 - Prob. 2.4SDCCh. 2 - Prob. 2.5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journal Entries Following is a list of transactions entered into during the first month of operations of Gardener Corporation, a new landscape service. Prepare in journal form the entry to record each transaction. April 1: Articles of incorporation are filed with the state, and 100,000 shares of common stock are issued for $100,000 in cash. April 4: A six-month promissory note is signed at the bank. Interest at 9% per annum will be repaid in six months along with the principal amount of the loan of $50,000. April 8: Land and a storage shed are acquired for a lump sum of $80,000. On the basis of an appraisal, 25% of the value is assigned to the land and the remainder to the building. April 10: Mowing equipment is purchased from a supplier at a total cost of $25,000. A down payment of $10,000 is made, with the remainder due by the end of the month. April 18: Customers are billed for services provided during the first half of the month. The total amount billed of $5,500 is due within ten days. April 27: The remaining balance due on the mowing equipment is paid to the supplier. April 28: The total amount of $5,500 due from customers is received. April 30: Customers are billed for services provided during the second half of the month. The total amount billed is $9,850. April 30: Salaries and wages of $4,650 for the month of April are paid.arrow_forwardStatement of Cash Flows Colorado Corporation was organized at the beginning of the year, with the investment of $250,000 in cash by its stockholders. The company immediately purchased an office building for $300,000, paying $210,000 in cash and signing a three-year promissory note for the balance. Colorado signed a five-year, $60,000 promissory note at a local bank during the year and received cash in the same amount. During its first year, Colorado collected $93,970 from its customers. It paid $65,600 for inventory, $20,400 in salaries and wages, and another $3,100 in taxes. Colorado paid $5,600 in cash dividends. Required Prepare a statement of cash flows for the year. What does this statement tell you that an income statement does not?arrow_forwardProvide journal entries to record each of the following transactions. For each, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. Paid $22,000 cash on bonds payable. B. Collected $12,600 cash for a note receivable. C. Declared a dividend to shareholders for $16,000, to be paid in the future. D. Paid $26,500 to suppliers for purchases on account. E. Purchased treasury stock for $18,000 cash.arrow_forward

- Discuss how each of the following transactions for Watson, International, will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. An investor invests an additional $25,000 into a company receiving stock in exchange. B. Services are performed for customers for a total of $4,500. Sixty percent was paid in cash, and the remaining customers asked to be billed. C. An electric bill was received for $35. Payment is due in thirty days. D. Part-time workers earned $750 and were paid. E. The electric bill in C is paid.arrow_forwardAssume that Denis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock. 2. Discount on Bonds Payable. 3. Treasury Stock (at cost). 4. Notes Payable (short-term). 5. Raw Materials. 6. Preferred Stock Investments (long-term). 7. Unearned Rent Revenue. 8. Work in Process. 9. Copyrights. 10. Buildings. 11. Notes Receivable (short-term). 12. Cash. 13. Salaries and Wages Payable. 14. Accumulated Depreciation—Buildings. 15. Restricted Cash for Plant Expansion. 16. Land Held for Future Plant Site. 17. Allowance for Doubtful Accounts. 18. Retained Earnings. 19. Paid-in Capital in Excess of Par—Common Stock. 20. Unearned Subscriptions Revenue. 21. Receivables—Officers (due in one year). 22. Inventory (finished goods). 23. Accounts Receivable. 24. Bonds Payable (due in 4 years). 25. Noncontrolling Interest. Instructions Prepare a classified balance sheet in good form. (No monetary amounts…arrow_forwardFor each of the transactions in M2 - 9 (including the sample), write the journal entry using the format shown in this chapter (omit explanations). M2 - 9 (Sample) Borrowed $3,940 from a local bank on a note due in six months. Received $4, 630 cash from investors and issued common stock to them. Purchased $1,000 in equipment, paying $200 cash and promising the rest on a note due in one year. Paid $300 cash for supplies. Bought and received $700 of supplies on account. LO 2 - 3arrow_forward

- Park & Company was recently formed with a $6,400 investment in the company by stockholders in exchange for common stock. The company then borrowed $3,400 from a local bank, purchased $1,140 of supplies on account, and also purchased $6,400 of equipment by paying $2,140 in cash and signing a promissory note for the balance. Based on these transactions, the company's total assets are: Multiple Choice $9,800. $15,200. $12,800. $11,940.arrow_forwardOn December 1, Williams Company borrowed $50,000 cash from Second National Bank by signing a 90-day, 5% note payable. a. Prepare Williams' journal entry to record the issuance of the note payable. b. Prepare Williams' journal entry to record the accrued interest due at December 31. C. Prepare Williams' journal entry to record the payment of the note on March 1 of the next year. Essay Toolbar navigation BIUS = 山 EE三、arrow_forwardPomona, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $30,000, 60 day, six percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received an $18,000, 120 day, seven percent note from B. Shore Company on account. Dec.16 Received a $14,400, 45 day, eight percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore’s account as uncollectible. Ponoma, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $24,500. An analysis of aged receivables indicates that the desired balance of the allowance account should be $21,300. Dec.31 Made the appropriate adjusting entries for interest. RequiredRecord the…arrow_forward

- Question: The following transactions apply to Ozark Sales for Year 1: 1. The business was started when the company received $48,500 from the issue of common stock. 2. Purchased equipment inventory of $175,000 on account. 3. Sold equipment for $204,500 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $129,500. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales. 5. Paid the sales tax to the state agency on $154,500 of the sales. 6. On September 1, Year 1, borrowed $21,500 from the local bank. The note had a 6 percent interest rate and matured on March 1, Year 2. 7. Paid $5,700 for warranty repairs during the year. 8. Paid operating expenses of $56,000 for the year. 9. Paid $124,100 of accounts payable. 10. Recorded accrued interest on the note issued in transaction no. 6. 1. Prepare the income statement for Year 1. 2.…arrow_forwardOn May 1, Year 1, Benz's Sandwich Shop loaned $10,000 to Mark Henry for one year at 6 percent interest. Required a. What is Benz's interest income for Year 1? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry?arrow_forwardOn May 1, Year 1, Benz's Sandwich Shop loaned $12,000 to Mark Henry for one year at 7 percent interest. Required a. What is Benz's interest income for Year 1? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry? (For all requirements, round your answers to the nearest dollar amount.) а. Int est income b. Receivables C. d. Interest income e. Cash f. g. Interest earnedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY