Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 1AIC

Starbucks

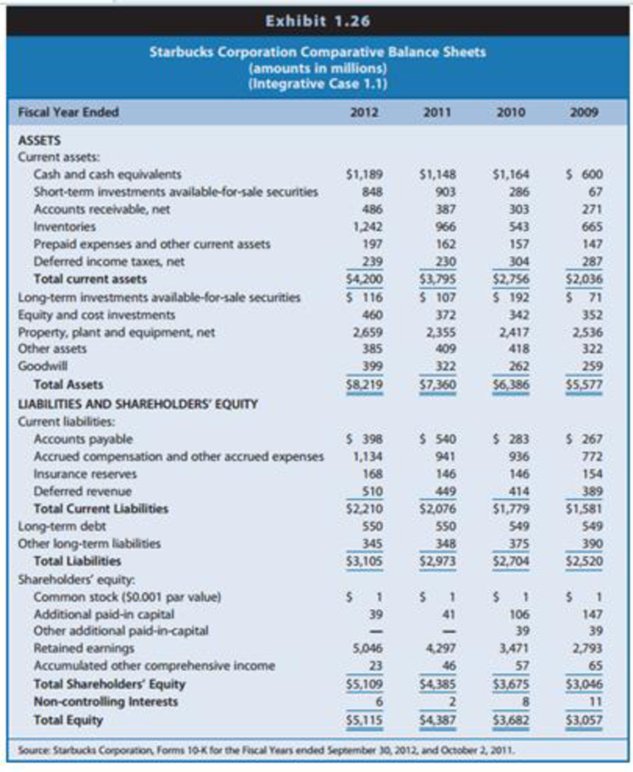

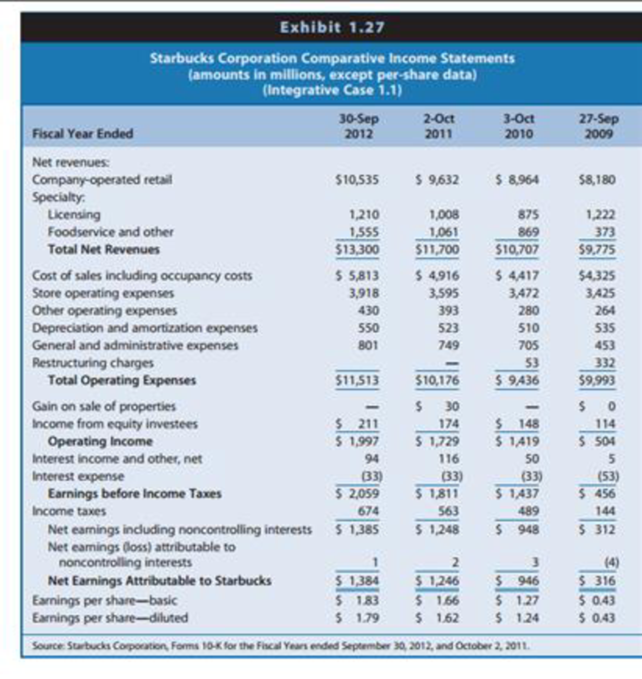

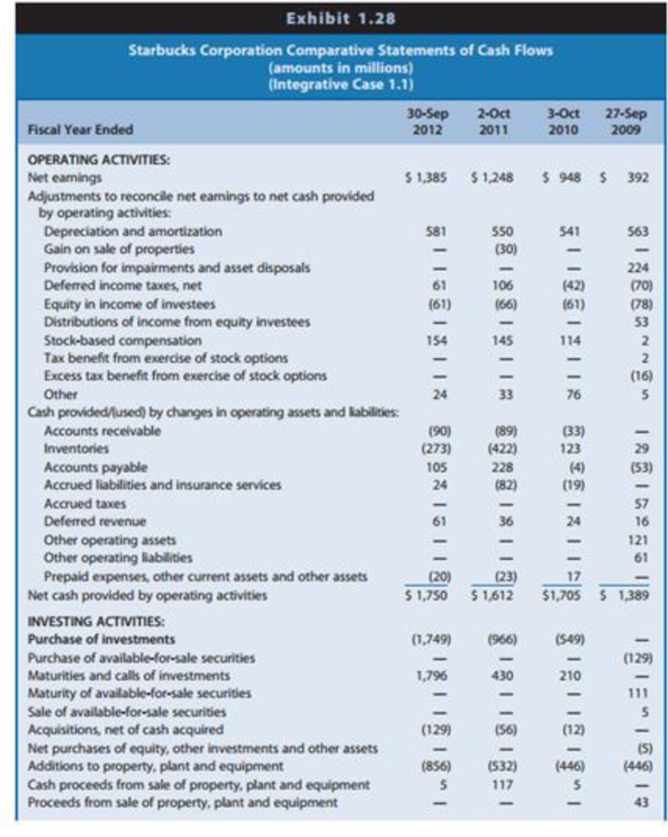

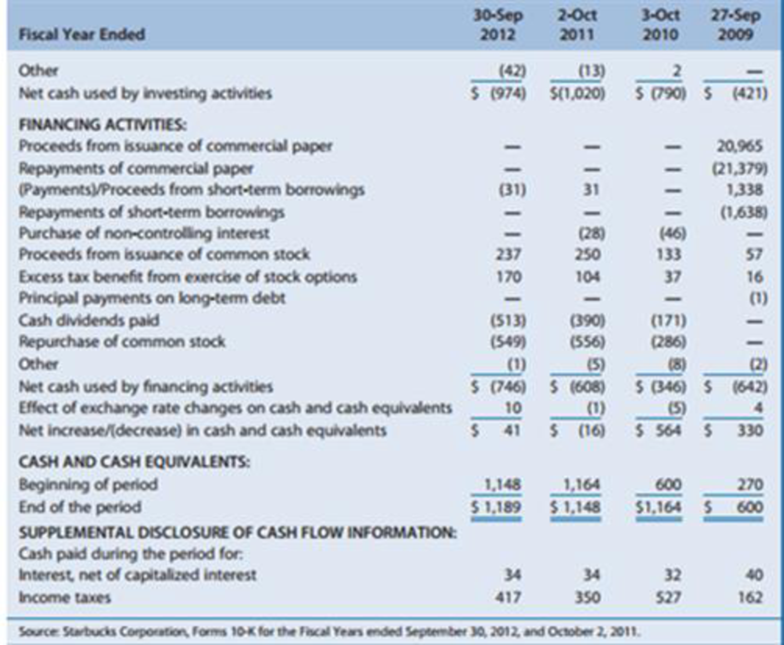

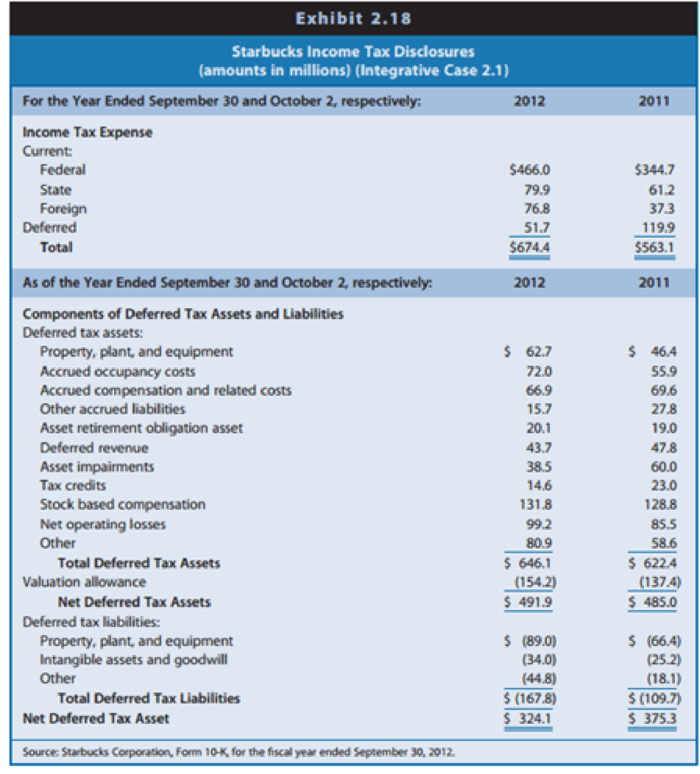

The financial statements of Starbucks Corporation are presented in Exhibits 1.26–1.28 (see pages 74–77). The income tax note to those financial statements reveals the information regarding income taxes shown in Exhibit 2.18.

REQUIRED

Assuming that Starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2012? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Using the information provided for Global, prepare the company's journal entry to record income taxes for 2012 and 2011. Round your answers to two decimal places. If an amount box does not require an entry, leave it blank.

Using the information provided for Global, determine the company's effective tax rate for 2012 and 2011. Round your answers to two decimal places.

2012

2011

Effective tax rate

%

%

Access the 2016 financial statements and related disclosure notes of Ford Motor Company from its

website at corporate.ford.com. Required: 1. In Note 21, find Ford's net deferred tax asset or liability. What

is that number? 2. Does Ford show a valuation allowance against deferred tax assets? If so, what is the

number, and what is Ford's explanation for it? 3-a. Does Ford have any NOL carryforwards? 3-b. What is

the amount of any carryforward, what deferred tax asset or liability is associated with it? (Round your

answer to 1 decimal place.) 3-c. What effective tax rate does that imply was used to calculate its deferred

tax effect?

Use the income statement for Microsoft Corporation to compute "NOPAT (net operating profit after taxes)." The company's

combined federal and state statutory tax rate is 37.0%. What is the company's NOPAT? *Need an Excel spreadsheet for

calculation? - MICROSOFT CORP. Income Statement June 30, 2016 (in millions) Revenue Product Service Total revenue -->

MS Excel $61,502 23,818 85,320

Chapter 2 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 2 - Prob. 1QECh. 2 - Asset Valuation and Income Recognition. Asset...Ch. 2 - Trade-Offs among Acceptable Accounting...Ch. 2 - Income Flows versus Cash Flows. The text states,...Ch. 2 - Prob. 5QECh. 2 - Prob. 6QECh. 2 - Prob. 7QECh. 2 - Prob. 8QECh. 2 - Computation of Income Tax Expense. A firms income...Ch. 2 - Computation of Income Tax Expense. A firms income...

Ch. 2 - Costs to Be Included in Historical Cost Valuation....Ch. 2 - Effect of Valuation Method for Nonmonetary Asset...Ch. 2 - Prob. 13PCCh. 2 - Prob. 14PCCh. 2 - Prob. 15PCCh. 2 - Deferred Tax Assets. Components of the deferred...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Interpreting Income Tax Disclosures. Prepaid Legal...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Analyzing Transactions. Using the analytical...Ch. 2 - Prob. 21PCCh. 2 - Starbucks The financial statements of Starbucks...Ch. 2 - Prob. 1BICCh. 2 - Prob. 1CICCh. 2 - Prob. 1DICCh. 2 - Prob. 1EICCh. 2 - Prob. 1FICCh. 2 - Starbucks The financial statements of Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Interpreting Income Tax Disclosures. The financial statements of ABC Corporation, a retail chain, reveal the information for income taxes shown in Exhibit 2.15. REQUIRED a. Assuming that ABC had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2013? Explain. b. Did income before taxes for financial reporting exceed or fall short of taxable income for 2014? Explain. c. Will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for 2013? For 2014? d. ABC does not contract with an insurance agency for property and liability insurance; instead, it self-insures. ABC recognizes an expense and a liability each year for financial reporting to reflect its average expected long-term property and liability losses. When it experiences an actual loss, it charges that loss against the liability. The income tax law permits self-insured firms to deduct such losses only in the year sustained. Why are deferred taxes related to self-insurance disclosed as a deferred tax asset instead of a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2012 and 2014. e. ABC treats certain storage and other inventory costs as expenses in the year incurred for financial reporting but must include these in Inventory for tax reporting. Why are deferred taxes related to inventory disclosed as a deferred tax asset? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2012 and 2014. f. Firms must recognize expenses related to postretirement health care and pension obligations as employees provide services, but claim an income tax deduction only when they make cash payments under the benefit plan. Why are deferred taxes related to health care obligation disclosed as a deferred tax asset? Why are deferred taxes related to pensions disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for these deferred tax items between 2012 and 2014. g. Firms must recognize expenses related to uncollectible accounts when they recognize sales revenues, but claim an income tax deduction when they deem a particular customers accounts uncollectible. Why are deferred taxes related to this item disclosed as a deferred tax asset? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2012 and 2014. h. ABC uses the straight-line depreciation method for financial reporting and accelerated depredation methods for income tax purposes. Why are deferred taxes related to depreciation disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax liability between 2012 and 2014.arrow_forwardAnalyzing Coca-Colas Income Tax Disclosures Obtain The Coca-Cola Companys 2017 annual report either using the Investor Relations portion of its website (do a web search for Coca-Cola investor relations) or go to http://www.sec.gov and click Search for company filings under filings and Forms (EDGAR). Required: 1. What was the total income tax expense related to income from continuing operations before income taxes for 2017? How much of this was current? How much was deferred? 2. What were the total gross deferred tax assets at the end of 2017? Total deferred tax liabilities? Net deferred tax liability? 3. How much was the noncurrent deferred tax liability at the end of 2017, and where was it reported? 4. How much were the operating loss carryforwards at the end of 2017? Over what time periods must these be utilized?arrow_forwardInterpreting Income Tax Disclosures. The financial statements of Nike, Inc., reveal the information regarding income taxes shown in Exhibit 2.17. REQUIRED a. Assuming that Nike had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? Explain. b. Did book income before taxes for financial reporting exceed or fall short of taxable income for 2008? Explain. c. Will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for 2008? d. Nike recognizes provisions for sales returns and doubtful accounts each year in computing income for financial reporting. Nike cannot claim an income tax deduction for these returns and doubtful accounts until customers return goods or accounts receivable become uncollectible. Why do the deferred taxes for returns and doubtful accounts appear as deferred tax assets instead of deferred tax liabilities? Suggest possible reasons why the deferred tax asset for sales returns and doubtful accounts increased between 2007 and 2008. e. Nike recognizes an expense related to deferred compensation as employees render services but cannot claim an income tax deduction until it pays cash to a retirement fund. Why do the deferred taxes for deferred compensation appear as a deferred tax asset? Suggest possible reasons why the deferred tax asset increased between 2007 and 2008. f. Nike states that it recognizes a valuation allowance on deferred tax assets related to foreign loss carryforwards because the benefits of some of these losses will expire before the firm realizes the benefits. Why might the valuation allowance have decreased slightly between 2007 and 2008? g. Nike reports a large deferred tax liability for Intangibles. In another footnote, Nike states, During the fourth quarter ended May 31, 2008 the Company completed the acquisition of Umbro Plc (Umbro). As a result, 378.4 million was allocated to unamortized trademarks, 319.2 million was allocated to goodwill and 41.1 million was allocated to other amortized intangible assets consisting of Umbros sourcing network, established customer relationships and the United Soccer League Franchise. Why would Nike report a deferred tax liability associated with this increase in intangible assets on the balance sheet? h. Nike recognizes its share of the earnings of foreign subsidiaries each year for financial reporting but recognizes income from these investments for income tax reporting only when it receives a dividend. Why do the deferred taxes related to these investments appear as a deferred tax liability? i. Why does Nike recognize both deferred tax assets and deferred tax liabilities related to investments in foreign operations?arrow_forward

- Starbucks The financial statements of Starbucks Corporation are presented in Exhibits 1.26-1.28 (see pages 74-77). The income tax note to those financial statements reveals the information regarding income taxes shown in Exhibit 2.18. REQUIRED Starbucks uses the straight-line depreciation method for financial reporting and accelerated depreciation for income tax reporting. Like most firms, the largest deferred tax liability is for property, plant, and equipment (depreciation). Explain how depreciation leads to a deferred tax liability. Suggest possible reasons why the amount of the deferred tax liability related to depreciation increased between 2011 and 2012.arrow_forwardP14-9 Calculating and recording a company's income tax The accounting records of Rhyme Timber Ltd provide income statement data for 2016: Total revenue Total expenses Profit before income tax $940000 Requirements 1 Calculate taxable income for the year. (750 000) $190000 Total expenses include depreciation of $50000 calculated under the straight-line method. In calculating taxable income on the tax return, Rhyme Timber uses the reducing-balance (RB) method. RB depreciation was $80000 for 2016. The company income tax rate is 30%. 2 Prepare the journal entry in respect of income tax for 2016. 3 Show how to report income tax liabilities on Rhyme's balance sheet.arrow_forwardRefer to information in images below. question: Calculate the profit before tax as it will appear in the published statement of profit or loss and other comprehensive income of GM Foods Limited for the year ended 31 December 20.15. The actual statement of profit or loss and other comprehensive income is NOT requiredarrow_forward

- do not copy he pretax financial income (or loss) figures for Tamarisk Company are as follows. 2017 78,000 2018 ( 43,000 ) 2019 ( 38,000 ) 2020 115,000 2021 106,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years.Prepare the journal entries for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.)arrow_forwardThe following is the income statement belongs to Shining Star LLC for the year 31 December 2019: Shining Star LLC Income Statement for the year ending 31 December 2019 Net Sales OMR 25000 Cost of Goods Sold 7000 Gross Profit 18000 Operating Expenses 8000 Operating 10000 Income Other Income: Interest Income 4000 Net Income OMR 14000 If the company must pay an income tax expense on its profit and the tax rate is 30%, determine the Net income after-tax Select one: O a. OMR 10000 O b. OMR 9800 C. OMR 18200 O d. OMR 4200arrow_forward1. Prepare journal entries to record the income tax and 2. Present the income tax expense in the income statement Problem 16-3 (ACP) In 2021, Argentina Company received an advance payment of P1,000,000, which was subject to tax but not reported in accounting income until 2022. The income statement and tax return showed the following: 2021 2022 Income before tax per income statement Income before tax per tax return Income tax rate 6,000,000 7,000,000 9,000,000 8,000,000 25% 25% Required: 1. Prepare journal entries to record the income tax a deferred tax for 2021 and 2022. for 2021 and 2022.arrow_forward

- The following income statement does not reflect Intraperlod tax allocation. Sales revenue Cost of goods sold Gross profit INCOME STATEMENT For the Fiscal Year Ended March 31, 2021 ($ in millions) Operating expenses Income tax expense Income before discontinued operations Loss from discontinued operations Net income Gross profit (loss) The company's tax rate is 25%. Required: Recast the income statement to reflect Intraperlod tax allocation. (Loss amounts should be indicated with a minus sign. Enter your answers in millions (l.e., 5,500,000 should be entered as 5.5).) Income Statement For the fiscal year ended March 31, 2021 Operating expenses Income from continuing operations before income taxes Net income (loss) Income before discontinued operations $ 874 (434) 440 (208) (23) 289 (140) $ 69 ($ in millions)arrow_forwardLO 1 E17.5 The Sakai Stores Corporation calculated its income before taxes and the loss on the sale of its shoe division but wants you to advise it on how to present this information to external users Determine the after-tax loss from the shoe division and show how this information would be presented on the income statement. Explain in a brief memo to the owners why this informa tion is shown this way on the income statement. Earnings before income taxes and Discontinued Operations Tax rate Loss on Discontinued Operations $700,000 20% $250,000 LOarrow_forwardILLUSTRATION 1. Compute the tax payable by a company for the Assessment year 2012-13 if (a) its total income is $ 4,00,000 and book profit is $ 15,00,000 ; or (b) its total income is $ 6,20,000 and book profit is $ 10,00,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License