Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 18PC

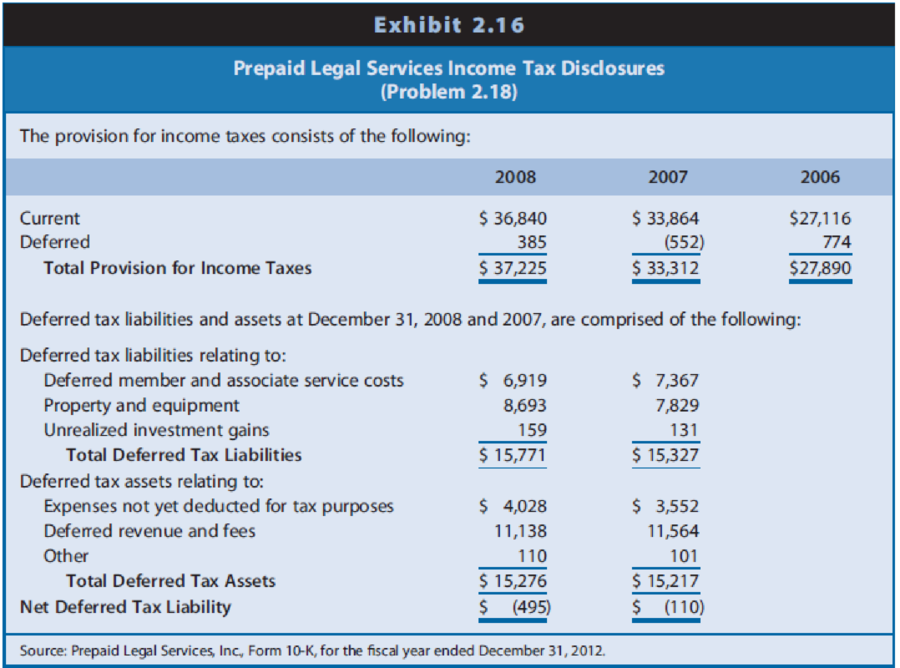

Interpreting Income Tax Disclosures. Prepaid Legal Services (PPD) is a company that sells insurance for legal expenses. Customers pay premiums in advance for coverage ever some specified period. Thus, PPD obtains cash but has unearned revenue until the passage of time over the specified period of coverage. Also, the company pays various costs to acquire customers (such as sales materials, commissions, and prepayments to legal firms who provide services to customers). These upfront payments are expensed over the specified period that customers’ contracts span. Exhibit 2.16 provides information from PPD’s income tax note.

REQUIRED

- a. Assuming that PPD had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? For 2008? Explain.

- b. Will the adjustment to net income for

deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for 2007? For 2008? - c. PPD must report as taxable income premiums collected from customers, although the company defers recognizing them as income for financial reporting purposes until they are earned over the contract period. Why are deferred taxes related to deferred revenue disclosed as a

deferred tax asset instead of adeferred tax liability ? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008. - d. Firms are generally allowed to deduct cash costs on their tax returns, although they might defer some of these costs for financial reporting purposes. As noted above, PPD defers various costs associated with obtaining customers. Why are deferred taxes related to this item disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008.

- e. Like most companies, PPD uses the straight-line

depreciation method for financial reporting and accelerated depredation methods for income tax purposes. Why are deferred taxes related to depredation disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax liability between 2007 and 2008. - f. Based only on the selected disclosures from the income tax footnote provided in Exhibit 2.16 and your responses to Parts d and e above, do you believe that PPD reported growing or declining revenue and profitability in 2008 relative to 2007? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How would each of the following items be reported on the balance sheet?

a. Accrued vacation pay.

b. Estimated taxes payable.

c. Service warranties on appliance sales.

d. Bank overdraft.

e. Employee payroll deductions unremitted.

f. Unpaid bonus to officers.

g. Deposit received from customer to guarantee performance of a contract.

h. Sales taxes payable.

i. Gift certificates sold to customers but not yet redeemed.

j. Premium offers outstanding.

k. Discount on notes payable.

l. Personal injury claim pending.

m. Current maturities of long-term debts to be paid from current assets.

n. Cash dividends declared but unpaid.

o. Dividends in arrears on preferred stock.

p. Loans from officers.

Accounting

The procedure that best reveals the existence of contingent debts is

а.

Review the invoices paid during the year to creditors of our client.

b.

Confirm with the client's attorneys.

C.

Confirm a sample of customer accounts payable.

Match each definition with its correct term:

Amounts owed by customers on account.

[ Choose ]

The analysis of customer balances by the

length of time they have been unpaid.

[ Choose ]

A method of accounting for bad debts that

involves estimating uncollectible accounts at

the end of each period.

[ Choose ]

An expense account to record uncollectible

[ Choose ]

receivables.

The net amount a company expects to

[ Choose ]

receive in cash.

A method of accounting for bad debts that

involves expensing accounts at the time they

[ Choose ]

are determined to be uncollectible.

A note that is not paid in full at maturity.

[ Choose ]

The party in a promissory note who is making

[ Choose ]

the promise to pay.

Written promise (as evidenced by a formal

[ Choose ]

instrument) for amounts to be received.

Various forms of nontrade receivables, such

[ Choose ]

as interest receivable and income taxes

refundable.

The party to whom payment of a promissory

[ Choose ]

note is to be made.

Management estimates…

Chapter 2 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 2 - Prob. 1QECh. 2 - Asset Valuation and Income Recognition. Asset...Ch. 2 - Trade-Offs among Acceptable Accounting...Ch. 2 - Income Flows versus Cash Flows. The text states,...Ch. 2 - Prob. 5QECh. 2 - Prob. 6QECh. 2 - Prob. 7QECh. 2 - Prob. 8QECh. 2 - Computation of Income Tax Expense. A firms income...Ch. 2 - Computation of Income Tax Expense. A firms income...

Ch. 2 - Costs to Be Included in Historical Cost Valuation....Ch. 2 - Effect of Valuation Method for Nonmonetary Asset...Ch. 2 - Prob. 13PCCh. 2 - Prob. 14PCCh. 2 - Prob. 15PCCh. 2 - Deferred Tax Assets. Components of the deferred...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Interpreting Income Tax Disclosures. Prepaid Legal...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Analyzing Transactions. Using the analytical...Ch. 2 - Prob. 21PCCh. 2 - Starbucks The financial statements of Starbucks...Ch. 2 - Prob. 1BICCh. 2 - Prob. 1CICCh. 2 - Prob. 1DICCh. 2 - Prob. 1EICCh. 2 - Prob. 1FICCh. 2 - Starbucks The financial statements of Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is correct about credit period? A. If a customer purchases goods within the credit period, a cash discount will be allowed to the customer B. If a customer settles the payment within the credit period, a cash discount will be allowed to the customer C. It refers to the period in which customers must settle their debts due D. It refers to the period in which customers need to settle one-third of the debts in order to avoid further interests chargedarrow_forwardWhen should companies that sell gift cards to customersreport revenue?a. When the gift card is issued and cash is received.b. When the gift card is used by the customer.c. At the end of the year in which the gift card is issued.d. None of the above.arrow_forwardThe expense for warranty costs is recorded in the period ________. A. when cash is paid to repair or replace the product B. when the product is sold C. when the product is repaired or replaced D. when cash is collected from the sale of the productarrow_forward

- An item that is not a contingent liability is: A. premium offer to customers for labels or box tops. B. accommodation endorsement on customer note. C. additional compensation that may be payable on a dispute now being arbitrated. D. note receivable discounted. A loss contingency that should be accrued is: A. note receivable discounted. B. pending lawsuit C. tax in dispute D. estimated claim under a service warranty on new products sold.arrow_forward29)Revenue is properly recognized: (Hint: What is Revenue Recognition principle?) Group of answer choices At the end of the accounting period. Upon completion of the sale or when services have been performed and the business obtains the right to collect the sales price. Only if the transaction creates an account receivable. When the customer's order is received.arrow_forwardAll of the following typically would be considered when estimated sellers cost except Transfer tax Pre-payment penalty Escrow refund Mortgage insurancearrow_forward

- Which of the following statements is false? Multiple Choice Prepaid insurance is a liability reported on the balance sheet. Prepaid insurance represents a future economic benefit. Prepaid insurance indicates that a company has already paid cash for insurance coverage that protects the company for some future time period. Prepaid insurance is a deferred expense.arrow_forwardWhich of the following is NOT an example of a contingency? Salaries payable to top management Potential expense related to repair or replace products sold under warranty Note receivable sold with recourse An amount potentially payable to settle a lawsuit All the other alternatives are contingenciesarrow_forwardIf the owner of a company pays an amount of interest on a personal loan that he uses to begin his business, does he has to to record the interest payment?arrow_forward

- Which of the following is the entry to be recorded by alaw firm when it receives a payment from a new client thatwill be earned when services are provided in the future?a. Debit Accounts Receivable; credit Service Revenue.b. Debit Unearned Revenue; credit Service Revenue.c. Debit Cash; credit Unearned Revenue.d. Debit Unearned Revenue; credit Casharrow_forwardWhen an item to be prorated is owed by the seller and has not yet been paid for, the amount owed is figured as A. a credit to the seller only. B. a debit to the buyer only. C. a credit to the seller and a debit to the buyer. D. a debit to the seller and a credit to the buyer. One item that is ALWAYS prorated on a closing statement is A. the state transfer tax. B. the earnest money. C. the unpaid principal balance of the seller's mortgage loan that is assumed by the buyer. D. the accrued interest on the seller's loan that is assumed by the buyer. mortgage The Closing Disclosure must be used to illustrate all settlement charges for A. all real estate transactions. B. transactions financed with FHA and VA loans only. 0258 C. residentiolarrow_forwardWhen should a company report the cost of an insurancepolicy as an expense?a. When the company first signs the policy.b. When the company pays for the policy.c. When the company receives the benefits from thepolicy over its period of coverage.d. When the company receives payments from the insurance company for its insurance claims.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License