Concept explainers

Problem 19-5B

Production transactions, subsidiary records, and source documents

P1 P2 P3 P4

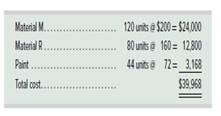

King Company produces variations of its product, a megaton, in response to custom orders from its customers, On June 1, the company had no inventories of work in process or finished goods but held the following raw materials.

On June 3, the company began working on two megatons: Job 450 for Encinita Company and Job 451 for Fargo, Inc.

Required

Using Exhibit 19.3 as a guide, prepare

a. Purchased raw materials on credit and recorded the following information from receiving reports and invoices.

Instructions: Record these purchases with a single

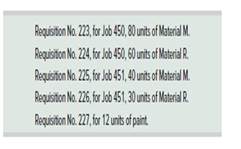

b. Requisitioned the following raw materials for production.

Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. Do not record a journal entry at this time.

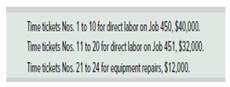

c. Received the following employee time tickets for work in June.

Instructions: Record direct labor from the time tickets on the job cost sheets. Do not record a journal entry at this time.

d. Paid cash for the Mowing items during the month: factory payroll, $84,000, and miscellaneous

Instructions: Record these payments with journal entries.

e. Finished Job 450 and transferred it to the warehouse. The company assigns overhead to each job with a predetermined overhead rate equal to 70% of direct labor cost.

Instructions: Enter the applied overhead on the cost sheet for Job 450, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." Prepare a journal entry to record the job's completion and its transfer to Finished Goods. f. Delivered Job 450 and accepted the customer's promise to pay $290,000 within 30 days,

Instructions: Prepare journal entries to record the sale of Job 450 and the cost of goods sold, g. Applied overhead cost to Job 451 based on the job's direct labor used to date,

Instructions: Enter overhead on the job cost sheet but do not mate a journal entry at tins time. h. Recorded the total direct and indirect materials costs as reported on all the requisitions for the month.

Instructions: Prepare a journal entry to record these. i. Recorded the total overhead costs applied to jobs. Instructions: Prepare a journal entry to record the allocation of these overhead costs. j. Compute the balance in the Factory Overhead account as of the end of June.

Check (h) Dr. Work in Process Inventory, $38,400

(j) Balance in Factory Overhead, $736 Cr., overapplied

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

FUND.ACCT.PRIN.

- Cost of production report: average cost method Sunrise Coffee Company roasts and packs coffee beans. The process begins in the Roasting Department. From the Roasting Department, the coffee beans are transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at December 31, 2016: ACCOUNT Work in ProcessRoasting Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Dec. 1 Bal., 10,500 units, 75% completed 21,000 31 Direct materials, 210,400 units 246,800 267,800 31 Direct labor 135,700 403,500 31 Factory overhead 168,630 572,130 31 Goods transferred. 208,900 units ? ? 31 Bal., ? units, 25% completed ? Instructions Prepare a cost of production report, using the average cost method, and identify the missing amounts for Work in ProcessRoasting Department.arrow_forwardMultiple production department factory overhead rates The management of Orange County Chrome Company, described in Problem 1A, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Stamping Department 115,200 Plating Department 105,600 Total 220,800 Instructions 1. Determine the multiple production department factory overhead rates, using direct labor hours for the Stamping Department and machine hours for the Plating Department. 2. Determine the product factory- overhead costs, using the multiple production department rates in (1).arrow_forwardActivity-based costing and product cost distortion The management of Four Finger Appliance Company in Exercise 14 has asked you to u.sc activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that 81,000 of factory overhead from each of the production departments can be associated with setup activity (162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. A. Determine the three activity rates (assembly, test and pack, and setup). B. Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (A).arrow_forward

- Cost of production report: average cost method Sunrise Coffee Company roasts and packs coffee beans. The process begins in the Roasting Department. From the Roasting Department, the coffee beans are transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at December 31: ACCOUNT Work in ProcessRoasting Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Dec. 1 Bal., 10,500 units.,75% completed 21,000 31 Direct materials, 210,400 units 246,800 267,800 31 Direct labor 135,700 403,500 31 Factory overhead 168,630 572,130 31 Goods transferred, 208,900 units ? ? 31 Bal., ?units, 25% completed ? Instructions Prepare a cost of production report, using the average cost method, and identify the missing amounts for Work in ProcessRoasting Departmentarrow_forwardQUESTION 2 A company manufacture it main product in two different consecutive processes, process 1 and process 2. The output from process 1 is transferred to process 2 the output of process 2 is sent to the packaging department. Information for the week ended 31 August 2009 is as follows; Process 1 Input Material X 18,00kg @ GH¢1 per kg Material Y 12,000 kg @ GH¢2 per kg Labour 1,720 hours @ GH¢3 per hour Normal loss 5% of input Sales price of scrap GH¢0.32 per kg Output 27,000 kg There was no opening stock but 600 kg of closing work in progress in process 1 at the end of the week which is estimated to be 60% complete with regard to conversion cost. Process 2 Input Material P 19,800 kg @ GH¢2.5 per kg Material Y 12,600 kg @ GH¢1.5 per kg Additives GH¢1,800 Labour 1,480 hours @ GH¢3 per hour Normal loss 5% of input Output 56,000 kg There was no opening WIP but there 3,000 kg in process 2 at the end of the week which is estimated to be 50% complete with…arrow_forwardProblem 1 PPG Company manufactures two products: Product SS and Product HH. During January, 50 of Product SS and 300 of Product HH were produced, and overhead costs of P81,000 were incurred. An analysis of overhead costs reveals the following activities: Total Cost Activity 1. Materials handling 2. Machine setups 3. Quality inspections Cost Driver Number of requisitions Number of Setups Number of Inspections The cost drive volume for each product was as follows: P30,000 27,000 24,000 Product HH Cost Driver Number of requisitions Product SS 400 600 76arrow_forward

- Questions 14 – 17 are based on the following Chen Company produces a product in a two-department process, Assembly and Finishing. The following information is available on their first department, Assembly: Beginning Work-in-process Units started Units completed and transferred to Finishing Ending Work-in-process Direct Material Added Direct Labour Factory Overhead Total cost to account for -0- 200,000 168,000 32,000 $700,000 960,000 480,000 2,140,000 The units still in process are 100% complete with respect to direct materials and 75% complete with respect to conversion costs. 14. The unit cost of direct materials is: (A) $3.50 (C) $3.65 (B) $4.17 (D) $0.29 The unit cost for conversion costs is: (A) $5.00 (B) $2.50 (C) $7.20 (D) $7.50 The total cost of units completed and transferred to finished goods is: (A) $2,112,000 (B) $2,140,000 (C) $1,848,000 (D) $352,000 The total cost of ending work-in-process is: (A) $352,000 (B) $292,000 (C) $264,000 (D) $240,000arrow_forwardQuestion 12 Kimberly Manufacturing uses a process-costing system to manufacture Dust Density Sensors for the mining industry. The following information pertains to operations for the month of May, Year 5. Units Beginning work-in-process inventory, May 1 16,000 Started in production during May 100,000 Ending work-in-process inventory, May 31 24,000 The beginning inventory was 60% complete for direct materials and 20% complete for conversion costs. The ending inventory was 90% complete for direct materials and 40% complete for conversion costs. Costs pertaining to the month of May are as follows: Beginning inventory costs are direct materials, $54,560; direct manufacturing labor $20,320; and manufacturing overhead, $15,240. Costs incurred during May are direct materials used, $468,000; direct manufacturing labor, $182,880; and manufacturing overhead, $391,160. Using the weighted-average method,…arrow_forward20 EXERCISES Soved Prepare jourmal entries to record the following production activities for Hotwax. 1. Incurred $145,000 of direct labor in its Mixing department and $70,000 of direct labor in its Shapi Wages Payable). 2 Incured indirect labor of $11,500 (credit Factory Wages Payable). 3. Total factory payroll of $226,500 was paid in cash. View transaction list Journal entry worksheet 1 Record direct labor used, but not yet paid. Note: Enter debits before credits. Transaction General Journal Debit Credit Work in process inventory-Shaping 70,000 Work in process inventory-Mixing < Prev 6 of 8 Next search 0 門arrow_forward

- Question 2 Vaasa Chemicals makes a product by way of two processes Mixing & Refining. Its process costing system in the Mixing Department has two direct cost categories (Chemical P & Chemical Q) and one conversion costs pool. Chemical P is introduced at the start of the operations in the Mixing Department and Chemical Q is added when the product is three- fourths (75%) completed in the Mixing Department. The following information pertains to the Mixing department for July: Units Work in process inventory, July 1 Started production Completed and transferred to Refining Department Ending work in process inventory [two-thirds (66%%)of the way through the Mixing process] 50,000 35.000 15,000 Costs Beginning WIP inventory SO Costs added during July: Chemical P 250,000 Chemical Q 70,000 Direct Labour 32,000 Manufacturing overhead 103,000 Required: i) Compute the equivalent units in the Mixing Department for direct materials and for conversion costs ii) Compute: a) the cost of the units…arrow_forwardQuestion 7.1 DNA Ltd. produces two main products, A and B; and, a byproduct, C. There were no beginning inventories. During April, it incurred $275,000 of joint costs, which are allocated to main products using the physical output method. Additional information follows: Product Units Produced Units Sold Unit Sales Price A 12,000 9,600 $22 B 18,000 15,300 38 C 6,000 5,200 3 Required: Assuming DNA recognizes byproduct revenue at the time of sale, what is the total value of ending inventory?arrow_forward8:06 Problem 6A-7 CloverSweet Inc. manufactures a product that goes through two departments prior to completion. The information shown in the table below is available about work in the first department, the Mixing Department, during June: Work in process, beginning Started into production Completed and transferred out Work in process, ending Work in process, beginning Cost added during June. Equivalent units of production Materials Conversion Cost of ending work in process inventory Cost of units transferred out Required: Assume that the company uses the FIFO method. 1. Determine the equivalent units for June for the first process. Cost Reconciliation Costs to be accounted for Cost of beginning work in process inventory Costs added to production during the period Total cost to be accounted for Costs accounted for as follows: Cost of ending work in process inventory Costs of units transferred out Total cost accounted for Units 64,000 427,000 363,000 128,000 $ 24,500 $477,000 $ Materials…arrow_forward

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning