Concept explainers

Cheerful Colors manufactures crayons in a three-step process: mixing, molding, and packaging. The Mixing Department combines the direct materials of paraffin wax and pigments. The heated mixture is pumped to the Molding Department, where it is poured into molds. After the molds cool, the crayons are removed from the molds and are transferred to the Packaging Department, where paper wrappers are added and the crayons are boxed.

In the Mixing Department, the direct materials are added at the beginning of the process and the conversion costs are incurred evenly throughout the process. Work in process of the Mixing Department on March 1, 2018, consisted of 800 batches of crayons that were 10% of the way through the production process. The beginning balance in Work-in-Process Inventory---Mixing was $32,800, which consisted of $14,000 in direct materials costs and $18,800 in conversion costs. During March, 5,200 batches were started in production. The Mixing Department transferred 3,000 batches to the Molding Department in March, and 3,000 were still in process on March 31. This ending inventory was 80% of the way through the mixing process. Cheerful Colors uses FIFO process costing.

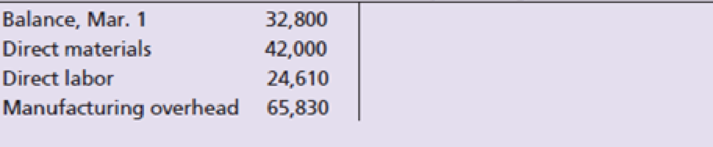

At March 31, before recording the transfer of costs from the Mixing Department to the Molding Department, the Cheerful Colors general ledger included the following account:

Work-in Process Inventory—Mixing

Requirements

- 1. Prepare a production cost report for the Mixing Department for March. Round equivalent unit of production costs to four decimal places. Round all other costs to the nearest whole dollar.

- 2. Journalize all transactions affecting the Mixing Department during March, including the entries that have already been posted. Assume labor costs are accrued and not yet paid.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Fundamentals Of Cost Accounting (6th Edition)

Introduction To Managerial Accounting

FINANCIAL ACCT.FUND.(LOOSELEAF)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

- Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Required: 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places. 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.arrow_forwardBenson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardScribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion Work in process inventory, March 1 3,800 100 % 80 % Work in process inventory, March 31 5,000 100 % 75 % Pulping cost in work in process inventory, March 1 $ 1,349 Conversion cost in work in process inventory, March 1 $ 684 Units transferred to the…arrow_forward

- Scribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion Work in process inventory, March 1 3,500 100 % 80 % Work in process inventory, March 31 7,500 100 % 60 % Pulping cost in work in process inventory, March 1 $ 1,085 Conversion cost in work in process inventory, March 1 $ 350 Units transferred to the…arrow_forwardScribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, thedried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: No materials are added in the Drying Department. Pulping cost represents the costs of the wet fibers transferred in from the Pulping Department. Wet fiber is processed in the Drying Department in batches; each unit in the above table is a batch and one batch of wet fibers produces a setamount of dried paper that is passed on to the…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion 20% Work in process inventory, March 1 Work in process inventory, March 31 5,000 100% 8,000 100% 25% $4,800 $500 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during…arrow_forward

- Scribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Pulping 100% Units Conversion Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during March Units Percent Completed Pulping Conversion…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during March Complete this question by entering your…arrow_forward

- Scribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted average method in its process costing system. Data for March for the Drying Department follow. Work in process inventory, March 11 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during March Units 3,500 7,500 Percent Completed…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Pulping 100% Conversion 80% Units 2,700 7,500 Work in process inventory, March 1 Work in process inventory, March-31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion…arrow_forwardBavarian Chocolate Company processes chocolate into candy bars. The process begins by placing direct materials (raw chocolate, milk, and sugar) into the Blending Department. All materials are placed into production at the beginning of the blending process. After blending, the milk chocolate is then transferred to the Molding Department, where the milk chocolate is formed into candy bars. The following is a partial work in process accountof the Blending Department at October 31:AttachmentInstructions1. Prepare a cost of production report and identify the missing amounts for Work in Process—Blending Department.2. Assuming that the October 1 work in process inventory includes direct materials of $38,295, determine the increase or decrease in the cost per equivalent unit for direct materials and conversion between September and October.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning