Joint costs and decision making. Jack Bibby is a prospector in the Texas Panhandle. He has also been running a side business for the past couple of years. Based on the popularity of shows such as “Rattlesnake Nation,” there has been a surge of interest from professionals and amateurs to visit the northern counties of Texas to capture snakes in the wild. Jack has set himself up as a purchaser of these captured snakes.

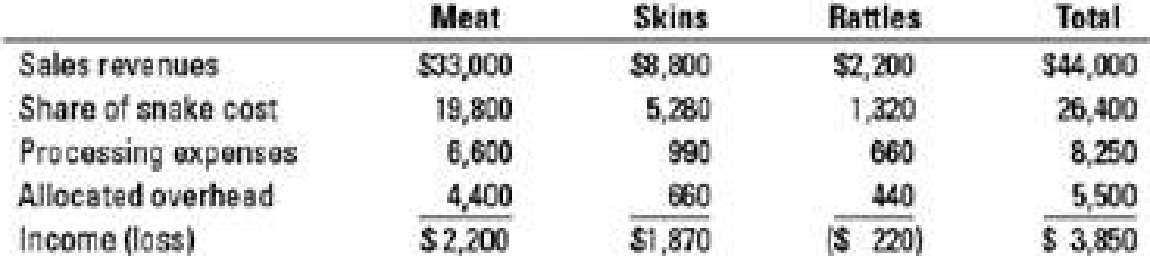

Jack purchases rattlesnakes in good condition from “snake hunters” for an average of $11 per snake. Jack produces canned snake meat, cured skins, and souvenir rattles, although he views snake meat as his primary product. At the end of the recent season, Jack Bibby evaluated his financial results:

The cost of snakes is assigned to each product line using the relative sales value of meat, skins, and rattles (i.e., the percentage of total sales generated by each product). Processing expenses are directly traced to each product line.

Jack has a philosophy of every product line paying for itself and is determined to cut his losses on rattles.

- 1. Should Jack Bibby drop rattles from his product offerings? Support your answer with computations.

Required

- 2. An old miner has offered to buy every rattle “as is” for $0.60 per rattle (note: “as is” refers to the situation where Jack only removes the rattle from the snake and no

processing costs are incurred). Assume that Jack expects to process the same number of snakes each season. Should he sell rattles to the miner? Support your answer with computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Three recent computer-science graduates are forming a company to write and distribute software for various personal computers. Initially, the company will operate in Eastern Australia. Twelve serious prospects for retail outlets have already been identified and committed to the firm. The firm’s software products have been tested and displayed at several trade shows and computer fairs in the perceived operating region. All that is lacking is adequate financing to continue with the project . A small group of private investors is interested in financing the company. Two financing proposals are being evaluated. (A 34% tax rate is appropriate for this analysis.) 1) Plan A is an all-ordinary share capital structure. ‒ $2m dollars would be raised by selling shares at $10 each. 2) Plan B would involve the use of financial leverage. ‒ $1m dollars would be raised selling bonds with an effective interest rate of 11% per annum. ‒ The remaining $1m would be raised by selling shares at the $10 price…arrow_forwardPiscataway valves decided to pursue development of a new product line for natural gas pipelines. The development effort has been successful and Piscataway is preparing to begin manufacturing and marketing the new product line next year. Piscataway has learned that marketing to natural gas pipeline companies requires commercial skills and experience they do not have. Management has, as a consequence, decided to have a partner and are in serious discussions with two companies having the requisite marketing expertise: Fargo Pipeline Supplies (FPS) and Quantum International (QI) Note: For this question, all cash flows are incremental cash flows. Part A: FPS Proposal FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. Piscataway would have to invest in faciliites to manufacture the valves, spending $7,465 in Year 0 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative…arrow_forwardNikularrow_forward

- After working for years as a regional manager for a retail organization, Scott Parry opened his own business with Susan Gonzalez, one of his district managers, as his partner. They formed S&S to sell appliances and consumer electronics. Scott and Susan pursued a “clicks and bricks” strategy by renting a building in a busy part of town and adding an electronic storefront. Scott and Susan invested enough money to see them through the first six months. They will hire 15 employees within the next two weeks – three to stock the shelves, four sales representatives, six checkout clerks, and two to develop and maintain the electronic storefront. Scott and Susan will host S&S’s grand opening in five weeks. To meet that deadline, they have to address the following important issues: 16. What business processes are needed, and how should they be carried out? 17. What functionality should be provided on the website?arrow_forwardYou have been hired as a consultant for Pristine Urban - Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.4 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.6 million on an aftertax basis. In four years, the land could be sold for $2.8 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $275,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6, 100, 6, 800, 7, 400, and 5, 700 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.9 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $3.1 million on an aftertax basis. In four years, the land could be sold for $3.3 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $375,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 7,100,7,800, 8,400, and 6,700 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.7 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.9 million on an aftertax basis. In four years, the land could be sold for $3.1 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $335,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,700, 7,400, 8,000, and 6,300 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that…arrow_forward

- Gary is the operating manager of Crane, a company that manufactures three different types of all-terrain vehicles: four-wheelers, personal watercraft, and snowmobiles. Naturally, Gary has the opportunity to test all of these products for quality-control purposes. At the end of the year, Gary needs to perform a profitability analysis for each product line to better evaluate the company's pricing strategy. He has a gut feeling that the company has room to increase selling prices in the snowmobile category, but he wants to see what the financials look like before he makes a case to the CEO. He has gathered the following information. The costs for the three support departments, Payroll, Maintenance, and IT, are allocated to the product lines according to number of employees, maintenance hours used, and IT hours used, respectively. Four-Wheelers Personal Watercraft Snowmobiles Sales $1,126,000 $1,416,000 $1,996,000 Payroll Maintenance IT Four-Wheelers Watercraft Snowmobiles Costs $95,000…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.55 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.75 million on an aftertax basis. In four years, the land could be sold for $2.95 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $305,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,400, 7,100, 7,700, and 6,000 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.65 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.85 million on an aftertax basis. In four years, the land could be sold for $3.05 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $325,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,600, 7,300, 7,900, and 6,200 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub