CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

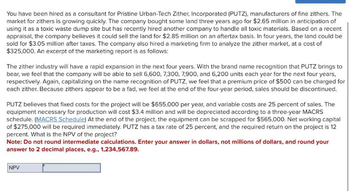

Transcribed Image Text:You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The

market for zithers is growing quickly. The company bought some land three years ago for $2.65 million in anticipation of

using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent

appraisal, the company believes it could sell the land for $2.85 million on an aftertax basis. In four years, the land could be

sold for $3.05 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of

$325,000. An excerpt of the marketing report is as follows:

The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to

bear, we feel that the company will be able to sell 6,600, 7,300, 7,900, and 6,200 units each year for the next four years,

respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a premium price of $500 can be charged for

each zither. Because zithers appear to be a fad, we feel at the end of the four-year period, sales should be discontinued.

PUTZ believes that fixed costs for the project will be $655,000 per year, and variable costs are 25 percent of sales. The

equipment necessary for production will cost $3.4 million and will be depreciated according to a three-year MACRS

schedule. (MACRS Schedule) At the end of the project, the equipment can be scrapped for $565,000. Net working capital

of $275,000 will be required immediately. PUTZ has a tax rate of 25 percent, and the required return on the project is 12

percent. What is the NPV of the project?

Note: Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, and round your

answer to 2 decimal places, e.g., 1,234,567.89.

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardYou have been hired as a consultant for Pristine Urban - Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.4 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.6 million on an aftertax basis. In four years, the land could be sold for $2.8 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $275,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6, 100, 6, 800, 7, 400, and 5, 700 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.45 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.65 million on an aftertax basis. In four years, the land could be sold for $2.85 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $285,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,200, 6,900, 7,500, and 5,800 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.55 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.75 million on an aftertax basis. In four years, the land could be sold for $2.95 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $305,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,400, 7,100, 7,700, and 6,000 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $1.39 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $1,490,000 on an aftertax basis. At the end of the project, the land could be sold for $1,590,000 on an aftertax basis. The company also hired a marketing firm to analyze the zither market, at a cost of $124,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,700, 4,600, 5,200, and 4,100 units each year for the next four years, respectively. Again, capitalizing on the name recognition of…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.9 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $3.1 million on an aftertax basis. In four years, the land could be sold for $3.3 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $375,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 7,100,7,800, 8,400, and 6,700 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $1,190,000 in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $1,400,000 on an aftertax basis. In four years, the land could be sold for $1,675,000 after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $220,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 7,300, 8,280, 9,485, and 6,290 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ),manufacturers of fine zithers. The market for zithers is growing quickly. The company boughtsome land three years ago for $2.1 million in anticipation of using it as a toxic waste dump sitebut has recently hired another company to handle all toxic materials. Based on a recentappraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. Infour years, the land could be sold for $2.4 million after taxes. The company also hired amarketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketingreport is as follows:The zither industry will have a rapid expansion in the next four years. With the brand namerecognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600,4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again,capitalizing on the name recognition of PUTZ, we feel that a premium price…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $740,000 in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $950,000 on an aftertax basis. In four years, the land could be sold for $1,225,000 after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $130,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 7,120, 7,920, 9,215, and 6,110 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a premium…arrow_forwardVijayarrow_forwardou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning