Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.23E

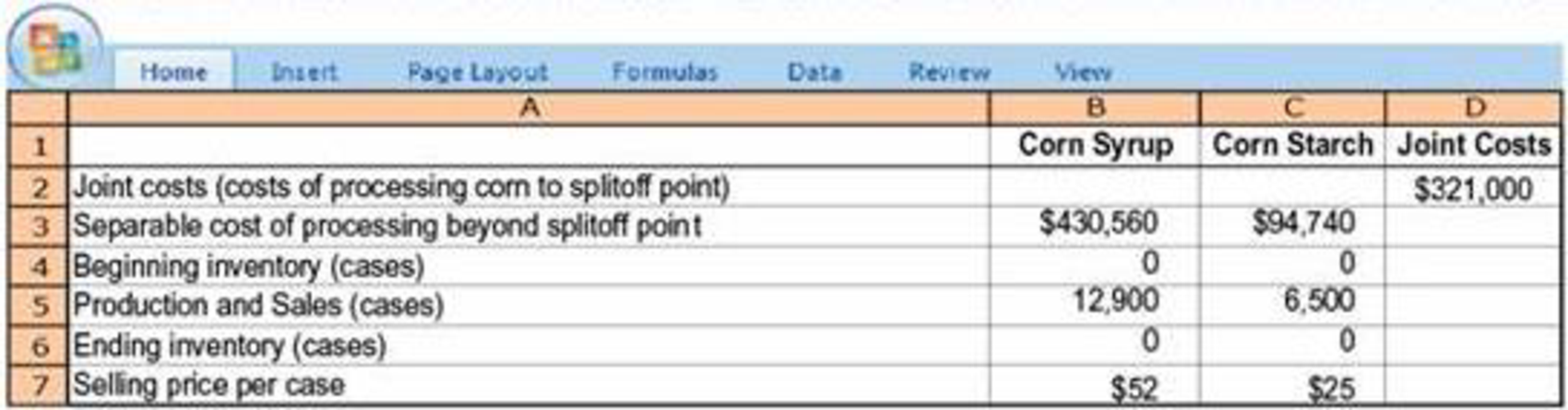

Net realizable value method. Sweeney Company is one of the world’s leading corn refiners. It produces two joint products—corn syrup and corn starch—using a common production process. In July 2017, Sweeney reported the following production and selling-price information:

Allocate the $321,000 joint costs using the NRV method.

Required

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting for a main product and a byproduct. (Cheatham and Green, adapted) Crispy, Inc., is a producer of potato chips. A single production process at Crispy, Inc., yields potato chips as the main product, as well as a byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs.

For September 2017, the cost of operations is $520,000. Production and sales data are as follows:

Production (lbs) Sales (lbs) Sell price per lb

Potato Chips 46,000 34,960 $26

Byproducts 8200 5000 $5

There were no beginning inventories on September 1, 2017.

What is the gross margin for Crispy, Inc., under the production method and the sales method of byproduct accounting?

What are the inventory…

Tasty, Inc., is a producer of potato chips. A single production process at Tasty, Inc., yields

potato chips as the main product and a byproduct that can also be sold as snack. Both

products are fully processed by the splitoff point, and there are no separable costs.

For September 2022, the cost of operation is $300,000. Production and sales data are as

follows:

Main Product:

Potato Chips

Byproduct

Production (in pounds) Sales (in pounds)

Main products:

Byproducts:

80,000

8,000

72,000

6,000

Selling Price per Pound

There were no beginning inventories on September 1, 2022.

What are the inventory costs reported in the balance sheet on September 30, 2022, for the

main product and byproduct under the production method and the sales method of byproduct

accounting?

The production method

$20

$5

The sales method

1. ABC Corp is the owner of MBT bottling, a bulk soft-drink producer. A single process yields tow bulk soft drinks: Rain Dew (Main product) and Resi Dew (by product). Both products are fully processed at the split off point and there are no separable cost.For July 2015, the cost of soft drink operations is P 120,000 (Joint cost). Production and sales data are as follows: Main product and by product’s production are 20,000 liters and 4,000 liters, respectively ; sales price is 12 per liter for main and 2 per liter for by product; the unsold liters are 4,000 liters for Main product and 600 liters for by product. Operating expenses are as follows: Rent expense of P 5,000; salaries expense of P 4,000 and other expenses of P 6,000. By-Product is recognized at time of production. There were no beginning inventories on July 1, 2015. What is the gross margin for the company?

choose the answer from the following:

99,200

84,200

102,000

96,200

None of the above

2. ABC Corp is the owner of…

Chapter 16 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 16 - Give two examples of industries in which joint...Ch. 16 - What is a joint cost? What is a separable cost?Ch. 16 - Distinguish between a joint product and a...Ch. 16 - Why might the number of products in a joint-cost...Ch. 16 - Provide three reasons for allocating joint costs...Ch. 16 - Why does the sales value at splitoff method use...Ch. 16 - Prob. 16.7QCh. 16 - Distinguish between the sales value at splitoff...Ch. 16 - Give two limitations of the physical-measure...Ch. 16 - How might a company simplify its use of the NRV...

Ch. 16 - Why is the constant gross-margin percentage NRV...Ch. 16 - Managers must decide whether a product should be...Ch. 16 - Prob. 16.13QCh. 16 - Describe two major methods to account for...Ch. 16 - Why might managers seeking a monthly bonus based...Ch. 16 - Prob. 16.16MCQCh. 16 - Joint costs of 8,000 are incurred to process X and...Ch. 16 - Houston Corporation has two products, Astros and...Ch. 16 - Dallas Company produces joint products, TomL and...Ch. 16 - Earls Hurricane Lamp Oil Company produces both A-1...Ch. 16 - Joint-cost allocation, insurance settlement....Ch. 16 - Joint products and byproducts (continuation of...Ch. 16 - Net realizable value method. Sweeney Company is...Ch. 16 - Alternative joint-cost-allocation methods,...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Prob. 16.26ECh. 16 - Joint-cost allocation, sales value, physical...Ch. 16 - Joint-cost allocation: Sell immediately or process...Ch. 16 - Accounting for a main product and a byproduct....Ch. 16 - Joint costs and decision making. Jack Bibby is a...Ch. 16 - Joint costs and byproducts. (W. Crum adapted)...Ch. 16 - Methods of joint-cost allocation, ending...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Comparison of alternative joint-cost-allocation...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Joint-cost allocation. SW Flour Company buys 1...Ch. 16 - Further processing decision (continuation of...Ch. 16 - Joint-cost allocation with a byproduct. The...Ch. 16 - Byproduct-costing journal entries (continuation of...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Prob. 16.41PCh. 16 - Prob. 16.42PCh. 16 - Methods of joint-cost allocation, comprehensive....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Venezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint processing costs to get the crude oil to split-off are $10,000,000. Additional information includes: Required: Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)arrow_forwardCrispy, Inc. is a producer of potato chips. A single production process at Crispy, Inc., yields potato chips as the main product, as well as a byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs. For September 2020, the cost of operations is $520,000. Production and sales data are as follows: (Click the icon to view the production and sales data.) Data table Potato Chips Byproduct Production (in pounds) Sales (in pounds) 46,000 8,200 Deduct value of byproduct production Print 34,960 $ 5,000 $ Done Selling Price per pound 26 5 X There were no beginning inventories on September 1, 2020. Read the requirements. Requirements 1. What is the gross margin for Crispy, Inc., under the production method and the sales method of byproduct accounting? 2. What are the inventory costs reported in the balance sheet on September 30, 2020, for the main product and byproduct under the two methods of byproduct accounting in…arrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q.Explain the effect that the different cost-allocation methods have on the decision to sell the products at…arrow_forward

- Joint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Q. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the following: a. Physical-measure method (using cups) of joint-cost allocation b. Sales value at splitoff method of joint-cost allocation c. NRV method of joint-cost allocation d. Constant gross-margin percentage NRV method of joint-cost allocationarrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q.If SW uses the physical-measure method, what combination of products should SW sell to maximize profits?arrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Q. Some claim that the sales value at splitoff method is the best method to use. Discuss the logic behind this claimarrow_forward

- I need answers to the following questions: Fritz Co. Produces 2 Products "Maria and Rose" , and 1 by-product "Sina" Total Joint Cost is P3,840,000. The by product however would need an additional cost of P180,000 to fully utilize Sina. The Cost is allocated based on Net Realizable Value method, while the by Product will be accounted for using the Cost Reduction Method. How much is the Adjusted Joint Cost? This will pertain to #12 to #15 (IMAGE) Using the NRV Method, How much cost would be allocated to Maria? Using the NRV Method, How much cost would be allocated to Rose? How much is the total Gain in the by product if the Company opted for the Sales Method?arrow_forwardJoint-cost allocation. SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process. The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. SW Flour Company has decided that their bread flour may sell better if it was marketed for gourmet baking and sold with infused spices. This would involve additional cost for the spices of $0.80 per cup. Each cup could be sold for $5.50. Q. If SW uses the sales value at splitoff method, what combination of products should SW sell to maximize profits?arrow_forwardPremium Candy Inc. is a producer of premium chocolate based in Palo Alto. For 2017, the trucking fleet had a practical capacity of 85 round-trips between the Palo Alto plant and the two suppliers. It recorded the following information: Premium Candy Inc. decides to examine the effect of using the dual-rate method for allocating truck costs to each round-trip. Read the requirements4. Requirement 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? Dark chocolate Milk chocolate Variable costs Fixed costs Total costs Requirement 2. From the viewpoint of the dark chocolate…arrow_forward

- Following a strategy of product differentiation, Arseniq Company makes a high-end Appliance, XT15. Arseniq presents the following data for the years 2014 and 2015: 2014 59.000 $600 154,000 2015 Units of XT15 produced and aold Selling price Direct materials (square feet) Direct matenals costs per square foot Manufacturing capacity in units of XT15 Total convermon costs 61,500 $650 157,200 $68 63,500 $7.429,500 $60 63,500 $6,985,000 Conversion costs perunit of capaaty Selling and oustomer-ervice capacity (customers) Total selling and customer-ervice conts Selling and customer-service capacity cost per customer $110 $117 190 $2.907,000 $15,300 190 $3,030,500 $15,950 Arseniq produces no defective units but it wants to reduce direct materials usage per unit of XT15. Manufacturing conversion costs in each year depend on production capacity defined in terms of XT15 units that can be produced. Selling and customer-service costs depend on the number of customers that the customer and service…arrow_forwardBrevall Industries makes corn oil and corn meal from harvested corn in a joint process. Corn oil can be further processed into margarine, and the corn meal can be further processed into corn muffin mix. The joint cost incurred to process the corn to the split-off point is $140,000. Information on the quantities, value, and further processing costs for the joint product appears below: Sales Value Estimated Further Sales Value Quantity At Split-off Processing Cost After Processing Corn Oil 800,000 lbs. $0.30/lb. $0.35/lb. $0.60/lb. Corn Meal 1,600,000 lbs. 0.10/lb. 0.40/lb. 0.55/lb. Brevall allocates the joint cost to the products based on physical units. Corn oil is assigned $46,667 of joint cost and corn meal is assigned $93,333 of joint cost. Which…arrow_forwardBrevall Industries makes corn oil and corn meal from harvested corn in a joint process. The corn oil can be further processed into margarine, and the corn meal can be further processed into corn muffin mix. The joint cost incurred to process the corn to the split-off point is $140,000. Information on the quantities, value, and further processing costs for the joint products appear below: Sales Value Estimated Further Sales Value Quantity At Split-off Processing Cost After Processing Corn Oil 800,000 lbs. $0.30/lb. $0.15/lb. $0.60/lb. Corn Meal 1,600,000 lbs. 0.10/lb. 0.46/lb. 0.55/lb. Brevall allocates the joint cost to the products based on the relative sales value at split-off point. How much joint cost should be assigned to the corn meal?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License