Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 13E

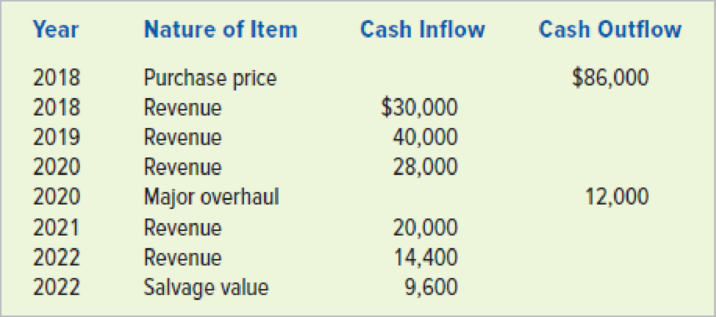

Exercise 10-13A Determining the payback period with uneven

Currie Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift would be leased on an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Currie would sell it at the end of the fifth year of its useful life. The expected

Required

- a. Determine the payback period using the accumulated cash flows approach.

- b. Determine the payback period using the average cash flows approach. Round your computation to one decimal point.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 6 - Shirt Corporation is considering purchasing equipment that costs $60,000 and is expected to provide

the following cash inflows over its five-year useful life:

Year

Cash Inflow

1

$18,000

2

$22,000

3

$24,000

4

$16,000

5

$ 9,000

Calculate the payback period for this investment.

Exercise 24-2 (Algo) Payback period, equal cash flows, and depreciation adjustment LO P1

Quary Company is considering an investment in machinery with the following information.

Initial investment

Useful life

Salvage value

Expected sales per year

Required A Required B

(a) Compute the investment's annual income and annual net cash flow.

(b) Compute the investment's payback period.

$ 380,000

Complete this question by entering your answers in the tabs below.

Annual Amounts

9 years

$ 20,000

19,000 units

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation-Machinery

Selling, general, and administrative expenses

Selling price per unit

Compute the investment's annual income and annual net cash flow.

Income

Net cash flow

Required A

$

Income

0

$

Cash Flow

Required B

>

0

$ 85,500

40,000

9,500

$ 10

Exercise 26-3 (Algo) Payback period and unequal cash flows LO P1

Beyer Company is considering buying an asset for $400,000. It is expected to produce the following net cash flows.

Year 2

$80,000

Year

Initial investment

Year 1

Year 2

Year 3

Year 4

Year 5

Total

Year 1

$80,000

Net cash flows

Compute the payback period for this investment.

Note: Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.

Net Cash Flows

$

(400,000)

Payback period=>

Year 3

$70,000

Cumulative Cash

Flows

Year 4

$200,000

Year 5

$15,000

Chapter 16 Solutions

Survey Of Accounting

Ch. 16 - Prob. 1QCh. 16 - Prob. 2QCh. 16 - Prob. 3QCh. 16 - 4. Define the term return on investment. How is...Ch. 16 - Prob. 5QCh. 16 - Prob. 6QCh. 16 - Prob. 7QCh. 16 - Prob. 8QCh. 16 - Prob. 9QCh. 16 - Prob. 10Q

Ch. 16 - 11. Maria Espinosa borrowed 15,000 from the bank...Ch. 16 - Prob. 12QCh. 16 - 13. What criteria determine whether a project is...Ch. 16 - Prob. 14QCh. 16 - Prob. 15QCh. 16 - Prob. 16QCh. 16 - 17. What is the relationship between desired rate...Ch. 16 - Prob. 18QCh. 16 - Prob. 19QCh. 16 - Prob. 20QCh. 16 - Prob. 21QCh. 16 - Prob. 22QCh. 16 - Prob. 23QCh. 16 - Exercise 10-1A Identifying cash inflows and...Ch. 16 - Exercise 10-2A Determining the present value of a...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Exercise 10-5A Determining net present value...Ch. 16 - Exercise 10-6A Determining net present value Aaron...Ch. 16 - Exercise 10-7A Using the present value index Rolla...Ch. 16 - Exercise 10-8A Determining the cash flow annuity...Ch. 16 - Prob. 9ECh. 16 - Exercise 10-10A Using the internal rate of return...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Exercise 10-13A Determining the payback period...Ch. 16 - Prob. 14ECh. 16 - Prob. 15ECh. 16 - Prob. 16PCh. 16 - Prob. 17PCh. 16 - Problem 10-18A Postaudit evaluation Brett Collins...Ch. 16 - Problem 10-19A Using net present value and...Ch. 16 - Problem 10-20A Using the payback period and...Ch. 16 - Problem 10-21A Using net present value and payback...Ch. 16 - Problem 10-22A Effects of straight-line versus...Ch. 16 - Problem 10-23A Comparing internal rate of return...Ch. 16 - Prob. 1ATCCh. 16 - ATC 10-4 Writing Assignment Limitations of capital...Ch. 16 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 24-3 (Algo) Payback period and unequal cash flows LO P1 Beyer Company is considering buying an asset for $310,000. It is expected to produce the following net cash flows. Year 3 $70,000 Year 4 $250,000 Net cash flows Year Year 1 $80,000 Initial investment Year 1 Year 2 Year 3 Year 4 Year 5 Total Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.) Net Cash Flows $ (310,000) Payback period Year 2 $40,000 = Year 5 $18,000 Cumulative Cash Flowsarrow_forwardExercise 24-3 (Algo) Payback period and unequal cash flows LO P1 Beyer Company is considering buying an asset for $350,000. It is expected to produce the following net cash flows. Year 3 Year 4 $70,000 $180,000 Net cash flows Year Initial investment Year 1 Year 2 Year 3 Year 4 Year 1 $82,000 Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.) Year 5 Total $ S Net Cash Flows dicates no response was expected Year 2 $45,000 (350,000) S 82.000 Payback period 45.000 70,000 180,000 14.000 41,000 Cumulative Cash Flows (391.000) 82.000 127.000 197.000 377.000 391.000 6.93- based calculation a Year 5 $14,000 years ret: he ports deductedarrow_forward21 Beyer Company is considering the purchase of an asset for $210,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Net cash flows Year 0 1 2 3 4 5 Cash Inflow (Outflow) Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal place.) S (210,000) Year 1 $64,000 Payback period = Year 2 Year 3 Year 4 $33,000 $62,000 $150,000 Cumulative Net Cash Inflow (Outflow) Year 5 $28,000 Saved Total $337,000arrow_forward

- Part 1 The aggregated cash flows, in dollars, for each of the two alternatives are given in the table below. Relative Cash Flows compared to current operations for year 0 and the first two years Year O Year 1 Year 2 Alternative 1 -592020 +269100 +538200 Alternative 2 -627003 +538200 +269100 MitMart is currently using a discount rate of 10% to evaluate all proposed projects. What is the payback period for each of the two alternatives?arrow_forwardQuestion Completion Status: QUESTION 1 For the below Cash Flow, find the total PW value using 10% interest rate years cost $ 0 1 2 3 4 QUESTION 2 for the below Cash flow, find the total Present value using 10% interest rate. years $ cost 0 1 2 5 3 5 4,981 1,000.00 3,414 4.000.00 1,000.00 4,661 3,258 3,258 3,258 5,508arrow_forwardSave Question list Question 1 Question 2 K Operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is $1.88 million plus $110,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery period (see table B). Additional sales revenue from the renewal should amount to $1.28 million per year, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 36% of the additional sales. The firm is subject to a tax rate of 21%. (Note: Answer the following questions for each of the next 6 years.) a. What net incremental earnings before depreciation, interest, and taxes will result from the renewal? b. What net incremental operating profits after taxes will result from the renewal? c. What net incremental operating cash inflows will result from the renewal? Question 2 a. The net incremental profits before…arrow_forward

- Depreciation rates Year 1 Year 2 33.33% Year 3 44.45% 14.81% Year 4 7.41% Complete the following table and calculate incremental cash flows in each year. Hint: Round your answers to the nearest dollar and remember to enter a minus sign if the calculated value is negative. Year 0 Year 1 Year 2 Year 3 Year 4 New machine cost $1,700 After-tax salvage value, old machine $700 Sales revenues $4,500 $4,500 Operating costs except depreciation $380 $380 $4,500 $380 $4,500 $380 Operating income $ $3,364 $3,868 $3,994 After-tax operating income $2,018 $2,321 $2,396 Net cash flows after replacement (adding back depreciation) Incremental Cash Flows $ $ $2,774 $2,321 $2,522 $394 $193 $142 Next evaluate the incremental cash flows by calculating the net present value (NPV), the internal rate of return (IRR), and the modified IRR (MIRR). Assume again that the cost of financing the new project is the same as the WACC and equals 10%. Hint: Use a spreadsheet program's functions or use a financial…arrow_forwardeBook Show Me How Print Item Determine Cash Flows Marigold Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The garden tool is expected to generate additional annual sales of 9,700 units at $52 each. The new manufacturing equipment will cost $210,100 and is expected to have a 10-year life and $16,100 residual value. Selling expenses related to the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $8.80 Direct materials 28.90 Fixed factory overhead-depreciation 2.00 Variable factory overhead 4.50 Total $44.20 Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use a minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answer to the nearest dollar. Marigold Inc. Net Cash Flows Year 1 Years 2-9 Last Year Initial investment Operating cash…arrow_forwardQuestion 28 Given the future cash flows (from cost savings) of an equipment for the next three years, use a discount rate of 10% to calculate the profitability index. (Correct to 3 decimal places) Year O: -$1,000,000 (initial investment) Year 1: +$600,000 Year 2: +$500,000 Year 3: +$400,000arrow_forward

- Question 6 Compute the payback period for the following data: Jones Co. is considering an investment that requires immediate payment of $28,000 and provides expected cash inflows of $7,000 annually for four years. Show your work.arrow_forwardProblem 4: Consider the following EOY cash flows for two mutually exclusive alternatives (one must be chosen): Alternative A Alternative B Capital investment Annual expenses $6,000 $2,500 12 years $0 $14,000 $2,400 18 years $2,800 Useful life Market value at the end of useful life If the MARR is 5% per year. a. Determine which alternative should be selected if the repeatability assumption applies. b. Determine which alternative should be selected if the analysis period is 18 years, the repeatability assumption does not apply, and a substitute can be leased for $8,000 per year after the useful life of either alternative is over.arrow_forwardHomework, Chapter 26 Cash Payback Period for a Service Company Jane's Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of $150,000 and each with an eight-year life and expected total net cash flows of $240,000. Location 1 is expected to provide equal annual net cash flows of $30,000, and Location 2 is expected to have the following unequal annual net cash flows: Year 1 $68,000 Year 2 51,000 Year 3 31,000 Year 4 29,000 Year 5 22,000 Year 6 16,000 Year 7 13,000 Year 8 10,000 Determine the cash payback period for both location proposals. Location 1 years Location 2 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License