Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 18P

Problem 10-18A Postaudit evaluation

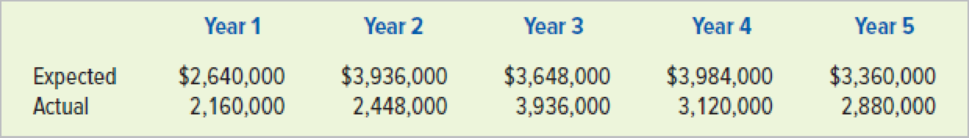

Brett Collins is reviewing his company’s investment in a cement plant. The company paid $12,000,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company’s discount rate for present value computations is 8 percent. Expected and actual cash flows follow:

Required

Round your computations to the nearest whole dollar.

- a. Compute the

net present value of the expected cash flows as of the beginning of the investment. - b. Compute the net present value of the actual cash flows as of the beginning of the investment.

- c. What do you conclude from this postaudit?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question z

You are working as a finance manager for Fire Fox Transport Ltd. The company is considering to invest in one of the two following projects to buy a new equipment for their storage which is expected to boost the company’s revenue. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9.5%. The cash flows of the projects are provided below.

Equipment 1

Equipment 2

Cost

$157,000

$182,000

Future Cash Flows

Year 1

Year 2

Year 3

Year 4

Year 5

67 000

82 000

78 000

64 000

56 000

83 000

94 000

80 000

77 000

73 000

Required:

a) Identify which option of equipment should the company accept based on Net Present Value (NPV) method?

b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 3…

8.2-15

Question Help

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $440,000. The Sisyphean Company

expects cash inflows from this project as detailed below:

Year 1

Year 2

Year 3

Year 4

$200,000

$225,000

$275,000

$200,000

The appropriate discount rate for this project is 15%.

The net present value (NPV) for this project is closest to:

A. $199,213

B. $498,032

C. $209,174

D. $139,449

Homework, Chapter 26

Determine Cash Flows

Natural Foods Inc. is planning to invest in new manufacturing equipment to make a new

garden tool. The new garden tool is expected to generate additional annual sales of

5,600 units at $38 each. The new manufacturing equipment will cost $91,000 and is

expected to have a 10-year life and a $7,000 residual value. Selling expenses related to

the new product are expected to be 4% of sales revenue. The cost to manufacture the

product includes the following on a per-unit basis:

Direct labor

$6.50

Direct materials

21.00

Fixed factory overhead-depreciation

1.50

Variable factory overhead

3.30

Total

$32.30

Determine the net cash flows for the first year of the project, Years 2-9, and for the last

year of the project. Use the minus sign to indicate cash outflows. Do not round your

intermediate calculations but, if required, round your final answers to the nearest dollar.

Natural Foods Inc.

Net Cash Flows

Year 1 Years 2-9 Last Year

Initial investment…

Chapter 16 Solutions

Survey Of Accounting

Ch. 16 - Prob. 1QCh. 16 - Prob. 2QCh. 16 - Prob. 3QCh. 16 - 4. Define the term return on investment. How is...Ch. 16 - Prob. 5QCh. 16 - Prob. 6QCh. 16 - Prob. 7QCh. 16 - Prob. 8QCh. 16 - Prob. 9QCh. 16 - Prob. 10Q

Ch. 16 - 11. Maria Espinosa borrowed 15,000 from the bank...Ch. 16 - Prob. 12QCh. 16 - 13. What criteria determine whether a project is...Ch. 16 - Prob. 14QCh. 16 - Prob. 15QCh. 16 - Prob. 16QCh. 16 - 17. What is the relationship between desired rate...Ch. 16 - Prob. 18QCh. 16 - Prob. 19QCh. 16 - Prob. 20QCh. 16 - Prob. 21QCh. 16 - Prob. 22QCh. 16 - Prob. 23QCh. 16 - Exercise 10-1A Identifying cash inflows and...Ch. 16 - Exercise 10-2A Determining the present value of a...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Exercise 10-5A Determining net present value...Ch. 16 - Exercise 10-6A Determining net present value Aaron...Ch. 16 - Exercise 10-7A Using the present value index Rolla...Ch. 16 - Exercise 10-8A Determining the cash flow annuity...Ch. 16 - Prob. 9ECh. 16 - Exercise 10-10A Using the internal rate of return...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Exercise 10-13A Determining the payback period...Ch. 16 - Prob. 14ECh. 16 - Prob. 15ECh. 16 - Prob. 16PCh. 16 - Prob. 17PCh. 16 - Problem 10-18A Postaudit evaluation Brett Collins...Ch. 16 - Problem 10-19A Using net present value and...Ch. 16 - Problem 10-20A Using the payback period and...Ch. 16 - Problem 10-21A Using net present value and payback...Ch. 16 - Problem 10-22A Effects of straight-line versus...Ch. 16 - Problem 10-23A Comparing internal rate of return...Ch. 16 - Prob. 1ATCCh. 16 - ATC 10-4 Writing Assignment Limitations of capital...Ch. 16 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 2 You expect to receive $100 in year 1, $150 in year 2, and $200 in year 3 if you invest in Project XYZ. The project requires you to make an initial investment of $150 in year 0. You also expect to incur the following expenses: $80 in year 1, $80 in year 2, $100 in year 3. Suppose the current discount rate is 10% and remain the same. Suppoe all cash flows are incurred at the end of each year. What is the dynamic payback period? (round to 2nd decimal place)arrow_forwardFinancial Management Question QUESTION TWO A company is considering an investment proposal to install new milling controls. The project will cost Kshs 50,000,000. The facility has a life expectancy of five years and no salvage value. The company’s tax rate is 40%. The estimated cash flows from the proposed investment proposal are as follows: Year CF Kshs 000 1 13,000 2 14,000 3 18,000 4 23,000 5 25,000 Compute: Accounting Rate of Return Discounted payback period at 6% discounting factor Net present value at 15% discounting factor and advise management on the project’s feasibilityarrow_forwardQuestion 2 New Age Ltd is considering investing in one of the two following projects to buy a new assembly line. Each option will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Assembly Line 1 Assembly Line 2 Cost $386,000 $425,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 136 000 213 000 283 000 215 000 175 000 197 000 184 000 186 000 265 000 263 000 Required: Identify which option of assembly line the company should accept based on the NPV method (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) Identify which option of assembly line the company should accept based on the Profitability Index method.arrow_forward

- Question 10 Cobb Leather purchased a lot in 6 years ago at a cost of $170,000. Today, that lot has a market value of $350,000. When they purchased the land, the company spent $35,000 to level the lot and another $17,000 to install a drainage system. The company now wants to build a new facility on that site. The building cost is estimated at $1.20 million. What amount should be used as the initial cash flow for this project? O $2.572,000 $1,550,000 O$1,477,000 O $1.425,000 O-$225.000arrow_forwardQuestion 13 You have just completed a $24,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $101,000, and if you sold it today, you would net $111,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $28,000 plus an initial investment of $4,900 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Price you paid for the space two years ago. B. Feasibility study for the new coffee shop. C. Initial investment in inventory. D. Amount you would net after taxes should you sell the space today. E. Capital expenditure to outfit the space. Calculate the initial cash flow below: (Round to the nearest dollar.) 1 (1) $ 2 (2) $ 3 (3) $ 4…arrow_forwardQuestion 14 You have just completed a $20,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $115,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $30,000 plus an initial investment of $5,000 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Capital expenditure to outfit the space. B. Initial investment in inventory. C. Amount you would net after taxes should you sell the space today. D. Price you paid for the space two years ago. E. Feasibility study for the new coffee shop. Calculate the initial cash flow below:Round to the nearest dollar.) 1 (1) $ 2 (2) $ 3 (3) $ 4…arrow_forward

- Problem 6 - Shirt Corporation is considering purchasing equipment that costs $60,000 and is expected to provide the following cash inflows over its five-year useful life: Year Cash Inflow 1 $18,000 2 $22,000 3 $24,000 4 $16,000 5 $ 9,000 Calculate the payback period for this investment.arrow_forwardQuestion 26 Miller and Sons is evaluating a project with the following cash flows: Year Cash Flows 0 -$150,000 1 20,000 2 45,000 3 100,000 4 30,000 5 -10,000 The company uses a 7 percent reinvestment rate and a 12 percent discount rate on all of its projects. What is the MIRR of the project using the discount approach? Hint: This information will be used on three related MIRR problems. Group of answer choices 7.76 percent 9.05 percent 8.74 percent 7.05 percent 7.92 percentarrow_forwardHomework, Chapter 26 Cash Payback Period for a Service Company Jane's Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of $150,000 and each with an eight-year life and expected total net cash flows of $240,000. Location 1 is expected to provide equal annual net cash flows of $30,000, and Location 2 is expected to have the following unequal annual net cash flows: Year 1 $68,000 Year 2 51,000 Year 3 31,000 Year 4 29,000 Year 5 22,000 Year 6 16,000 Year 7 13,000 Year 8 10,000 Determine the cash payback period for both location proposals. Location 1 years Location 2 yearsarrow_forward

- Question 27 PART 1 Miller and Sons is evaluating a project with the following cash flows: Year Cash Flows 0 -$150,000 1 20,000 2 45,000 3 100,000 4 30,000 5 -10,000 The company uses a 7 percent reinvestment rate and a 12 percent discount rate on all of its projects. What is the MIRR of the project using the reinvestment approach? Hint: This information will be used on three related MIRR problems. Group of answer choices 7.76 percent 9.05 percent 8.74 percent 7.05 percent 7.92 percent Question 27 PART 2 Miller and Sons is evaluating a project with the following cash flows: Year Cash Flows 0 -$150,000 1 20,000 2 45,000 3 100,000 4 30,000 5 -10,000 The company uses a 7 percent reinvestment rate and a 12 percent discount rate on all of its projects. What is the MIRR of the project using the combination approach? Hint: This information will be used on three related MIRR problems. Group of answer…arrow_forwardProblem 13-21 Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows: Windy Acres Yearly Aftertax Cash Inflow 20,000 25,000 40,000 55,000 60,000 Coefficient of Variation 0-0.35 0.35-0.40 0.40-0.50 Over 0.50 Probability 0.2 0.2 0.2 Windy Acres Hillcrest Apartments 0.2 0.2 Mr. Backster is likely to hold the apartment complex of his choice for about 20 years and will use this period for decision-making purposes. Either apartment can be purchased for $140,000. Mr. Backster uses a risk-adjusted discount rate approach when evaluating Investments. His scale is related to the coefficient of variation (for other types of investments, he also considers other measures). O Windy Acres O Hillcrest O Both O None Discount Rate 7% 10 14 not considered Hillcrest Apartments Yearly Aftertax Cash Inflow…arrow_forwardNEED PART 4 & 5 ANSWERED ONLY Boston Cola is considering the purchase of a special-purpose bottling machine for $35,000. It is expected to have a useful life of 4 years with no terminal disposal value. The plant manager estimates the following savings in cash operating costs: Boston Cola uses a required rate of return of 14% in its capital budgeting decisions. Ignore income taxes in your analysis. Assume all cash flows occur at year-end except for initial investment amounts. Data Table Year Amount Year 1 $15,000 Year 2 11,000 Year 3 10,000 Year 4 8,000 Total $44,000 (Use factor amounts rounded to three decimal places. Round your answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) Calculate the following for the special purpose bottling machine: 1. Net present value = -1900 2. Payback period = 2.90 3. Discounted payback period: Amount can not be determined…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License