Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

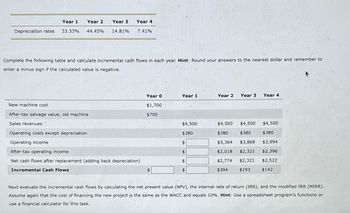

Transcribed Image Text:Depreciation rates

Year 1 Year 2

33.33%

Year 3

44.45%

14.81%

Year 4

7.41%

Complete the following table and calculate incremental cash flows in each year. Hint: Round your answers to the nearest dollar and remember to

enter a minus sign if the calculated value is negative.

Year 0

Year 1

Year 2

Year 3

Year 4

New machine cost

$1,700

After-tax salvage value, old machine

$700

Sales revenues

$4,500

$4,500

Operating costs except depreciation

$380

$380

$4,500

$380

$4,500

$380

Operating income

$

$3,364 $3,868 $3,994

After-tax operating income

$2,018 $2,321 $2,396

Net cash flows after replacement (adding back depreciation)

Incremental Cash Flows

$

$

$2,774

$2,321 $2,522

$394

$193

$142

Next evaluate the incremental cash flows by calculating the net present value (NPV), the internal rate of return (IRR), and the modified IRR (MIRR).

Assume again that the cost of financing the new project is the same as the WACC and equals 10%. Hint: Use a spreadsheet program's functions or

use a financial calculator for this task.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Valuation of cash flow streams Question 1 Suppose that you are considering an investment product that promises to pay $2,000 at the end of each year for the next five years. Assume that a discount rate of 12% is applicable to similar investment alternatives. Answer questions a) and b) below. a) How much would you be willing to pay for the investment product? ( Lecture notes pp.9-11) Answer (show the steps/ calculation toward your results): b) Consider another investment product that promises to pay $1,000 every six months for the next five years, with the first payment to be made in six months from today. Applying the same discount rate, how much would you pay for this product? (See p.15 for a monthly case.) Answer (show the steps/calculation toward your results):arrow_forwardA8arrow_forwardNeed help on this question thank you.arrow_forward

- A machine costing P8,350 yields total cash flows of P.13,100 over 5 years. The following pertains to the annual cash flows using the machine: Year Net Cash inflows 1 P1,750 2 2,250 3 2,850 4 3,000 5 3,250 Compute for the company's payback reciprocal.arrow_forwardA8 please help.....arrow_forwardDoor to Door Moving Company is considering purchasing new equipment that costs $734,000. Its management estimates that the equipment will generate cash inflows as follows: Year 1 2 3 4 5 $204,000 204,000 262,000 262,000 158,000 Present value of $1: 6% 1 2 3 4 5 0.943 0.890 0.840 0.792 0.747 7% A. $36,312 B. $886,000 OC. $871,928 OD. $786,000 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 9% 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0.683 0.621 The company's annual required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar.)arrow_forward

- ► CRC Inc. is buying new equipment that has the following cash flows: Year Cash Flow O-$17.7 What is the NPV if the interest rate is $6%? O $482.24 D -$537.78 0 -$500 O $22.44 1 $100 2 $200 3 $250arrow_forwardCalculate the total capital cost and the annual worth for the following cash flow diagram (the time is infinity)arrow_forwardCompany Express S. A. asks you to construct cash flows for following three (3) investment projects, containing following information:PROJECT 1a. Sales (in ThCh$):- Year 1: 90,000- Year 2: 55,000- Year 3: 75,000- Year 4: 190,000b. Cost of sales is estimated at 53% of sales.c. Depreciation for year is ThCh$ 15,000 per period (period 1 to 3). In year 4 there is a sale of machinery that results in a gain on sale of non-current assets of ThCh$ 9,800. Total depreciation for year 4 is ThCh$ 12,500.d. Administrative expenses are equivalent to 17% of sales.e. In period 0 there is an investment of ThCh$ 58,000.f. There is credit financing of ThCh$ 32,000 which is amortized in equal parts of ThCh$ 8,000 per period with a financial expense of ThCh$ 3,700 per period.g. There is an investment in working capital of ThCh$ 24,000 in period 0, which is recovered in period 4.h. In period 4 there is an investment in land of ThCh$ 40,000.i. Income tax rate is 17%. Calculate: cash flow per period. Please…arrow_forward

- Consider the following data showing the cash flows per year from a real estate property: Year: 1 2 3 4 5 Cash Flow: $21,000 $22,000 $23,000 $24,000 $25,000 After the 5th year, cash flows are expected to rise at a constant rate of 2.5% per year for the many years in the future. Your cost of money (interest paid on the loan) is 5.5% per year. A. Calculate the appraisal value of the house. B. Define and calculate the cap rate. Explain what it means. (Answer with respect to Excel for both)arrow_forwardOperating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,220 in Year 1; $3,552 in Year 2; $2,109 in Year 3; $1,332 in both Year 4 and Year 5; and $555 in Year 6. The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table. The firm is subject to a 40% tax rate on ordinary income. a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6.) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. a. Calculate the operating cash inflows associated with the new lathe below: (Round to the nearest dollar.) Year Revenue Expenses (excluding…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education