Javier Company has sales of $8 million and quality costs of $1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The “right” prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs.

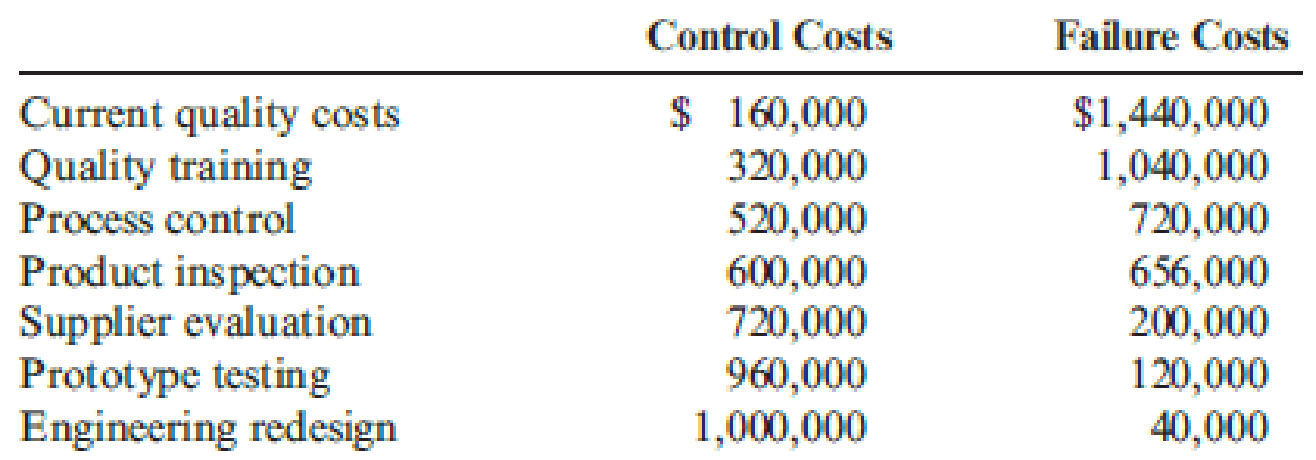

Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to $320,000, and the failure costs drop to $1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected.

Required:

- 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool.

- 2. Given the activities selected in Requirement 1, calculate the following:

- a. The reduction in total quality costs

- b. The percentage distribution for control and failure costs

- c. The amount for this year’s bonus pool

- 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.

Trending nowThis is a popular solution!

Chapter 14 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Accurate answerarrow_forwardOpereting cash flow if the tax rate in 34 percent?arrow_forwardManufacturing overhead is applied based on budgeted direct labor hours. The direct labor budget indicates that 6,200 direct labor hours will be required during the year. The variable overhead rate is $4.10 per direct labor hour. The company's budgeted fixed manufacturing overhead is $92,500 per year, which includes depreciation of $18,400. All other fixed manufacturing overhead costs represent current cash flows. The predetermined overhead rate would be_.helparrow_forward

- Manufacturing overhead is applied based on budgeted direct labor hours. The direct labor budget indicates that 6,200 direct labor hours will be required during the year. The variable overhead rate is $4.10 per direct labor hour. The company's budgeted fixed manufacturing overhead is $92,500 per year, which includes depreciation of $18,400. All other fixed manufacturing overhead costs represent current cash flows. The predetermined overhead rate would be_.arrow_forwardHelparrow_forwardDove, Incarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning