InterGlobal Industries is a diversified corporation with separate operating divisions. Each division’s performance is evaluated on the basis of profit and

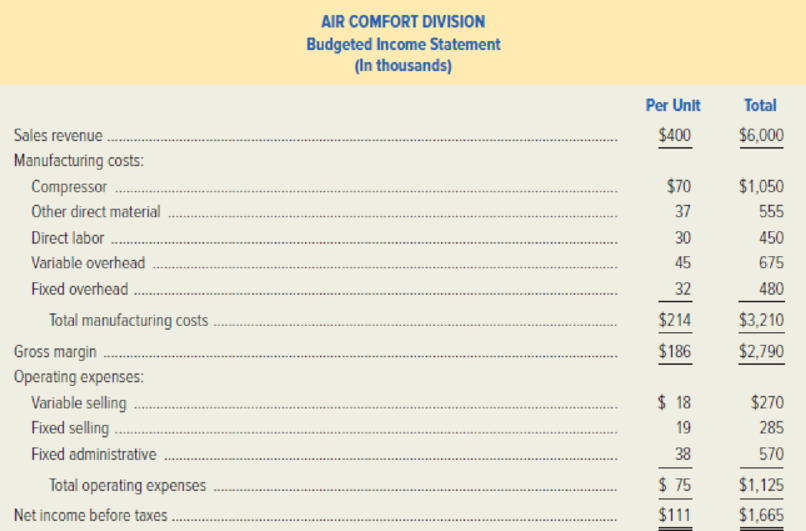

The Air Comfort Division manufactures and sells air-conditioner units. The coming year’s

Air Comfort’s division manager believes sales can be increased if the price of the air-conditioners is reduced. A

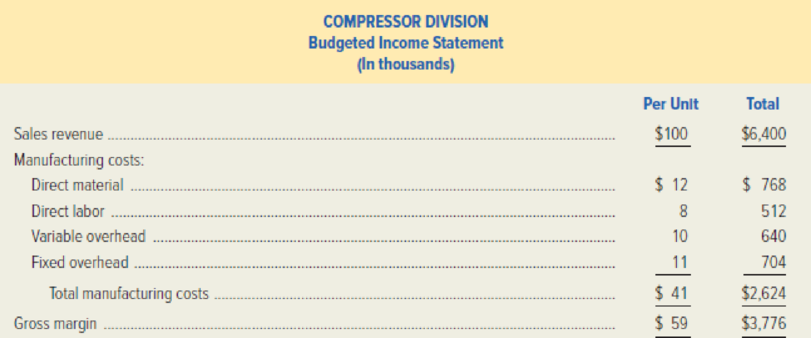

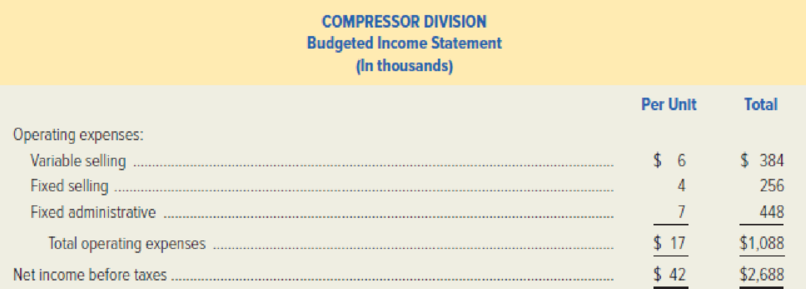

The Air Comfort Division uses a compressor in its units, which it purchases from an outside supplier at a cost of $70 per compressor. The Air Comfort Division manager has asked the manager of the Compressor Division about selling compressor units to Air Comfort. The Compressor Division currently manufactures and sells a unit to outside firms that is similar to the unit used by the Air Comfort Division. The specifications of the Air Comfort Division compressor are slightly different, which would reduce the Compressor Division’s direct material cost by $1.50 per unit. In addition, the Compressor Division would not incur any variable selling costs in the units sold to the Air Comfort Division. The manager of the Air Comfort Division wants all of the compressors it uses to come from one supplier and has offered to pay $50 for each compressor unit.

The Compressor Division has the capacity to produce 75,000 units. Its budgeted income statement for the coming year, which follows, is based on a sales volume of 64,000 units without considering Air Comfort’s proposal.

Required:

- 1. Should the Air Comfort Division institute the 5 percent price reduction on its air-conditioner units even if it cannot acquire the compressors internally for $50 each? Support your conclusion with appropriate calculations.

- 2. Independently of your answer to requirement (1), assume the Air Comfort Division needs 17,400 units. Should the Compressor Division be willing to supply the compressor units for $50 each? Support your conclusions with appropriate calculations.

- 3. Independently of your answer to requirement (1), assume Air Comfort needs 17,400 units. Suppose InterGlobal’s top management has specified a transfer price of $50. Would it be in the best interest of InterGlobal Industries for the Compressor Division to supply the compressor units at $50 each to the Air Comfort Division? Support your conclusions with appropriate calculations.

- 4. Is $50 a goal-congruent transfer price? [Refer to your answers for requirements (2) and (3).]

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the products they produce. AC Division is smaller and the life of the products it produces tend to be shorter than those produced by the larger SO Division. Selected financial data for the past year is shown as follows. Divisional investment is as of the beginning of the year. Colonial Pharmaceuticals uses a 9 percent cost of capital and uses beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes. so Division $ 1,500 AC Division $ 630 Allocated corp. overhead Cost of goods sold 3,260 7,600 77,000 Divisional investment 9,600 R&D 4,200 1,875 9,200 Sales 20,600 SG&A 790 1,230 R&D is assumed to have a two-year life in the AC Division and a nine-year life in the SO division. All R&D expenditures are spent at the beginning of the year. Assume there are no current liabilities and (unrealistically) that no R&D investments had taken…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries. However, the…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it.The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries. However, the…arrow_forward

- CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries.…arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses an 8 percent cost of capital and beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes. Division Canal ($000) Lake ($000) Allocated corporate overhead $ 4,100 $ 9,600 Cost of goods sold 20,000 30,000 Divisional investment 60,100 400,000 R&D 12,000 32,000 Sales 50,000 100,000 Selling, general and administrative (excluding R&D) 4,500 8,000 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent…arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses an 8 percent cost of capital and beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes. Division Canal ($000) Lake ($000) Allocated corporate overhead $ 4,100 $ 9,600 Cost of goods sold 20,000 30,000 Divisional investment 60,100 400,000 R&D 12,000 32,000 Sales 50,000 100,000 Selling, general and administrative (excluding R&D) 4,500 8,000 Required: Compute divisional income for the two divisions. Calculate the operating margin, which is equivalent to the return on sales,…arrow_forward

- Navarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses a(n) 8 percent cost of capital and beginning-of- the-year investment when computing ROI and residual income. Ignore income taxes. Allocated corporate overhead Cost of goods sold Divisional investment R&D Sales Selling, general and administrative. (excluding R&D) Division Canal ($000) $4,900 28,000 60,900 12,800 66,008 5,300 Lake (5000) $ 10,000 38,800 400,000 72,000 180,000 7,600 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent at the beginning of the year. Assume…arrow_forwardThe new chief executive officer (CEO) of Richard Manufacturing has asked for a variety of information about the operations of the firm from last year. The CEO is given the following information, but with some data missing: (Click the icon to view the variety of operations information.) Read the requirements, Requirement 1. Find (a) total sales revenue, (b) selling price, (c) rate of return on investment, and (d) markup percentage on full cost for this product. (a) The total sales revenue is (Round your answer to the nearest cent.) (b) The selling price per unit is (Round the retum on investment to the nearest whole percent, X%.) (c) The rate of return on investment is (d) Calculate the markup percentage on full cost for this product. (Round your intermediary calculations to the nearest cent and the markup to the nearest hundredth percent XXX%) The markup percentage on full cost for this product is Requirement 2. The new CEO has a plan to reduce fixed costs by $200,000 and variable…arrow_forwardBarfield Corporation prepares business plans and marketing analyses for start-up companies in the Cleveland area. Barfield has been very successful In recent years in providing effective service to a growing number of clients. The company provides its service from a single office building in Cleveland and is organized into two main client-service groups: one for market research and the other for financial analysis. The two groups have budgeted annual costs of $530,000 and $800,000, respectively. In addition, Barfield has a support staff that is organized into two main functions: one for clerical, facilities, and logistical support (called the CFL group) and another for computer-related support. The CFL group has budgeted annual costs of $108,000, while the annual costs of the computer group are $630,000. Tom Brady, CFO of Barfield, plans to prepare a departmental cost allocation for his four groups, and he assembles the following Information: Percentage of estimated dollars of work and…arrow_forward

- The managers of Lessing Toy & Hobby (LTH) have decided to keep the stores in the Northern Division open, in spite of the dwindling demand in the area. They want to forecast what the income will be in the coming year, using the income statement as the base. The cost analyst at LTH estimates sales in the coming year will only be 85 percent of the current year sales. Cost of goods sold is estimated to be 90 percent of the current year. The managers have decided to increase advertising next year by 10 percent above the current year, but will cut administrative salaries in the Northern Division by 30 percent. They also expect to lower rent and occupancy costs by 15 percent. Allocated corporate overhead, based on information from the CFO, is expected to be $1.2 million. Required: Prepare an income statement for Year 2 for the Northern Division based on the estimates provided by the cost analyst and other managers at LTH. Note: Enter your answers in thousands e.g., 10,000,000 should be…arrow_forwardBarfield Corporation prepares business plans and marketing analyses for start-up companies in the Cleveland area. Barfield has been very successful in recent years in providing effective service to a growing number of clients. The company provides its service from a single office building in Cleveland and is organized into two main client-service groups: one for market research and the other for financial analysis. The two groups have budgeted annual costs of $440,000 and $810,000, respectively. In addition, Barfield has a support staff that is organized into two main functions: one for clerical, facilities, and logistical support (called the CFL group) and another for computer-related support. The CFL group has budgeted annual costs of $216,000, while the annual costs of the computer group are $654,000. Tom Brady, CFO of Barfield, plans to prepare a departmental cost allocation for his four groups, and he assembles the following information: Percentage of estimated dollars of work and…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. The company's management team is seeking guidance on the use of financial performance measures to identify the key drivers of the company's financial performance and develop a strategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-tax operating income from sales of clothing in 2022 is $900,000. Income for the clothing division has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operating income in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-tax return on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers should have their compensation structure aligned with their performance measures with no fixed salaries. However,…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning