Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 39P

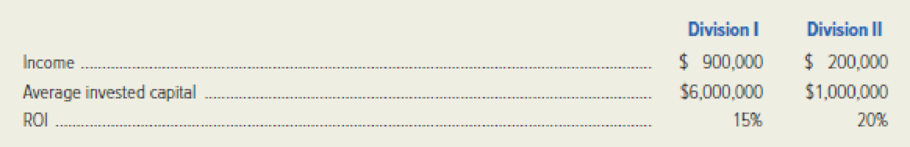

Long Beach Pharmaceutical Company has two divisions, which reported the following results for the most recent year.

Required: Compute each division’s residual income for the war under each of the following assumptions about the firm’s cost of acquiring capital.

- 1. 12 percent.

- 2. 15 percent.

- 3. 18 percent.

Which division was more successful? Explain your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of

$228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes.

Required:

a. Compute the divisional ROI for the Custodial Division.

b. Compute the divisional RI for the Custodial Division.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the divisional ROI for the Custodial Division.

Divisional ROI

%

Required A

Required B >

Required Information

[The following Information applies to the questions displayed below.]

Megamart provides the following Information on its two Investment centers.

Investment Center

Electronics

Sporting goods

Sales

$ 63,460,000

19,050,000

1. Compute return on Investment for each center. Using return on investment, which center is most efficient at using assets to

generate Income?

2. Assume a target Income of 12% of average assets. Compute residual income for each center. Which center generated the most

residual Income?

3. Assume the Electronics center is presented with a new Investment opportunity that will yield a 14% return on Investment. Should

the new Investment opportunity be accepted? The target return is 12%.

Complete this question by entering your answers in the tabs below.

Numerator:

Required 1 Required 2 Required 3

Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to

generate income?

Income

$ 3,173,000…

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial

information (in thousands of dollars) for the first year of business follows:

Sales revenue

Income

Divisional assets (beginning of year)

Current liabilities (beginning of year)

R&D expendituresa

aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year.

Required:

a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA).

a-2. Which division had the better performance?

Complete this question by entering your answers in the tabs below.

Req A1

Divisions

Req A2

Carolinas

Northeast

Carolinas

$ 1,100

190

1,000

190

550

Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA).

Note: Note: Enter answers in thousands of dollars. Round your answers to 1 decimal place.

EVA

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 13 - What is the managerial accountants primary...Ch. 13 - Define goal congruence, and explain why it is...Ch. 13 - Describe the managerial approach known as...Ch. 13 - Prob. 4RQCh. 13 - Prob. 5RQCh. 13 - Prob. 6RQCh. 13 - Create an example showing how residual income is...Ch. 13 - What is the chief disadvantage of ROI as an...Ch. 13 - Why is there typically a rise in ROI or residual...Ch. 13 - Define the term economic value added. How does it...

Ch. 13 - Distinguish between the following measures of...Ch. 13 - Why do some companies use gross book value instead...Ch. 13 - Explain why it is important in performance...Ch. 13 - How do organizations use pay for performance to...Ch. 13 - Describe an alternative to using ROI or residual...Ch. 13 - Prob. 16RQCh. 13 - Prob. 17RQCh. 13 - Discuss the importance of nonfinancial information...Ch. 13 - Identify and explain the managerial accountants...Ch. 13 - Describe four methods by which transfer prices may...Ch. 13 - Explain the significance of excess capacity in the...Ch. 13 - Why might income-tax laws affect the...Ch. 13 - Prob. 23RQCh. 13 - The following data pertain to Dakota Divisions...Ch. 13 - Refer to the preceding exercise. Requited:...Ch. 13 - Refer to the data for Exercise 1324. Assume that...Ch. 13 - Golden Gate Construction Associates, a real estate...Ch. 13 - Prob. 28ECh. 13 - Prob. 29ECh. 13 - Refer to Exhibit 133. Assume that you are a...Ch. 13 - Prob. 32ECh. 13 - Prob. 33ECh. 13 - Prob. 34ECh. 13 - Prob. 35ECh. 13 - Long Beach Pharmaceutical Company has two...Ch. 13 - Prob. 37PCh. 13 - Prob. 38PCh. 13 - Long Beach Pharmaceutical Company has two...Ch. 13 - Prob. 40PCh. 13 - Prob. 41PCh. 13 - Megatronics Corporation, a massive retailer of...Ch. 13 - Prob. 43PCh. 13 - Prob. 44PCh. 13 - Prob. 45PCh. 13 - Clearview Window Company manufactures windows for...Ch. 13 - Prob. 47PCh. 13 - Alpha Communications, Inc., which produces...Ch. 13 - Prob. 49PCh. 13 - Holiday Entertainment Corporation (HHC), a...Ch. 13 - InterGlobal Industries is a diversified...Ch. 13 - Prob. 52C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardLasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expendituresa aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). a-2. Which division had the better performance? Complete this question by entering your answers in the tabs below. Req A1 Divisions Carolinas $2,400 160 1,000 320 1,200 Req A2 Carolinas Northeast Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). Note: Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1). Northeast $ 7,200 372 1,500 320 1,120 ROI % %arrow_forwardThe Western Division of Claremont Company had net operating income of $154,000 and average invested assets of $557,000. Claremont has a required rate of return of 14.75 percent. Western has an opportunity to increase operating income by $48,000 with a $84,000 investment in assets. Compute Western Division's return on investment and residual income currently and if it undertakes the project. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answers to the nearest whole dollar. Return on Investment (ROI) Residual Income (Loss) Current % Proposed Projectarrow_forward

- Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expendituresa aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). a-2. Which division had the better performance? Req A1 Complete this question by entering your answers in the tabs below. Divisions Carolinas $ 2,100 170 1,000 290 1,050 Req A2 Carolinas Northeast Northeast $ 6,600 372 1,500 290 970 Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). Note: Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1). ROI % %arrow_forwardThe vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,00 Cost of goods sold Operating expenses Invested assets 900,000 4,000,000 495,000 968,000 750,000 3,600,000 Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 20Y9, assuming that there were no service department charges. Touting Bike Division Trial Bike Divisionarrow_forwardEvaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). Note: Note: Enter answers in thousands of dollars. Round your answers to 1 decimal place.arrow_forward

- Alyeska Services Company, a division of a major all company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales Net operating income Average operating assets Required: 1. Compute the margin. (Round your answer to 2 decimal places.) 2. Compute the turnover. (Round your answer to 2 decimal places.) 3. Compute the return on investment (ROI). (Round your intermediate calculations and final answer to 2 decimal places.) 1. Margin 2. Turnover 3. ROI % $ 17,900,000 $ 5,600,000 $ 36,100,000 %arrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $33,667,200, net operating income of $4,679,741, and average operating assets of $7,014,000. The company's minimum required rate of return is 22%. Required: a. What is the division's margin? Note: Round your percentage answer to 2 decimal places. b. What is the division's turnover? Note: Round your answer to 2 decimal places. c. What is the division's return on investment (ROI)? Note: Round percentage your answer to 2 decimal places. a. Margin b. Turnover c. Return on investmentarrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $24,048,000, net operating income of $2,765,520, and average operating assets of $6,012,000. The company's minimum required rate of return is 17% Required: a. What is the division's margin? (Round your percentage answer to 2 decimal places.) b. What is the division's turnover? (Round your answer to 2 decimal places.) c. What is the division's return on investment (ROI)? (Round percentage your answer to 2 decimal places.) a. Margin b. Turnover c. Return on investment 96arrow_forward

- Augustus Electrical Company has 2 divisions, one in Georgetown and one in Berbice Guyana and information on the both divisions are as follows: Georgetown Berbice Total assets $100,000 $500,000 Current liabilities 25,000 150,000 Revenue 50,000 50,000 Income before tax 20,000 75,000 Required: Calculate the return on investment (ROI) using net income and total assets as the measure of income and investment for the Berbice division. a.150% b.1.5% c.15% d.20%arrow_forwardHardin Company is a division of a major corporation. The following data are for the latest year of operations: Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 % Required: What is the division's residual income?arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses a(n) 8 percent cost of capital and beginning-of- the-year investment when computing ROI and residual income. Ignore income taxes. Allocated corporate overhead Cost of goods sold Divisional investment R&D Sales Selling, general and administrative. (excluding R&D) Division Canal ($000) $4,900 28,000 60,900 12,800 66,008 5,300 Lake (5000) $ 10,000 38,800 400,000 72,000 180,000 7,600 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent at the beginning of the year. Assume…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License