Megatronics Corporation, a massive retailer of electronic products, is organized in four separate divisions. The four divisional managers are evaluated at year-end, and bonuses are awarded based on ROI. Last year, the company as a whole produced a 13 percent return on its investment.

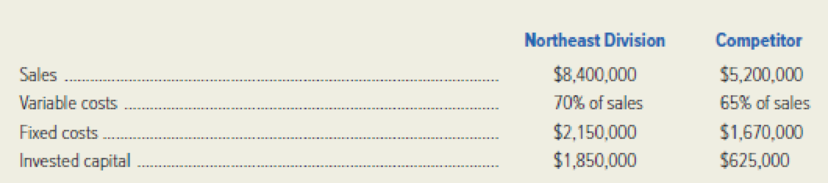

During the past week, management of the company’s Northeast Division was approached about the possibility of buying a competitor that had decided to redirect its retail activities. (If the competitor is acquired, it will be acquired at its book value.) The data that follow relate to recent performance of the Northeast Division and the competitor:

Management has determined that in order to upgrade the competitor to Megatronics’ standards, an additional $375,000 of invested capital would be needed.

Required: As a group, complete the following requirements.

- 1. Compute the current ROI of the Northeast Division and the division’s ROI if the competitor is acquired.

- 2. What is the likely reaction of divisional management toward the acquisition? Why?

- 3. What is the likely reaction of Megatronics’ corporate management toward the acquisition? Why?

- 4. Would the division be better off if it didn’t upgrade the competitor to Megatronics’ standards? Show computations to support your answer.

- 5. Assume that Megatronics uses residual income to evaluate performance and desires a 12 percent minimum

return on invested capital. Compute the current residual income of the Northeast Division and the division’s residual income if the competitor is acquired. Will divisional management be likely to change its attitude toward the acquisition? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Faced with headquarters’ desire to add a new product line, Stefan Grenier, manager of Bilti Products’ East Division, felt that he had to see the numbers before he made a move. His division’s ROI has led the company for three years, and he doesn’t want any letdown. Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the company’s East Division for last year are given below: Sales $ 28,700,000 Variable expenses 14,390,000 Contribution margin 14,310,000 Fixed expenses 12,301,000 Operating income $ 2,009,000 Divisional operating assets $ 7,175,000 The company had an overall ROI of 16% last year (considering all divisions). The new product line that headquarters wants Grenier’s East Division to add would require an investment of $4,100,000. The cost and revenue characteristics…arrow_forwardPaula Boothe, president of the Flint Corporation, has mandated a minimum 6% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 8%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 14% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,960,000 in a new line of energy drinks that is expected to generate $224,200 in operating income. (a) Calculate the residual income for the proposed new line of energy drinks. Residual income $arrow_forwardFaced with headquarters’ desire to add a new product line, Stefan Grenier, manager of Bilti Products’ East Division, felt that he had to see the numbers before he made a move. His division’s ROI has led the company for three years, and he doesn’t want any letdown. Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the company’s East Division for last year are given below: Sales $ 23,800,000 Variable expenses 13,760,000 Contribution margin 10,040,000 Fixed expenses 8,374,000 Operating income $ 1,666,000 Divisional operating assets $ 5,950,000 The company had an overall ROI of 16% last year (considering all divisions). The new product line that headquarters wants Grenier’s East Division to add would require an investment of $3,400,000. The cost and revenue characteristics of…arrow_forward

- Paula Boothe, president of the Flint Corporation, has mandated a minimum 8% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 10%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 13% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,812,000 in a new line of energy drinks that is expected to generate $329,000 in operating income. Assume that Flint Corporation's actual weighted-average cost of capital is 9% and its tax rate is 30%. (a) Calculate the economic value added of the proposed new line of energy drinks. (If the economic value added is negative then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125). Round answer to 0…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forwardRichmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forward

- Paula Boothe, president of the Indigo Corporation, has mandated a minimum 8% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 10%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 16% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $2,000,000 in a new line of energy drinks that is expected to generate $300,000 in operating income. (a) Calculate the return on investment expected on the new line of energy drinks. (Round answer to 1 decimal place, eg. 5.1%.) % Return on Investmentarrow_forwardPaula Boothe, president of the Bramble Corporation, has mandated a minimum 9% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 11%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 17% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $2,000,000 in a new line of energy drinks that is expected to generate $300,000 in operating income. (a) Calculate the return on investment expected on the new line of energy drinks. (Round answer to 1 decimal place, e.g. 5.1%.) Return on Investment eTextbook and Media do %arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward

- “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forwardknow headquarters wants us to add that new product line," said Dell Havasi, manager of Billings Company's Office Products Division. "But I want to see the numbers before I make a decision. Our division's return on investment (ROI) has led the company for three years, and I don't want any letdown." Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROL with year-end bonuses given to the divisional managers who have the highest ROIS. Operating results for the company's Office Products Division for this year are given below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Divisional average operating assets The company had an overall return on investment (ROI) of 17.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,755,000 of additional average operating assets. The annual cost and revenue estimates for the new…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning