Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 8P

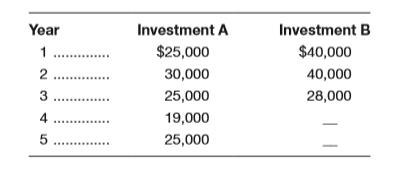

Assume a

a. Calculate the payback for investments A and B.

b. If the inflow in the fifth year for Investment A was

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider two mutually exclusive investment alternatives given in the table below.

Click the icon to view the cash flows for the projects.

(a) Determine the IRR on the incremental investment in the amount of $5,000. (Assume that MARR=4%.)

The rate of return on the incremental investment is %. (Round to two decimal places.)

a)Calculate the internal rate of retum (IRR) of the following cash flow. Determine if this is a

good investment for a MARR of 3% per year.

b)Calculatethe extemalrate of return (ERR) of the following cash flow by assuming a MARR

of 3% per year. Determine if this is a good investment.

Cash Flow, $

-100,000

-10,000

-1,000

13,000

13,000

13,000

Cash Flow, $

|16,000

|16,000

16,000

16,000

16,000

16,000

Year

6

Year

1

2

3

4

5

10

11

Calculate the payback period, net present value, and internal rate of return for Project A. Assume a discount rate of 10%. Should the firm accept or reject Project A? Explain. If Project A and Project B are mutually exclusive, which is the better choice? Explain. What are “non-conventional” cash flows? What issues arise when evaluating projects with “non-conventional” cash flows?

Project A

Project B

Year

Cash Flow

Year

Cash Flow

0

-$100,000

0

-$1

1

$70,000

1

$0

2

$0

2

$0

3

$50,000

3

$10

Chapter 12 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 12 - Prob. 1DQCh. 12 - Why does capital budgeting rely on analysis of...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - What does the term mutually exclusive investments...Ch. 12 - Prob. 6DQCh. 12 - If a corporation has projects that will earn more...Ch. 12 - What is the net present value profile? What three...Ch. 12 - How does an asset’s ADR (asset depreciation...Ch. 12 - Assume a corporation has earnings before...

Ch. 12 - Assume a corporation has earnings before...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Al Quick, the president of a New York Stock...Ch. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Assume a 90,000 investment and the following cash...Ch. 12 - Prob. 9PCh. 12 - X-treme Vitamin Company is considering two...Ch. 12 - You buy a new piece of equipment for 16,230, and...Ch. 12 - Prob. 12PCh. 12 - Home Security Systems is analyzing the purchase of...Ch. 12 - Aerospace Dynamics will invest 110,000 in a...Ch. 12 - The Horizon Company will invest 60,000 in a...Ch. 12 - Skyline Corp. will invest 130,000 in a project...Ch. 12 - The Hudson Corporation makes an investment of ...Ch. 12 - The Pan American Bottling Co. is considering the...Ch. 12 - You are asked to evaluate the following two...Ch. 12 - Turner Video will invest 76,344 in a project. The...Ch. 12 - The Suboptimal Glass Company uses a process of...Ch. 12 - Keller Construction is considering two new...Ch. 12 - Davis Chili Company is considering an investment...Ch. 12 - Telstar Communications is going to purchase an...Ch. 12 - Assume 65,000 is going to be invested in each of...Ch. 12 - The Summit Petroleum Corporation will purchase an...Ch. 12 - Oregon Forest Products will acquire new equipment...Ch. 12 - Universal Electronics is considering the purchase...Ch. 12 - Prob. 30PCh. 12 - Prob. 31PCh. 12 - Prob. 32PCh. 12 - Hercules Exercise Equipment Co. purchased a...Ch. 12 - Prob. 2WECh. 12 - Returning to TXN’s summary page, record the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?arrow_forwardThe management of Ryland International Is considering Investing in a new facility and the following cash flows are expected to result from the investment: A. What Is the payback period of this uneven cash flow? B. Does your answer change if year 6s cash inflow changes to $920,000?arrow_forwardYour company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forward

- Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardYou are asked to analyze the following scenario and determine its value. What it the most you would be willing to invest in this project if your required rate of return is 11%. (Assume cash flows occur at the end of each year). Cash flows Year 1-3: $150,000,000 Year 4: ($550,000,000) Year 5-10: $175,000,000 O $845,654,114 O $491,942,778 $346,568,100 $263,458,478arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forward

- An investment project has annual cash inflows of $3,500, $4,400, $5,600, and $4,800, and a discount rate of 14 percent. a. What is the discounted payback period for these cash flows if the initial cost is $6,200? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the discounted payback period for these cash flows if the initial cost is $8,300? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the discounted payback period for these cash flows if the initial cost is $11,300? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardA firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: -$25,000 today (t=0); $11,000 after one year (t=1), 17,000 after two years (t=2); and 10,000 after three years (t=3). What is the Internal Rate of Return (“IRR”) for this project?arrow_forwardA firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: Year Cash Flow $28,900 12,900 15,900 11,900 2. What is the NPV for the project if the required return is 11 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forward

- What is the project’s internal rate of return? Round your answer to two decimal places. % For the press brake project, at what annual rates of return do the net present value and internal rate of return methods assume that the net cash inflows are being reinvested? Round your answers to two decimal places. The net present value calculation assumes the net cash flows are reinvested at %. The internal rate of return calculation assumes the net cash flows are reinvested at %.arrow_forwardYou are evaluating five different investments, all of which involve an upfront outlay of cash. Each investment will provide a single cash payment back to you in the future. Details of each investment appears here: Calculate the IRR of each investment. State your answer to the nearest basis point (i.e., the nearest 1/100th of 1%, such as 3.76%). The yield for investment A is The yield for investment B is The yield for investment C is The yield for investment D is The yield for investment E is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) C Data table Investment A B с D E Initial Investment $1,600 $10,000 $600 $3,400 $5,200 Future Value Print $3,120 $15,775 $2,923 $4,526 $8,789 End of Year 10 11 16 Done 3 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 12 D Xarrow_forwardFind the modified internal rate of return (MIRR) for the following series of future cash flows if the company is able to reinvest cash flows received from the project at an annual rate of 11.59 percent. The initial outlay is $ 398,400. Year 1: $194,000; year 2: $161, 100; year 3; $132,200; year 4: $175, 500; year 5: $ 199,000. Round the answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License