Concept explainers

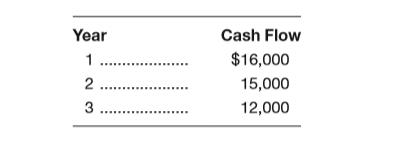

Davis Chili Company is considering an investment of

You are going to use the

a. Determine the net present value of the project based on a zero discount rate.

b. Determine the net present value of the project based on a 10 percent discount rate.

c. Determine the net present value of the project based on a 15 percent

discount rate (it will be negative).

d. Draw a net present value profile for the investment and observe the discount rate at which

the net present value is zero. This is an approximation of the internal rate of return based

on the procedure presented in this chapter.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardPerform a financial analysis for an IT Project which requires an initial investment of $32,000, but it is expected to generate revenues of S10,000, $20,000 and $15,000 for the first, second and third years respectively. The target rate of return is 12%. Write the formula and calculate the Net Present Value (NPV). In addition, Justify your result. (For this question Write the answer on the paper and take photo and upload OR Type in the MS Word document and upload the file) tach File Browse My Computerarrow_forward

- Use the following data to answer questions (a) to (d). A company is considering the purchase of a copier that costs RM 50,000. Assume the required rate of return is 10% and the following is cash flow schedule: Year 1: RM 20,000 Year 2: RM 30,000 Year 3: RM 20,000 What is the project’s payback period? What is the project’s NPV? What is the project’s IRR? What is the project’s profitability index (PI)?arrow_forwardFind the modified internal rate of return (MIRR) for a proposed project costing $5,489. Assume that the appropriate cost of capital for projects of this risk level, at this company is 11.46%, and the estimated cash flows for the life of the project are found in the table below. (If you calculate an MIRR of 20.22%, please enter 20.22 - do not include the % symbol, and use at least two decimal places). Year 1 Year 2 Year 3 Year 4 Year 5 $6,100 $10,836 $9,527.1 $13,000 $7,285arrow_forwardSuppose a project with a 6% discount rate yields R5000 for the next three years. Annual operating costs amount to R1000 for each year, and the one time initial investment cost is R8000. a. Calculate the Net Present Value (NPV) of this project.b. Calculate the cost-benefit ratio for the project. c. Is the project acceptable? Motivate your answer.arrow_forward

- Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4,000,000 and has a present value of cash flows of $6,000,000. 1. Compute the profitability index for each project. 2. Based on the profitability index, which project should the company prefer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the profitability index for each project. Project 1 Project 2 Choose Numerator: Profitability Index T 7 Choose Denominator: 4 of 5 180 # Next > G Oarrow_forwardA company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows below. At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using (a) tabulated factors, (b) calculator functions, and (c) a spreadsheet. Which method did you find the easiest to use?arrow_forwardYou are asked to evaluate the following two projects for the Norton Corporation. Using the net present value method combined with the profitability index approach described in footnote 2 of this chapter, which project would you select? Use a discount rate of 14 percent. Project X (videotapes of the weather report) ($20,000 investment) Year Cash Flow 1. $10,000 2 8,000 3 9.000 4 8.600 Project X (videotapes of the weather report) ($40,000 investment) Year Cash Flow $20,000 2 13,000 3 14.000 4 16.800arrow_forward

- ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NP of the assembler if the required rate of return is 12%. Show calculation. Would you accept/reject a project based on NPV decision criteria? Why? Based on NPV calculated in part A, determine Profitability Index (PI). Show calculation. Would you accept/reject a project based on PI decision criteria? Why?arrow_forwardConsider the following project-balance profiles for proposed investment projects: Now consider the following statements:Statement 1: For Project A, the cash flow at the end of year 2 is $100.Statement 2: The future value of Project C is $0.Statement 3: The interest rate used in the Project B balance calculationsis 25%.Which of the preceding statements is (are) correct?(a) Just statement 1.(b) Just statement 2.(c) Just statement 3.(d) All of them.arrow_forwardAssume that it costs $1,000 to start a project. If the project will give $400 profit in the first year, $500 in the second year and $300 in the third year. find the payback period. Now assume that the interest rate is 10%, find the net present value (NPV) and the profitability index (PI) for this projectarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College