Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 27P

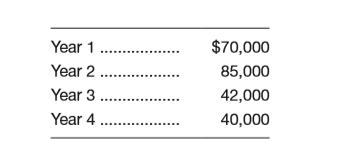

The Summit Petroleum Corporation will purchase an asset that qualifies for three-year MACRS

The firm is in a 35 percent tax bracket and has an 8 percent cost of capital. Should it purchase the asset? Use the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Summit Petroleum Corporation will purchase an asset that qualifies for three-year MACRS depreciation. The cost is $450,000 and

the asset will provide the following stream of earnings before depreciation and taxes for the next four years: Use Table 12-12.

Year 1 $200,000

Year 2

263,000

90,000

80,000

Year 3

Year 4

The firm is in a 30 percent tax bracket and has a cost of capital of 12 percent. Use Appendix B for an approximate answer but calculate

your final answer using the formula and financial calculator methods.

a. Calculate the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations

and round your answer to 2 decimal places.)

Net present value

Suppose an asset has a purchase cost of $15,000, a life of five years, a salvage value of $3,000 at the end of five years, and a net annual before-tax revenue of $7,500. The firm's marginal tax rate is 35%. The asset will be depreciated by five-year MACRS.(a) Determine the cash flow after taxes, assuming that the purchase cost will be entirely financed by the equity funds.(b) Rework part (a), assuming that the entire investment would be financed by a bank loan at an interest rate of 9%.(c) Given a choice between paying the purchase cost up front from the firm's equity and using the financing method of part (b), show calculations to justify which is the better choice at an interest rate of 9%.

The Summit Petroleum Corporation will purchase an asset that qualifies for three-year MACRS depreciation. The cost is $340,000 and

the asset will provide the following stream of earnings before depreciation and taxes for the next four years: Use Table 12-12.

Year 1

Year 2

Year 3

Year 4

$ 160,000

209,000

75,000

68,000

The firm is in a 35 percent tax bracket and has a cost of capital of 9 percent. Use Appendix B for an approximate answer but calculate

your final answer using the formula and financial calculator methods.

a. Calculate the net present value.

Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to

2 decimal places.

Net present value

b. Under the net present value method, should Summit Petroleum Corporation purchase the asset?

O Yes

O No

Chapter 12 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 12 - Prob. 1DQCh. 12 - Why does capital budgeting rely on analysis of...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - What does the term mutually exclusive investments...Ch. 12 - Prob. 6DQCh. 12 - If a corporation has projects that will earn more...Ch. 12 - What is the net present value profile? What three...Ch. 12 - How does an asset’s ADR (asset depreciation...Ch. 12 - Assume a corporation has earnings before...

Ch. 12 - Assume a corporation has earnings before...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Al Quick, the president of a New York Stock...Ch. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Assume a 90,000 investment and the following cash...Ch. 12 - Prob. 9PCh. 12 - X-treme Vitamin Company is considering two...Ch. 12 - You buy a new piece of equipment for 16,230, and...Ch. 12 - Prob. 12PCh. 12 - Home Security Systems is analyzing the purchase of...Ch. 12 - Aerospace Dynamics will invest 110,000 in a...Ch. 12 - The Horizon Company will invest 60,000 in a...Ch. 12 - Skyline Corp. will invest 130,000 in a project...Ch. 12 - The Hudson Corporation makes an investment of ...Ch. 12 - The Pan American Bottling Co. is considering the...Ch. 12 - You are asked to evaluate the following two...Ch. 12 - Turner Video will invest 76,344 in a project. The...Ch. 12 - The Suboptimal Glass Company uses a process of...Ch. 12 - Keller Construction is considering two new...Ch. 12 - Davis Chili Company is considering an investment...Ch. 12 - Telstar Communications is going to purchase an...Ch. 12 - Assume 65,000 is going to be invested in each of...Ch. 12 - The Summit Petroleum Corporation will purchase an...Ch. 12 - Oregon Forest Products will acquire new equipment...Ch. 12 - Universal Electronics is considering the purchase...Ch. 12 - Prob. 30PCh. 12 - Prob. 31PCh. 12 - Prob. 32PCh. 12 - Hercules Exercise Equipment Co. purchased a...Ch. 12 - Prob. 2WECh. 12 - Returning to TXN’s summary page, record the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardMason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardYour firm is considering a project that would require purchasing $7.5 million worth of new equipment. Determine the present value of the depreciation tax shield associated with this equipment if the firm's tax rate is 40%, the appropriate cost of capital is 8%, and the equipment can be depreciated Straight- line over a five-year period, with the first deduction starting in one year. Please express the answer in the unit of million and up to 2 places of decimal.arrow_forward

- Consider an asset that costs $311,000 and is depreciated straight-line to zero over its six-year tax life. The asset is to be used in a four-year project; at the end of the project, the asset can be sold for $58,000. If the relevant tax rate is 34 percent, what is the aftertax cash flow from the sale of this asset? Can the calculator and excel solution be provided?arrow_forwardyour company is considering a new project that will require $10,000 of new equipment at the start of the project. T he equipment will have a depreciable life of five years and will be depreciated to a book value of $3000 using straight line depreciation. the cost of capital is 9 percent and the firm tax rate is 21 percent. estimate the present value of the tax benifits frm depreciation.arrow_forwardLarson is considering the purchase of manufacturing equipment categorized under the 5-year MACRS scale. The asset will cost $260,000, producing earnings before depreciation and taxes of $92,000 per year for three years and then $41,000 per year for the remaining years. Larson has a tax rate of 19 percent. Assume the cost of capital is 10 percent. What is the anticipated Payback period, Net present value, Internal rate of return, and Profitability index for this equipment? Should this equipment be purchased (please, explain)?arrow_forward

- Engro Incorporation wants to evaluate an acquisition of an equipment worth $200,000. Its marginal tax rate is 40 percent. If purchased, the depreciation of equipment will take place at straight line method. The salvage value of the equipment is assumed to be $20,000 at the end of its useful life of 10 years. If the equipment is purchased, Engro will finance the asset through borrowing from bank at annual before tax cost of 10%. further, if Engro decides to purchase the equipment, it will incur $1000 as annual maintenance expense each year. These expenses would not be incurred if the computer is leased. If leased, Engro can have the equipment at $28000 pre-tax rate per year, which is to be paid at the beginning of each year. Company’s weighted average after tax cost of capital is 12 percent. Compute the net advantage to leasing What alternative, leasing or owning, should be chosenarrow_forwardThe Shakey Company can finance the purchase of a new building costing $2 million with a bond issue, for which it would pay $100,000 interest per year, and then repay the $2 million at the end of the life of the building. Instead of buying in this manner, the company can lease the building by paying $125,000 per year, the first payment being due one year from now. The building would be fully depreciated for tax purposes over an expected life of 20 years. The income tax rate is 40% for all expenses and capital gains or losses, and the firm’s after-tax MARR is 5%. Use AW analysis basedon equity (nonborrowed) capital to determine whether the firm should borrow and buy or lease if, at the end of 20 years, the building has the following market values for the owner: (a) nothing, (b) $500,000. Straight-line depreciation will be used but is allowable only if the company purchases the building.arrow_forwardA project requires an initial investment of $500,000 and expects to produce an after-tax operating cash flow of $180,000 per year for three years. The asset value will be depreciated to zero using straight-line depreciation over the three years. At the end of the project, the asset could be sold at market price. Assume a 21% tax rate and 15% cost of capital. What is the market price of the fixed asset that will make this project break even?arrow_forward

- ABC, Inc. is considering the purchase of a $116,000 piece of equipment. The equipment is classified as 5-year MACRS property. The company expects to sell the equipment after two years at a price of $50,000. The tax rate is 35 percent. What is the expected after-tax cash flow from the anticipated sale?arrow_forwardThe Shakey Company can finance the purchase of a new building costing $2 million with a bond issue, for which it would pay S90,000 interest per year, and then repay the $2 million at the end of the life of the building. Instead of buying in this manner, the company can lease the building by paying $135,000 per year, the first payment being due one year from now. The building would be fully depreciated for tax purposes over an expected life of 20 years. The income tax rate is 40% for all expenses and capital gains or losses, and the firm's after-tax MARR is 6%. Use AW analysis based on equity (nonborrowed) capital to determine whether the firm should borrow and buy or lease if, at the end of 20 years, the building has the following market values for the owner: (a) nothing, (b) S500,000. Straight-line depreciation will be used but is allowable only if the company purchases the building.arrow_forwardBigCo is considering leasing the new equipment that it requires, for $146000 a year, payable in advance. The cost of the equipment is $775000, and will last for 5 years. The expected scrap value at the end of 5th year is $140000. Assume that the equipment will be fully depreciated under straightline method. The tax rate is 35%, the cost of equity is 13% and the cost of debt is 10%. i. What is the net cost of buying? ii. What is the net cost of leasing? iii. What is the net advantage of leasing (NAL)? iv. What is the maximum lease payment that would make BigCo indifferent between leasing or buying?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License