Concept explainers

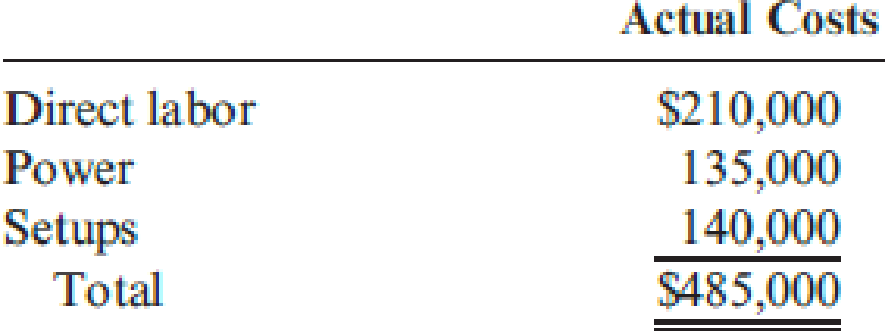

Kelly Gray, production manager, was upset with the latest performance report, which indicated that she was $100,000 over budget. Given the efforts that she and her workers had made, she was confident that they had met or beat the budget. Now, she was not only upset but also genuinely puzzled over the results. Three items—direct labor, power, and setups—were over budget. The actual costs for these three items follow:

Kelly knew that her operation had produced more units than originally had been budgeted, so more power and labor had naturally been used. She also knew that the uncertainty in scheduling had led to more setups than planned. When she pointed this out to John Huang, the controller, he assured her that the budgeted costs had been adjusted for the increase in productive activity. Curious, Kelly questioned John about the methods used to make the adjustment.

JOHN: If the actual level of activity differs from the original planned level, we adjust the budget by using budget formulas—formulas that allow us to predict what the costs will be for different levels of activity.

KELLY: The approach sounds reasonable. However, I’m sure something is wrong here. Tell me exactly how you adjusted the costs of labor, power, and setups.

JOHN: First, we obtain formulas for the individual items in the budget by using the method of least squares. We assume that cost variations can be explained by variations in productive activity where activity is measured by direct labor hours. Here is a list of the cost formulas for the three items you mentioned. The variable X is the number of direct labor hours:

Labor cost = $10X

Power cost = $5,000 + $4X

Setup cost = $100,000

KELLY: I think I see the problem. Power costs don’t have a lot to do with direct labor hours. They have more to do with machine hours. As production increases, machine hours increase more rapidly than direct labor hours. Also, ...

JOHN: You know, you have a point. The coefficient of determination for power cost is only about 50 percent. That leaves a lot of unexplained cost variation. The coefficient for labor, however, is much better—it explains about 96 percent of the cost variation. Setup costs, of course, are fixed.

KELLY: Well, as I was about to say, setup costs also have very little to do with direct labor hours. And I might add that they certainly are not fixed—at least not all of them. We had to do more setups than our original plan called for because of the scheduling changes. And we have to pay our people when they work extra hours. It seems as if we are always paying overtime. I wonder if we simply do not have enough people for the setup activity. Supplies are used for each setup, and these are not cheap. Did you build these extra costs of increased setup activity into your budget?

JOHN: No, we assumed that setup costs were fixed. I see now that some of them could vary as the number of setups increases. Kelly, let me see if I can develop some cost formulas based on better explanatory variables. I’ll get back with you in a few days.

Assume that after a few days’ work, John developed the following cost formulas, all with a coefficient of determination greater than 90 percent:

Labor cost = $10X; where X = Direct labor hours

Power cost = $68,000 + 0.9Y; where Y = Machine hours

Setup cost = $98,000 + $400Z; where Z = Number of setups

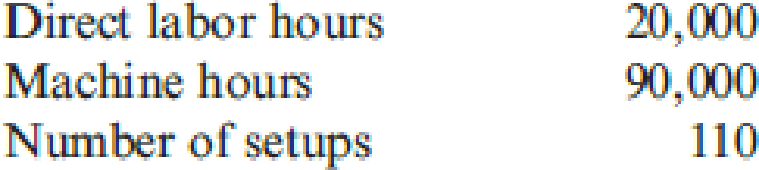

The actual measures of each of the activity drivers are as follows:

Required:

- 1. Prepare a performance report for direct labor, power, and setups using the direct-labor-based formulas.

- 2. Prepare a performance report for direct labor, power, and setups using the multiple cost driver formulas that John developed.

- 3. Of the two approaches, which provides the most accurate picture of Kelly’s performance? Why?

- 4. After reviewing the approach to performance measurement, a consultant remarked that non-value-added cost trend reports would be a much better performance measurement approach than comparing actual costs with budgeted costs—even if activity flexible budgets were used. Do you agree or disagree? Explain.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the costs of its customizable telescopes. Barbara wondered if it would be better to switch to a normal costing system, as she had heard a number of people talking about that at an industry conference she attended the previous month. Since Metlock has a highly machine-intensive operation, machine hours are used as its MOH cost driver. Here are the costs and other MOH information Barbara is analyzing: Budgeted MOH cost Actual MOH cost Budgeted machine hours Actual machine hours $426,240 Actual MOH rate $ 419,040 Determine the actual MOH rate and the budgeted MOH rate Metlock would have used last year under actual costing and normal costing, respectively. (Round answers to 2 decimal places, e.g. 52.75.) Budgeted MOH rate $ 96,000 108,000 /machine hour /machine hourarrow_forwardJane Erickson, manager of an electronics division, was not pleased with the results that had recently been reported concerning the divisions activity-based management implementation project. For one thing, the project had taken eight months longer than projected and had exceeded the budget by nearly 35 percent. But even more vexatious was the fact that after all was said and done, about three-fourths of the plants were reporting that the activity-based product costs were not much different for most of the products than those of the old costing system. Plant managers were indicating that they were continuing to use the old costs as they were easier to compute and understand. Yet, at the same time, they were complaining that they were having a hard time meeting the bids of competitors. Reliable sources were also revealing that the divisions product costs were higher than many competitors. This outcome perplexed plant managers because their control system still continued to report favorable materials and labor efficiency variances. They complained that ABM had failed to produce any significant improvement in cost performance. Jane decided to tour several of the plants and talk with the plant managers. After the tour, she realized that her managers did not understand the concept of non-value-added costs nor did they have a good grasp of the concept of kaizen costing. No efforts were being made to carefully consider the activity information that had been produced. One typical plant manager threw up his hands and said: This is too much data. Why should I care about all this detail? I do not see how this can help me improve my plants performance. They tell me that inspection is not a necessary activity and does not add value. I simply cant believe that inspecting isnt value-added and necessary. If we did not inspect, we would be making and sending more bad products to customers. Required: Explain why Janes division is having problems with its ABM implementation.arrow_forwardFlaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forward

- The controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forwardHandbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 2,000 direct labor hours. The total indirect labor is budgeted to be 200,000. Time records from indirect labor employees revealed that they spent 30% of their time setting up production runs and 70% of their time supporting actual production. The following information about cell phones and tablet PCs was determined from the corporate records: a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base. b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activitiesone for setup and the other for production support. c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing. d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?arrow_forwardJackie Iverson was furious. She was about ready to fire Tom Rich, her purchasing agent. Just a month ago, she had given him a salary increase and a bonus for his performance. She had been especially pleased with his ability to meet or beat the price standards. But now, she found out that it was because of a huge purchase of raw materials. It would take months to use that inventory, and there was hardly space to store it. In the meantime, space had to be found for the other materials supplies that would be ordered and processed on a regular basis. Additionally, it was a lot of capital to tie up in inventorymoney that could have been used to help finance the cash needs of the new product just coming online. Her interview with Tom was frustrating. He was defensive, arguing that he thought she wanted those standards met and that the means were not that important. He also pointed out that quantity purchases were the only way to meet the price standards. Otherwise, an unfavorable variance would have been realized. Required: 1. CONCEPTUAL CONNECTION Why did Tom Rich purchase the large quantity of raw materials? Do you think that this behavior was the objective of the price standard? If not, what is the objective(s)? 2. CONCEPTUAL CONNECTION Suppose that Tom is right and that the only way to meet the price standards is through the use of quantity discounts. Also, assume that using quantity discounts is not a desirable practice for this company. What would you do to solve this dilemma? 3. CONCEPTUAL CONNECTION Should Tom be fired? Explain.arrow_forward

- Waterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders. Required: 1. Explain why receiving would be viewed as a value-added activity. List all possible reasons. Also, list some possible reasons that explain why the demand for receiving is more than the efficient level of…arrow_forwardWaterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders. Required: 1. Explain why receiving would be viewed as a value-added activity. Which of these are possible reasons that explain why the demand for receiving is more than the efficient level of 36,000 orders. 2. Break…arrow_forwardThe president of Mission Inc. has been concerned about the growth in costs over the last several years. The president asked the controller to perform an activity analysis to gain a better insight into these costs. The activity analysis revealed the following: Activities Activity Cost Correcting invoice errors $8,500 Disposing of income materials with poor quality 16,000 Disposing of scrap 28,500 Expediting late production 21,500 Final inspection 19,000 Inspecting incoming materials 5,000 Inspecting work in process 25,000 Preventive machine maintenance 15,000 Producing product 95,500 Responding to customer quality complaints 15,000 Total 249,000 The production process is complicated by quality problems, requiring the production manager to expedite production and dispose of scrap. Prepare a Pareto chart of the company activities. Classify the activities into prevention, appraisal, internal failure,…arrow_forward

- Paul White has been studying his department’s profitability reports for the past six months. He has just completed a managerial accounting course and is beginning to question the company’s approach to allocating overhead to products based on machine hours. The current department overhead budget of $ 1,142,940 is based on 38,098 machine hours. In an initial analysis of overhead costs, Paul has identified the following activity cost pools.arrow_forwardHeintz Products uses activity-based costing to account for product costs. The plant manager has estimated the following cost drivers and rates. Activity Centers Materials inspection Equipment maintenance Machine setups Packing and shipping Direct materials costs were $552,000 and direct labor costs were $392,000 during November, when the plant finished 7,000 pounds of product, had 20 setups, and ran the machines for 15,000 hours. There were no work-in-process inventories. Beginning Balance Required: Use T-accounts to show the flow of materials, labor, and overhead costs from the four overhead activity centers through Work-in- Process Inventory and out to Finished Goods Inventory. Use the accounts Materials Inventory, Wages Payable, Work-in-Process Inventory, Finished Goods Inventory, and four overhead applied accounts. Ending Balance Beginning Balance Ending Balance Cost Drivers Direct materials cost Machine-hours Number of production runs Pounds of finished output Debit Debit…arrow_forwardChris Anderson has been studying his department’s profitability reports for the past six months. He has just completed a managerial accounting course and is beginning to question the company’s approach to allocating overhead to products based on machine hours. The current department overhead budget of $1,141,500 is based on 45,660 machine hours. In an initial analysis of overhead costs, Chris has identified the following activity cost pools. Cost Pool Expected Cost Expected Activities Product assembly $ 780,000 39,000 machine hours Machine setup and calibration 270,000 4,500 setups Product inspection 54,000 1,350 batches Raw materials storage 37,500 250,000 pounds $ 1,141,500 Chris Anderson is taking the next step in his exploration of activity-based costing and wants to examine the overhead costs that would be allocated to two of the department’s four products. He has gathered the following…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning