Concept explainers

Entries for payroll transactions

MLS Company has five employees, each of whom earns $1,600 per month and is paid on the last day of each month. All five have been employed continuously at this amount since January 1. On June 1, the following accounts and balances exist in its general ledger:

- a. FICA—Social Security Taxes Payable, $992; FICA—Medicare Taxes Payable, $232. (The balances of these accounts represent total liabilities for both the employer’s and employees’ FICA taxes for the May payroll only.)

- b. Employees’ Federal Income Taxes Payable, $1,050 (liability for May only).

- c. Federal

Unemployment Taxes Payable, $66 (liability for April and May together). - d. State Unemployment Taxes Payable, $440 (liability for April and May together).

During June and July, the company had the following payroll transactions.

| June 15 | Issued check payable to Security Bank, a federal depository bank authorized to accept employers’ payments of FICA taxes and employee income tax withholdings. The $2,274 check is in payment of the May FICA and employee income taxes. |

| 30 | Recorded the

|

| 30 | Recorded the employer’s payroll taxes resulting from the June payroll. The company has a merit rating that reduces its state unemployment tax rate to 4.0% of the first $7,000 paid each employee. The federal rate is 0.6%. Check June 30: Dr. Payroll Taxes Expenses, $612 |

| July 15 | Issued check payable to Security Bank in payment of the June FICA and employee income taxes July 15: Cr. Cash, $2,274 (Security Bank) |

| 15 | Issued check to the State Tax Commission for the April, May, and June state unemployment taxes. Filed the check and the second-quarter tax return with the State Tax Commission. |

| 31 | Issued check payable to Security Bank in payment of the employer’s FUTA taxes for the first quarter of the year. |

| 31 | Filed Form 941 with the IRS, reporting the FICA taxes and the employees’ federal income tax withholdings for the second quarter. |

Required

Prepare journal entries to record the transactions and events for both June and July.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Principles of Financial Accounting.

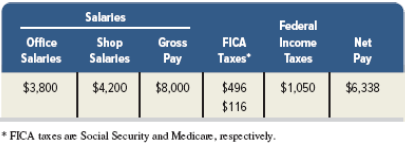

- The totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardIn the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning