Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 5BTN

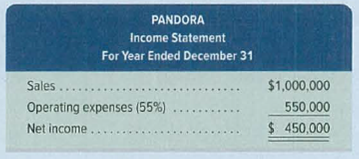

Review the chapter’s opening feature about Tim Westergren and the business he founded, Pandora. Assume that he is considering expanding the business to Europe and that the current abbreviated income statement appears as follows.

Assume also that the company currently has no interest-bearing debt. If it expands to Europe, it will require a $300,000 loan. The company has found a bank that will loan it the money on a 7% note payable. The company believes that, at least for the first few years, sales in Europe will equal $250,000 and that all expenses at both locations will continue to equal 55% of sales.

Required

- 1. Prepare an income statement (showing three separate columns for current operations, European, and total) for the company assuming that it borrows the funds and expands to Europe. Annual revenues for current operations are expected to remain at $1,000,000.

- 2. Compute the company’s times interest earned under the expansion assumptions in part 1.

- 3. Assume sales in Europe are $400,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 4. Assume sales in Europe are $100,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 5. Comment on your results from parts 1 through 4.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ryan Enterprises has a business plan for a QR Shopper, a start-up business. He is considering two financing alternatives for a business loan. Ryan is concerned about several issues that may influence the decision. One such issue is the comparative impact of the two alternatives on financial statements. Below are the two financing alternatives that Ryan Enterprises is considering:

Alternative A: A seven-year business loan in the amount of $450,000 with a 4.25% interest rate.

The terms of the loan require payments of principal and interest every six months

at the end of each period (six-months).

Alternative B: A five-year business loan in the amount of $450,000 with a 5.0% interest rate.

The terms of the loan require payments of principal and interest every quarter

at the beginning of each period (quarter).

Required:

Prepare the amortization schedule for each alternative. Create a separate worksheet…

Imagine that Commodore has taken out a multimilliondollar loan that must be repaid next year. How might the lender react if it learned that Commodore was using the book-and-hold method to make revenues look higher than they really are?

Alice’s second initiative calls for Fresh & Fruity to obtain a bank loan of a sufficient size to enable the company to take all suppliers’ discounts. What is the minimum size of this loan? (Hint: To take all suppliers’ discounts, the average payment period must be 10 days, and net purchases will be purchases – (Purchases from Figure 1 x .02). Assume that all this happens, and solve the following formula for the new accounts payable balance, using:

Accounts payable = Average payment period x Purchase per day*

*Based on net purchases/360.

Now compare the accounts payable you just solved with the new accounts payable balance you found in question 3. The difference is the size of the loan that is required.

Assume that Fresh &Fruity does obtain an 8 percent loan for one year in the amount you solved in question 5, and it reduces its accounts payable balance accordingly. Now the company is taking 2 percent discounts on all purchases and paying 8 percent a year on the loan…

Chapter 11 Solutions

Principles of Financial Accounting.

Ch. 11 - On December 1, a company signed a 6,000, 90-day,...Ch. 11 - Prob. 2MCQCh. 11 - Prob. 3MCQCh. 11 - Prob. 4MCQCh. 11 - Prob. 5MCQCh. 11 - Prob. 1DQCh. 11 - Prob. 2DQCh. 11 - What are the three important questions concerning...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQ

Ch. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - Prob. 9DQCh. 11 - Prob. 10DQCh. 11 - Prob. 11DQCh. 11 - What amount of income tax is withheld from the...Ch. 11 - Prob. 13DQCh. 11 - Prob. 14DQCh. 11 - Prob. 15DQCh. 11 - Refer to Samsungs recent balance sheet in Appendix...Ch. 11 - Which of the following items are normally...Ch. 11 - Prob. 2QSCh. 11 - Prob. 3QSCh. 11 - Prob. 4QSCh. 11 - Prob. 5QSCh. 11 - Prob. 6QSCh. 11 - Prob. 7QSCh. 11 - Prob. 8QSCh. 11 - Prob. 9QSCh. 11 - Prob. 10QSCh. 11 - Prob. 11QSCh. 11 - Prob. 12QSCh. 11 - Prob. 13QSCh. 11 - Prob. 14QSCh. 11 - Prob. 15QSCh. 11 - Prob. 1ECh. 11 - Prob. 2ECh. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Prob. 7ECh. 11 - Prob. 8ECh. 11 - Prob. 9ECh. 11 - Prob. 10ECh. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Prob. 18ECh. 11 - Prob. 19ECh. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Prob. 3APCh. 11 - Prob. 4APCh. 11 - Shown here are condensed income statements for two...Ch. 11 - Prob. 6APCh. 11 - Prob. 1BPCh. 11 - Prob. 2BPCh. 11 - Prob. 3BPCh. 11 - Prob. 4BPCh. 11 - Prob. 5BPCh. 11 - Entries for payroll transactions MLS Company has...Ch. 11 - Prob. 11SPCh. 11 - Prob. 1AACh. 11 - Prob. 2AACh. 11 - Prob. 3AACh. 11 - Beyond the Numbers Cameron Bly is a sales manager...Ch. 11 - Prob. 2BTNCh. 11 - Review the chapters opening feature about Tim...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are about to buy a business that is worth $200,000, but you do not have enough money to purchase the business entirely. You have a total of $90,000 in savings and you are looking at different financing options. Provide information for the following: Provide an example of debt financing Explain which type of long-term liability financing you would choose to buy the business? Provide a suggestion for future business owners on financingarrow_forwardYou have been asked by your employers to demonstrate your knowledge in business valuation process, by analyzing the value of Best Group Savings and Loans Company (BGSLC). The company paid a dividend of GH¢ 250,000 this year. The current return to shareholders of companies in the same industry as BGSLC is 12%, although it is expected that an additional risk premium of 2% will be applicable to BGSLC, being a smaller and unquoted company. Compute the expected valuation of BGSLC, if: The current level of dividend is expected to continue into the foreseeable future The dividend is expected to grow at a rate 4% par into foreseeable future The dividend is expected to grow at a 3% rate for three years and 2% afterwardsarrow_forwardAs a small software developer firm, you have approached the AXZ Bank to obtain a term loan so that the firm can purchase a new server. The AXZ bank provides two (2) offers to your company, as listed below:a) a loan of $100,000 over a five (5) year period at an interest rate of 7.65% per annum (per year) payable at the end of each month.b) a loan of $100, 000 over a three (3) year period at an interest rate of 5.5% per annum (per year) payable at the end of each month. 1. Calculate the monthly loan instalments for each offer listed above – a) and b).2. Calculate the total interest payments for each offer listed above – a) and b). Please kindly provide all the workings and calculations properly to understand. Thank youarrow_forward

- You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $810,000. Other data for the firm are shown below. How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity, i. e., what is EPSL - EPSU? 0% Debt, U 60% Debt, L Oper. income (EBIT) $810,000 $810,000 Required investment $ 2,500,000 $2,500,000 % Debt 0.0% 60.0% $ of Debt $0.00 $1,500,000 $ of Common equity $2,500,000 $ 1,000,000 Shares issued, $10/share 250,000 100, 000 Interest rate NA 10.00% Tax rate 25% 25% a. $0.75 b. $ 2.52 c. $3.36 d. $4.10 e. $2.90arrow_forwardSuppose you had the following propositions of returns from two companies W and Y: Company Returns (OMR) Comments W 475 Company W proposes to give OMR 475 today Y 550 Company Y proposes to give you OMR 550 but after 2 years You also know that the Interest Rate is by 10%. Question: In which company do you choose to invest your money and why? (Use two formulas (ways) and also use Tables to make sure your answers are correct).arrow_forwardAssume that you started a new business last year with RM30,000 of your own money to purchase equipment. You are seeking a RM100,000 loan to finance the inventory needed to reach this year’s sales target. You have agreed to pledge your venture’s delivery truck and your personal car as a security for the loan. Your family member has agreed to become the guarantor. During your initial year of operation, you paid your supplier in 30-day credit. (a) Assume that at the end of next year you will have an accounts receivable balance of RM15,000 and an inventory balance of RM30,000. If a bank lends an amount equal to 80% of accounts receivable and 50% of inventories pledged as collateral, estimate the amount that the bank might consider for a bank loan a year from now.arrow_forward

- Assume that you started a new business last year with RM30,000 of your own money to purchase equipment. You are seeking a RM100,000 loan to finance the inventory needed to reach this year’s sales target. You have agreed to pledge your venture’s delivery truck and your personal car as a security for the loan. Your family member has agreed to become the guarantor. During your initial year of operation, you paid your supplier in 30-day credit. (a) Use the five Cs of credit to analyse your loan request from the viewpoint of a lender in deciding whether you should make the loan. (b)Assume that you are currently carrying an accounts receivable balance of RM10,000. Analyze how you might use accounts receivables to obtain an additional bank loan.arrow_forwardUpon further investigation, you have found that the amount of account payables for Companies A and X at the start of the lyear is 20,000 and 30,000, respectively. Apart from that, the amount of credit purchase for Companies A and B is 250,000 and 280,000, respectively. Based on all this information, recommend on which company that gire lower risk to your company. The recommendation must be ustified by the following analysis: a) hiquidity analysis. b) Solvency analysis. c) Any other financial analysis that you think can help in making your decision. Table: Balance Sheet for Company A and Company B Assets Fixed Assets Other Non-Current Assets Account Receivables Inventory Cash 250,000 80,000 120,000 80,000 120,000 650,000 280,000 110,000 140,000 100,000 100,000 ТОTAL 730,000 Liabilities Саpital Long Term Debt Account Payables Other Current Liabilities ТОTAL 250,000 120,000 160,000 120,000 650,000 280,000 140,000 180,000 130,000 730,000arrow_forwardGandhi sells books, magazines, music, and videos through retail stores and online. For expanding its business Gandhi has taken following long term loans and their maturities are listed below. These are the current debt outstanding as on 2020. Calculate the weighted average Interest rate for Gandhi? Debt Issues and Maturities: 2022 Notes 2023 Notes 2028 Notes 2032 Notes 2041 Notes 2049 Notes Face Value Amounts (in million $) Answer is in % use 2 decimals while writing answers and no % sign. $ 404 $ 307 $147 $87 $ 283 $441 Stated Interest Rates 0.571% 0.949% 2.092% 2.377% 3.146% 3.317%arrow_forward

- You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $690,000. Other data for the firm are shown below. How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity, i.e., what is EPSL - EPSU? 0% Debt, U 60% Debt, L Oper. income (EBIT) $690,000 $690,000 Required investment $2,500,000 $2,500,000 % Debt 0.0% 60.0% $ of Debt $0.00 $1,500,000 $ of Common equity $2,500,000 $1,000,000 Shares issued, $10/share 250,000 100,000 Interest rate NA 10.00% Tax rate 35% 35% Select one: a. $1.29 b. $1.97 c. $2.23 d. $1.63 e. $1.72arrow_forwardUse the following information to answer the question(s) below. You have a small recycling business. A competitor has promised you to buy your business any time in the next 2 years for the amount of CHF 370,000. (If you do not sell she will probably enter the market and crash you out) On the other hand, you have some ideas for short term investments in your business that could yield to some interesting revenue before you sell. These are your options. Option 1: Sell the business right away. Option 2: Invest CHF 36,000 now, generating $47,880 in profit next year and then sell the business at the end of next year. Option 3: Invest CHF 63,000 now, generating profits of CHF 50,400 at the end of both the first and second years, then after 2 years, sell the business. If the discount rate is 6.2%: Format answers (#####.##) i) What is the present value of option 1? 370000 ii) What is the present value of option 2 ? iii) What is the present value of option 3 ?arrow_forwardThe liabilities and owners’ equity for Campbell Industries is found here. What percentage of the firm’s assets does the firm now finance using debt (liabilities)? If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm’s new debt ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Liquidity Risk (FRM Part 2 – Book 4 – Chapter 1); Author: AnalystPrep;https://www.youtube.com/watch?v=TguAvyxM6vg;License: Standard Youtube License