Principles Of Auditing & Other Assurance Services

21st Edition

ISBN: 9781259916984

Author: WHITTINGTON, Ray, Pany, Kurt

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 48P

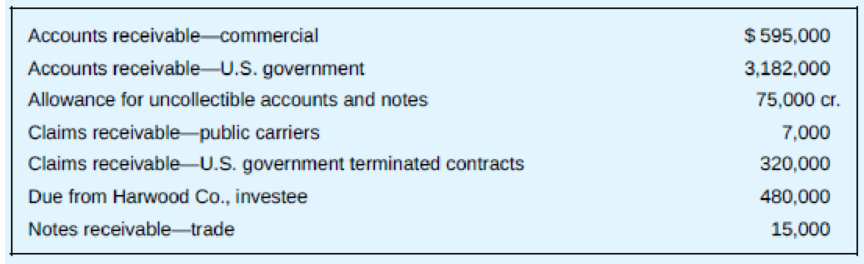

The July 31, 20X0, general ledger

Remember that two or more ledger accounts are often combined into one amount in the financial statements in order to achieve a concise presentation. The need for brevity also often warrants the disclosure of some information parenthetically: for example, the amount of the allowance for doubtful accounts.

Required:

- a. Draft a partial balance sheet for Aerospace Contractors at July 31, 20X0. In deciding which items deserve separate listing, consider materiality as well as the nature of the accounts.

- b. Write an explanation of the reasoning employed in your balance sheet presentation of these accounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following are typical questions that might appear on an internal control questionnaire for accounts payable.

1. Are monthly statements from vendors reconciled with the accounts payable listing?

2. Are vendors’ invoices matched with receiving reports before they are approved for payment?

Describe the manner in which each of the above procedures might be tested.

While reviewing a work paper on “pre-paid expenses” an auditor noticed that the schedule prepared by the audit team gave the opening balance, debits to the account, credits to the account and closing balance. Is the same sufficient documentation?

An auditor is likely to perform each of the below procedures to obtain evidence regarding the potential understatement of accounts payable at year-end (i.e., the Completeness assertion) except…

Question options:

Inspect purchase orders and receiving reports for accounts payable recorded at year-end.

Inspect the open invoice file for invoices to be paid after year-end.

All options describe procedures that can be used to identify a potential understatement of accounts payable.

Analyze cash disbursements made during the first few weeks of the subsequent year and inspect supporting documentation for each disbursement.

Chapter 11 Solutions

Principles Of Auditing & Other Assurance Services

Ch. 11 - Explain the difference between a customers order...Ch. 11 - Prob. 2RQCh. 11 - Prob. 3RQCh. 11 - State briefly the objective of the billing...Ch. 11 - Prob. 5RQCh. 11 - Prob. 6RQCh. 11 - Prob. 7RQCh. 11 - Prob. 8RQCh. 11 - Prob. 9RQCh. 11 - Prob. 10RQ

Ch. 11 - Prob. 11RQCh. 11 - Prob. 12RQCh. 11 - Prob. 13RQCh. 11 - Prob. 14RQCh. 11 - Prob. 15RQCh. 11 - Prob. 16RQCh. 11 - Prob. 17RQCh. 11 - Prob. 18RQCh. 11 - Prob. 19RQCh. 11 - Prob. 20RQCh. 11 - Prob. 21RQCh. 11 - Prob. 22RQCh. 11 - Give an example of a type of receivable...Ch. 11 - Prob. 24RQCh. 11 - Prob. 25QRACh. 11 - Prob. 26QRACh. 11 - Prob. 27QRACh. 11 - Prob. 28QRACh. 11 - Prob. 29QRACh. 11 - Prob. 30QRACh. 11 - Prob. 31QRACh. 11 - Prob. 32QRACh. 11 - Prob. 33QRACh. 11 - Prob. 34QRACh. 11 - Prob. 35QRACh. 11 - Prob. 36AOQCh. 11 - Which of the following would provide the most...Ch. 11 - Prob. 36COQCh. 11 - Prob. 36DOQCh. 11 - Prob. 36EOQCh. 11 - Under SEC rules, which of the following is not...Ch. 11 - Prob. 36GOQCh. 11 - Prob. 36HOQCh. 11 - Prob. 36IOQCh. 11 - Prob. 36JOQCh. 11 - Prob. 36KOQCh. 11 - Prob. 36LOQCh. 11 - Prob. 37OQCh. 11 - Prob. 38OQCh. 11 - An auditors working papers include the following...Ch. 11 - Prob. 40OQCh. 11 - Prob. 41OQCh. 11 - Prob. 42OQCh. 11 - Prob. 43OQCh. 11 - Prob. 44PCh. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - Prob. 47PCh. 11 - The July 31, 20X0, general ledger trial balance of...Ch. 11 - Prob. 49ITCCh. 11 - Prob. 50ECCh. 11 - Prob. 51EC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An auditor will most likely review an entity’s periodic accounting for the numerical sequence of shipping documents to ensure all documents are included to support management’s assertion about classes of transactions of: Select one: a. occurrence. b. completeness c. classification. d. accuracyarrow_forwardYou are a trainee in audit firm and you have been assigned to verify the follow balances for IJK Limited; Account receivables Sales Inventories Account payables Vehiclesarrow_forwardThe following are specific balance-related audit objectives applied to the audit of accounts receivable (a. through i.) and management assertions about account balances (1 through 6). The list referred to in the specific balance-related audit objectives is the list of the accounts receivable from each customer at the balance sheet date. i (Click the icon to view the audit objectives.) i (Click the icon to view the management assertions.) Requirement For each specific balance-related audit objective, identify the appropriate management assertion. (Hint: See table.) Specific balance-related audit objective There are no unrecorded receivables. b. Uncollectible accounts have been provided for. C. Receivables that have become uncollectible have been written off. d. All accounts on the list are expected to be collected within 1 year. The total of the amounts on the accounts receivable listing agrees with the general ledger balance for accounts receivable. a. e. Management assertionarrow_forward

- Determine the following as a result of your audit: subquestion a. How much is the correct amount of interest expense that should be reported in its Statement of Comprehensive Income for the period ending December 31, 2023? subquestion b. As an audit manager, you review the working papers of your audit staff and senior auditor and summarized the proposed adjusting entries (PAJE’s): Your proposed adjusting journal entry will include a credit to premium on note payable of? please show solution.arrow_forwardAn auditor will most likely review an entity’s periodic accounting for the numericalsequence of shipping documents to ensure all documents are included to supportmanagement’s assertion about classes of transactions of(1) occurrence. (3) accuracy.(2) completeness. (4) classificationarrow_forwardDodge, CPA, is auditing the financial statements of amanufacturing company with a significant amount of trade accounts receivable. Dodgeis satisfied that the accounts are correctly summarized and classified and that allocations,reclassifications, and valuations are made in accordance with GAAP. Dodge is planningto use accounts receivable confirmation requests to obtain sufficient appropriate evidenceas to trade accounts receivable.a. Identify and describe the two forms of accounts receivable confirmation requestsand indicate what factors Dodge will consider in determining when to use each.b. Assume that Dodge has received a satisfactory response to the confirmation requests.Describe how Dodge can evaluate collectibility of the trade accounts receivable.c. What are the implications to a CPA if during an audit of accounts receivable someof a client’s trade customers do not respond to a request for positive confirmation oftheir accounts?d. What auditing steps should a CPA perform if there…arrow_forward

- During the confirmation of accounts receivable, an auditor receives a confirmation via the client’s fax machine. Which of the following actions should the auditor take?a. Not accept the confirmation and select another customer’s balance to confirm.b. Not accept the confirmation and treat it as an exception.c. Accept the confirmation and file it in the working papers.d. Accept the confirmation but verify the source and content through a telephone call to the respondent.arrow_forwardAfter Bunker Hill Assay Services Inc. had completed all postings for March in the current year (20Y4), the sum of the balances in the following accounts payable ledger did not agree with the 36,600 balance of the controlling account in the general ledger: Assuming that the controlling account balance of 36,600 has been verified as correct, (a) determine the error(s) in the preceding accounts and (b) prepare a listing of accounts payable creditor balances (from the corrected accounts payable subsidiary ledger).arrow_forwardThe following are specific balance-related audit objectives applied to the audit of accounts receivable (a. through h.) and management assertions about account balances (1 through 4). The list referred to in the specific balance-related audit objectives is the list of the accounts receivable from each customer at the balance sheet date. Specific Balance-Related Audit Objective a . There are no unrecorded receivables. b . Receivables have not been sold or discounted. c . Uncollectible accounts have been provided for. d . Receivables that have become uncollectible have been written off. e . All accounts on the list are expected to be collected within 1 year. f . The total of the amounts on the accounts receivable listing agrees with the general ledger balance for accounts receivable. g . All accounts on the list arose from the normal course of business and are not due from related parties. h . Sales cutoff at year-end is proper. Management Assertion about Account Balances 1…arrow_forward

- You are auditing the December 31, 2021, accounts payable balance of one of your firm's divisions. The division controller's office has provided you with a schedule listing the creditors and the amount owed to each at December 31, 2021, Which of the following audit procedures would be your best choice for determining that no Individual account payable has been omitted from the schedule? A. Send confirmation requests to a randomly selected sample of creditors listed on the schedule B. Send confirmation requests to creditors that are listed on the schedule but not listed on the corresponding December 31, 2020, schedule. C. Examine support for selected 2022 payments to creditors, ascertaining that those relating to 2021 are on this schedule. D. Examine support for selected 2022 payments to creditors, ascertaining that those relating to 2022 are not on the schedule.arrow_forwardWhich of the following most likely would be included with the client’s confirmation letter, when an auditor decided to confirm customers’ account balances rather than individual invoices.? Select one: a. An auditor-prepared letter requesting the customer to supply missing and incorrect information directly to the auditor. b. A client-prepared letter reminding the customer that a nonresponse will cause a second request to be sent. c. A client-prepared statement of account showing the details of the customer’s account balance. d. An auditor-prepared letter explaining that a nonresponse may cause an inference that the account balance is correct.arrow_forward20. To correct all errors they discover in the accounting records for the year under audit. The auditors should prepare adjusting journal entries for material items only. Because they are concerned with the fairness, not the preciseness, of the client's financial statements. Select one:TrueFalsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License