Concept explainers

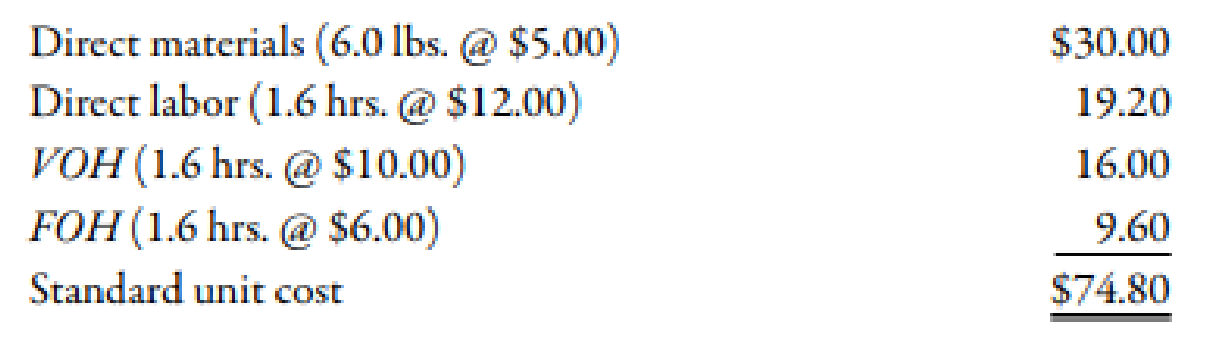

The Lubbock plant of Morril’s Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawn mowers. The plant uses a

During the year, the Lubbock plant had the following actual production activity: (a) Production of motors totaled 50,000 units, (b) The company used 82,000 direct labor hours at a total cost of $1,066,000. (c) Actual fixed

The Lubbock plant’s practical activity is 60,000 units per year. Standard overhead rates are computed based on practical activity measured in standard direct labor hours.

Required:

1. Compute the variable overhead spending and efficiency variances.

2. CONCEPTUAL CONNECTION Compute the fixed overhead spending and volume variances. Interpret the volume variance. What can be done to reduce this variance?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub