International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer General Accounting

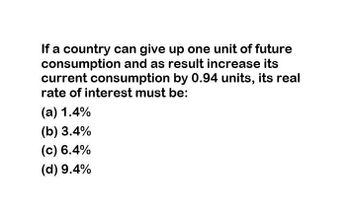

Transcribed Image Text:If a country can give up one unit of future

consumption and as result increase its

current consumption by 0.94 units, its real

rate of interest must be:

(a) 1.4%

(b) 3.4%

(c) 6.4%

(d) 9.4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ay 1. Imagine you observe the following situation. Would you expect this situation to change? Why? i(euro zone)= 1% per annum i(Sweden)=0.9% per annum S(€/SEK)=0.1 F(1 year, €/SEK)=0.106arrow_forwardLet in and if represent the nominal 1-year interest rates for a home and foreign country, respectively. According to the international Fisher effect (IFE) theory, which of the following best represents the predicted change in the foreign currency ef? O ○ ef = ef = 1-in 1-i 1+if 1+i - - 1 1 ○ ef 1+in ○ ef = +1 1+i ○ ef = 1+in 1+if - 1arrow_forwardAssume the spot rate between the uk and the US is .€ .6789= $1 while the one year Foward rate is €.6782=$1. The risk free rate in the UK is 3.1 percent. The risk free rate in the U.S is 2.9 percent. How much profit can you earn for the year on a loan of $1,500 by utilizing covered interest abitrage?arrow_forward

- If national income Y = 10,500, disposable income Yd = 8,500 , consumption is C = 8,000, transfer payments TR = 150 and the budget deficit is BD = 200, what is the level of private domestic investment, I ? (please insert the round number without the Euro symbol)arrow_forwardAssume a risk-free asset in the U.S. is currently yielding 2.7 percent while a Canadian risk-free asset is yielding 2.8 percent and the current spot rate is Can$1.2849 = $1. What is the approximate 6-month forward rate if interest rate parity holds? Can$1.2855 Can$1.2838 Can$1.2843 Can$1.2862 Can$1.2836arrow_forwardThe spot rate between the U.K. and the U.S. is £.7534/$, while the one-year forward rate is £.7524/$. The risk-free rate in the U.K. is 4.27 percent and in the United States is 2.58 percent. How much in profit can you earn on $9,000 utilizing covered interest arbitrage?arrow_forward

- Suppose that the exchange rate is $0.92/Euro. The dollar-denominatedinterest rate is 4% and the euro-denominated interest rate is 3%.u = 1.2, d = 0.9, T = 0.75, n = 3, and K = $1.00.a. What is the price of a 9-month European put?b. What is the price of a 9-month American put?arrow_forwardUsing the UIP equation, assume that the expected future rate (after one year) for euros (in terms of dollars) equals $1.20, while the current spot rate is 1.15. The current interest rate on euro deposits is 2%, and the interest rate on dollar deposits is 3%. Should you invest in the US or in Europe? Neither one In the US In Europe It is indifferentarrow_forwardAssume Sweden has policy interest rate of 4.3% and the real interest rate is 2%. If the interest rate rises to 6% while the real interest rate remains unchanged, what should be the impact on the Swedish Krona? Question 18 options: It should appreciate We do not have enough information to answer the question It should depreciate It should remain unchangedarrow_forward

- A 77.arrow_forwardThe following graph depicts the foreign exchange market for euros. The blue line represents the demand schedule for euros, while the orange line represents the euro supply schedule. Suppose that the inflation rate in France increases suddenly relative to the inflation rate in the United States. Use the graph to shift either the supply schedule, the demand schedule, or both, to depict the impact on the value of the euro. Then answer the question that follows. VALUE OF EURO (U.S. dollars per euro) D QUANTITY OF EUROS S D ☐ S ?arrow_forwardRequired:a. Calculate the dollar proceeds from the FI’s loan portfolio at the end of the year, the return on the FI’s loan portfolio, and the net return for the FI if the pound spot foreign exchange rate falls to $1.20/£1 and the lira spot foreign exchange rate falls to $0.156/TL1 over the year.b. Calculate the dollar proceeds from the FI’s loan portfolio at the end of the year, the return on the FI’s loan portfolio, and the net return for the FI if the pound spot foreign exchange rate rises to $1.40/£1 and the lira spot foreign exchange rate rises to $0.17/TL1 over the year.c. Suppose that the FI funds the $250 million U.S. loans with $250 million one-year U.S. CD at a rate of 4 percent; funds $150 equivalent British loans with $150 million equivalent one-year pound CDs at a rate of 5 percent; funds $100 million equivalent Turkish loans with $100 million equivalent one-year Turkish lira CDs at a rate of 6 percent. Assume no other changes. What will the FI’s balance sheet look like…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you