Mantenga Company provides routine maintenance services for heavy moving and transportation vehicles. Although the vehicles vary, the maintenance services provided follow a fairly standard pattern. Recently, a potential customer has approached the company, requesting a new maintenance service for a radically different type of vehicle. New servicing equipment and some new labor skills will be needed to provide the maintenance service. The customer is placing an initial order to service 150 vehicles and has indicated that if the service is satisfactory, several additional orders of the same size will be placed every 3 months over the next 3 to 5 years.

Mantenga uses a

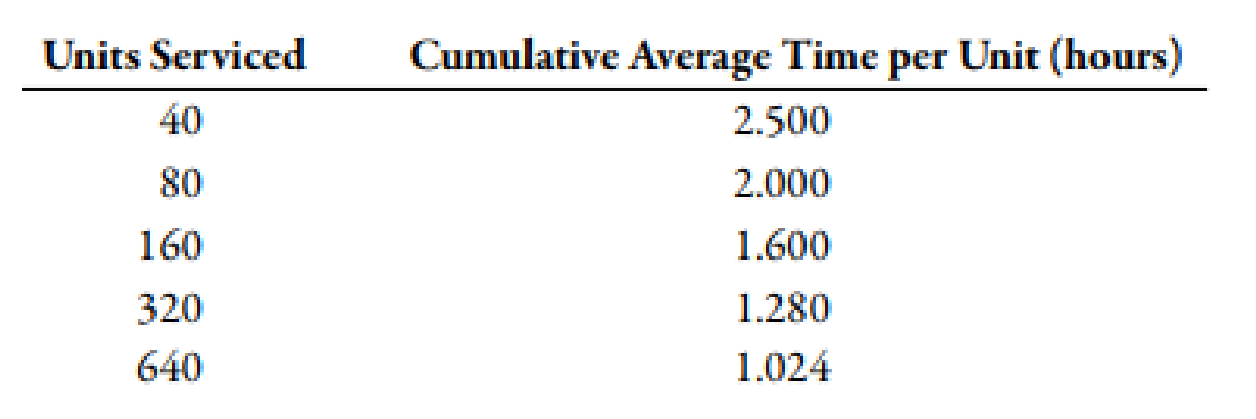

As the workers learn more about servicing the new vehicles, they become more efficient, and the average time needed to service one unit declines. Engineering estimates that all of the learning effects will be achieved by the time that 320 units are produced. No further improvement will be realized past this level.

Required:

- 1. Assume that the average labor time is 0.768 hour per unit after the learning effects are achieved. Using this information, prepare a standard cost sheet that details the standard service cost per unit. (Note: Round costs to two decimal places.)

- 2. CONCEPTUAL CONNECTION Given the per-unit labor standard set, would you expect a favorable or an unfavorable labor efficiency? Explain. Calculate the labor efficiency variance for servicing the first 320 units.

- 3. CONCEPTUAL CONNECTION Assuming no further improvement in labor time per unit is possible past 320 units, explain why the cumulative average time per unit at 640 units is lower than the time at 320 units. Show that the standard labor time should be 0.768 hour per unit. Explain why this value is a good choice for the per-unit labor standard.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- ! Required information [The following information applies to the questions displayed below.] Kinnear Plastics manufactures various components for the aircraft and marine industry. Kinnear buys plastic from two vendors: Tappan Corporation and Hill Enterprises. Kinnear chooses the vendor based on price. Once the plastic is received, it is inspected to ensure that it is suitable for production. Plastic that is deemed unsuitable is disposed of. The controller at Kinnear collected the following information on purchases for the past year: Total purchases (tons) Plastic discarded Tappan 5,000 200 The purchasing manager has just received bids on an order for 330 tons of plastic from both Tappan and Hill. Tappan bid $2,112 and Hill bid $2,109 per ton. Effective cost per ton Hill 7,500 375 Required: 1-a. Assume that the average quality, measured by the amounts discarded from the two companies, will continue as in the past. What is the effective cost per ton for both Tappan and Hill? (Do not…arrow_forwardRoscoe Construction Company (RCC) is a company specializing in building roads and highways. As a part of its business, it receives supplies of aggregate from two suppliers: Toorak Gravel (TG) and Kilda Corporation (KC). RCC purchasing has expressed a preference for KC based on price, but occasionally has to order from TG when KC cannot fill the order. RCC has recently had problems with the quality and the timeliness of deliveries. When a sup plier delivers a load to RCC, it goes through an initial inspection to assure it meets specification. If the load fails the initial inspection, it goes through a secondary inspection to determine the exact issue. Almost always, the issue can be resolved and the load can be used. The initial inspection costs $1,000 per load. A secondary inspection, which is more thorough, costs $5,000 per load. If a delivery is delayed, RCC has to hire temporary workers or pay overtime to some employees. The average cost of a delayed load is $2,000. The sales…arrow_forwardPrecision Equipment, Inc., specializes in designing and installing customized manufacturing equipment. On February 1, 2018, it signs a contract to design a fully automated wristwatch assembly line for $2 million, which willbe settled in cash upon completion of construction. Precision Equipment will install the equipment on the client’sproperty, furnish it with a customized software package that is integral to operations, and provide consulting services that integrate the equipment with Precision’s other assembly lines. How many performance obligations existin this contract?arrow_forward

- Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon Hessel Total Total purchases (cartons) 5,000 3,000 8,000 Average purchase price (per carton) $ 170 $ 186 $ 176 Number of deliveries 40 20 60 Percentage of cartons delivered late. 30% 15% 25% The Accounting Department recorded $243,750 as the cost of late deliveries to customers. Required: Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the past. Also…arrow_forwardCarrie Construction (CC) is a company specializing in building airport runways and major highways. As a part of its business, it receives supplies of aggregate (stone, sand, gravel, and so on) from two suppliers: Austin Aggregate and Granger Materials. The CC purchasing department has a preference for buying from Granger based on price but occasionally has to order from Austin when Granger cannot fill the order. Carrie Construction has recently had problems with the quality and the timeliness of deliveries. When a supplier delivers a load to CC, it goes through an initial inspection to assure it meets specification. If the load fails the initial inspection, it goes through a secondary inspection to determine the exact issue. Almost always, the issue can be resolved and the load can be used. The initial inspection costs $3,240 per load. A secondary inspection, which is more thorough, costs $16,200 per load. If a delivery is delayed, Carrie has to hire temporary workers or pay overtime…arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 192 40 30% Bacon Hessel Hessel 3,000 $ 208 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. The Accounting Department recorded $265,200 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 198 20 15% Required: Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the…arrow_forward

- Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 182 40 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. 30% Bacon Hessel Hessel 3,000 $198 20 15% The Accounting Department recorded $255,450 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 188 60 25% Exercise 10-38 (Algo) Activity-Based Costing of Suppliers (LO 10-3, 4) Required: Assume that the average quality, measured by the percentage of…arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon Hessel Total Total purchases (cartons) 5,000 3,000 8,000 Average purchase price (per carton) $ 176 $ 192 $ 182 Number of deliveries 40 20 60 Percentage of cartons delivered late. 30% 15% 25% The Accounting Department recorded $249,600 as the cost of late deliveries to customers. Exercise 10-38 (Algo) Activity-Based Costing of Suppliers (LO 10-3, 4) Required: Assume that the average quality, measured by the percentage of late…arrow_forwardJohn Patrick has recently been hired as controller of Valdosta Vinyl Company (VVC), a manufacturer of vinyl siding used in residential construction. VVC has been in the vinyl siding business form any year sand is currently investigating ways to modernize its manufacturing process. At the first staff meeting Patrick attended, Jack Kielshesky , chief engineer, presented a proposal for automating the Molding Department. Kielshesky recommended that the company purchase two robots that would have the capability of replacing the eight direct-labor employees in the department. The cost savings outlined in the proposal include the elimination of direct-labor cost in the Molding Department plus a reduction of manufacturing overhead cost in the department to zero, because VVC charges manufacturing overhead on the basis of direct-labor dollars using a plant wide rate. The president of VVC was puzzled by Kielshesky's explanation: “This just doesn't make any sense. How can a department’s overhead…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Bid Kinnear Plastics manufactures various components for the aircraft and marine industry. Kinnear buys plastic from two vendors: Tappan Corporation and Hill Enterprises. Kinnear chooses the vendor based on price. Once the plastic is received, it is inspected to ensure that it is suitable for production. Plastic that is deemed unsuitable is disposed of. The controller at Kinnear collected the following information on purchases for the past year: Total purchases (tons) Plastic discarded Tappan 5,000 200 Hill 7,500 375 The purchasing manager has just received bids on an order for 330 tons of plastic from both Tappan and Hill. Tappan bid $2,112 and Hill bid $2,109 per ton. Required: a. Assume all else remains the same. What bid by Tappan would make Kinnear indifferent between buying from Tappan or Hill? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardGemma Company is a midsize manufacturing company with 120 employees and approximately $45 million in sales. Management has established a set of processes to purchase fixed assets, described in the following paragraphs: When a user department decides to purchase a new fixed asset, the departmental manager prepares an asset request form. When completing the form, the manager must describe the fixed asset, the advantages or efficiencies offered by the asset, and estimates of costs and benefits. The asset request form is forwarded to the director of finance. Personnel in the finance department review estimates of costs and benefits and revise these if necessary. A discounted cash flow analysis is prepared and forwarded to the vice president of operations, who reviews the asset request forms and the discounted cash flow analysis, and then interviews user department managers if he or she feels it is warranted. After this review, she selects assets to purchase until she has exhausted the…arrow_forwardBrandon Technology makes two models of a specialized sensor for the aerospace Industry. The difference in the two models relates to the required accuracy of the sensor. The Standard model is used for most normal operations while the High-Performance model is used for high-altitude and specialized missions. Before shipment, the two models are passed through a machine that, among other things, certifies the accuracy of the sensor. The company only has one testing machine. The price and costs of the two sensor models are shown here: Price per sensor Standard $ 52 $ 34 0.04 Variable cost per sensor Testing hours per sensor The testing machine used for both models has a capacity of 8.250 hours annually. Fixed manufacturing costs are $2,400,000 annually. Required: a. Suppose that the maximum annual unit sales that is possible for Brandon Technology is 250,000 units of the Standard model and 80,000 of the High-Performance model. How many units of each sensor model should Brandon Technology…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning