Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 48PA

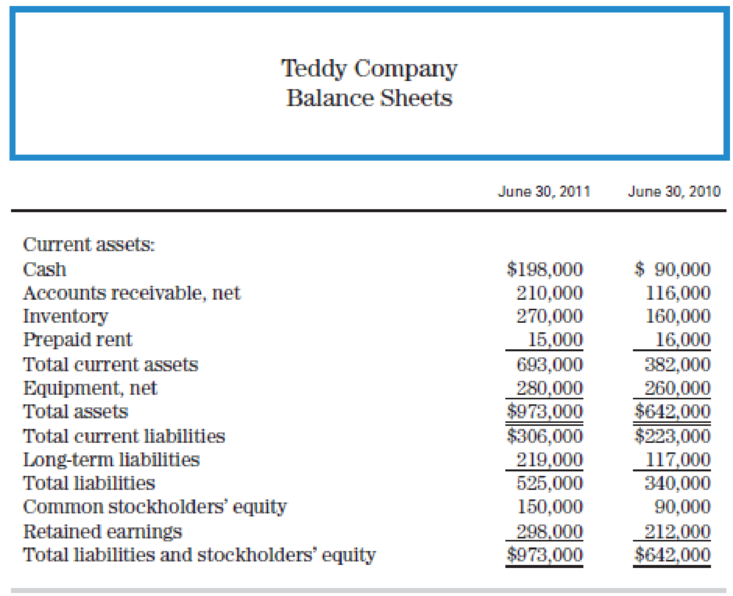

You are interested in investing in Teddy Company, and you have obtained the following balance sheets for the company for the past two years:

The following amounts were reported on the income statement for the year ended June 30, 2011:

Requirements

- 1. Compute as many of the financial statement ratios you have studied as possible with the information provided for Teddy Company. Some ratios can be computed for both years and others can be computed for only one year.

- 2. Would you invest in Teddy Company? Why or why not? What additional information would be helpful in making this decision?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are given the financial statements of Bersatu Berhad for the 2021 and 2020.

a. Use the above financial statements, determine the company’s return on equity (ROE). Is there is any significant different between the ROEs of the company for the two years? Provide the formula and show your calculation.b. Based on DuPont framework, return on equity is broken into three important components. What are the three components? Provide the formula for each component. What does each component attempts to measure?

Calculate the Current Ratio, Debt Ratio, Return on Assets (ROA) and Return on Equity (ROE). For the ROA and ROE, you should use the average total assets and the average total equity in your calculations. (The average is the total across two years divided by two). Calculate these values for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing?

A) How much stockholders equity does diamondback have at the beginning of the current fiscal year?

B) Use the accounting equation and your answer to part (a) to show how you would calculate Diamondback's assets and liabilities at the beginning of the current fiscal year.

C) Summarize your findings.

Chapter 10 Solutions

Financial Accounting

Ch. 10 - Prob. 1YTCh. 10 - Prob. 2YTCh. 10 - Prob. 3YTCh. 10 - Prob. 4YTCh. 10 - Prob. 5YTCh. 10 - Define the items that the Financial Accounting...Ch. 10 - Prob. 2QCh. 10 - Prob. 3QCh. 10 - Prob. 4QCh. 10 - Prob. 5Q

Ch. 10 - Prob. 6QCh. 10 - What is solvency? Which ratios are useful for...Ch. 10 - What is profitability? Which ratios are useful for...Ch. 10 - What are market indicators? Which ratios are...Ch. 10 - Prob. 10QCh. 10 - Prob. 1MCQCh. 10 - Current assets for Kearney Company are 120,000 and...Ch. 10 - Prob. 3MCQCh. 10 - Prob. 4MCQCh. 10 - Prob. 5MCQCh. 10 - Prob. 6MCQCh. 10 - Prob. 7MCQCh. 10 - Prob. 8MCQCh. 10 - Prob. 9MCQCh. 10 - Prob. 10MCQCh. 10 - Prob. 1SEACh. 10 - Prob. 2SEACh. 10 - Prob. 3SEACh. 10 - Prob. 4SEACh. 10 - Prob. 5SEACh. 10 - A five-year comparative analysis of Low Light...Ch. 10 - Prob. 7SEACh. 10 - Prob. 8SEBCh. 10 - Prob. 9SEBCh. 10 - Prob. 10SEBCh. 10 - Perform a vertical analysis on the following...Ch. 10 - Prob. 12SEBCh. 10 - Prob. 13SEBCh. 10 - Use the following information to construct a...Ch. 10 - Prob. 16EACh. 10 - Prob. 17EACh. 10 - Prob. 18EACh. 10 - Prob. 19EACh. 10 - Use the balance sheets from Suzannes Hotels in...Ch. 10 - Prob. 21EACh. 10 - Prob. 22EACh. 10 - Prob. 23EACh. 10 - Use the statements of earnings for Campbell Soup...Ch. 10 - Prob. 25EACh. 10 - Prob. 26EACh. 10 - Prob. 27EACh. 10 - Prob. 28EBCh. 10 - Prob. 29EBCh. 10 - Prob. 30EBCh. 10 - Prob. 31EBCh. 10 - Prob. 32EBCh. 10 - Prob. 33EBCh. 10 - Prob. 34EBCh. 10 - Prob. 35EBCh. 10 - Prob. 36EBCh. 10 - Prob. 37EBCh. 10 - Prob. 38EBCh. 10 - Prob. 39EBCh. 10 - Prob. 40EBCh. 10 - Prob. 41PACh. 10 - Prob. 42PACh. 10 - Prob. 43PACh. 10 - Following are the income statements for Alpha...Ch. 10 - Prob. 45PACh. 10 - Prob. 46PACh. 10 - Prob. 47PACh. 10 - You are interested in investing in Teddy Company,...Ch. 10 - Prob. 49PBCh. 10 - Prob. 50PBCh. 10 - Prob. 51PBCh. 10 - Prob. 52PBCh. 10 - Prob. 53PBCh. 10 - Prob. 54PBCh. 10 - Prob. 55PBCh. 10 - Prob. 56PBCh. 10 - Prob. 1CTPCh. 10 - Prob. 2CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identify information used in an investment decision Look forward to the daywhen you will have accumulated $5,000, and assume that you have decided to investthat hard-earned money in the common stock of a publicly owned corporation. Whatdata about that company will you be most interested in, and how will you arrangethose data so they are most meaningful to you? What information about the company will you want on a weekly basis, on a quarterly basis, and on an annual basis?How will you decide whether to sell, hold, or buy some more of the firm’s stock?arrow_forwardUse information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA). Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.arrow_forwardThis question requires an analysis of financial statements from annual reports of companies. Complete the analysis by incorporating the three dimensions of ratios which are liquidity, profitability, and solvency. As an investor, why you prefer this company to invest in? based on ratios and horizontal & vertical analysis of company the company that i’ve been made, justify your answer.arrow_forward

- You are provided with the Income Statement and the Balance Sheet of HTS software, Inc. for 2011.Required: (a) Calculate the ratios stated in the table below for HTS Software, Inc. for 2011 (b) Analyze the current financial position for the company from a time series and cross section viewpoint. (c) Break your analysis into an evaluation of the firm’s liquidity, activity, debt, profitability and market ratios.arrow_forwardHighland is a brewing company, which has been in existence over the years. With your finance background, a friend has requested you with the interest to invest in the company. Presented below is the financial statement for Highland. Required: You are required to calculate and interpret all relevant ratios for Highland Company Limited, stating all assumptions made and showing all workings to assist your friend in making his decision. Highland Company Limited Statement of Comprehensive Income for the year ended 30th June 2021 2021 (GH¢ '000) 2020 (GH¢ '000) Revenue 321,017 292,318 Cost of Sales (228,793) (192,923) Gross Profit 92,224 99,395 Advertising and marketing expenses (28,986) (24,895) Administrative expenses (13,350) (14,022) Other expenses (20,810) (20,197) Other Income 2,085 339 Results from operating activities 31,163 40,620 Finance income 815 354 Finance cost (4,110)…arrow_forwardCalculate the following ratios for F. Raser for the year ended 31 May 2016. State clearly the formulae used for each ratio. Return on capital employed Gross profit percentage Net profit percentage Quick/Acid test ratio Receivables collection period Earnings per share Using the additional information given and the ratios you calculated in part (a), write a brief report on the financial performance of F. Raser. Indicate in your report what additional information might be useful to help interpret the ratios. © List two factors F. Raser should consider in deciding whether to raise finance by issuing loan notes rather than issuing sharesarrow_forward

- You are provided with the Income Statement and the Balance Sheet of HTS software, Inc. for 2011. Required: (a) Calculate the ratios stated in the table below for HTS Software, Inc. for 2011 (b) Analyze the current financial position for the company from a time series and cross section viewpoint. (c) Break your analysis into an evaluation of the firm’s liquidity, activity, debt, profitability and market ratios. Historical and Industry Average Ratios HTS Software , Inc. Ratio 2010 2011 Industry2011 Current Ratio 2.6 — 2.7 Quick Ratio 1.8 — 1.75 Inventory Turnover 4.5 — 4.7 Average Collection Period 40days — 42 days Total Asset Turnover 1.2 — 1 Debt Ratio 20% — 21% Times Interest Earned 9 — 8.9 Gross Profit Margin 43% — 44% Operating Profit Margin 30% — 32% Net Profit Margin 20% — 21% Return on total assets 12% — 13% Return on Equity Price/Earnings Ratio…arrow_forwardYou are provided with the Income Statement and the Balance Sheet of HTS software, Inc. for 2011. Required: (a) Calculate the ratios stated in the table below for HTS Software, Inc. for 2011 (b) Analyze the current financial position for the company from a time series and cross section viewpoint. (c) Break your analysis into an evaluation of the firm’s liquidity, activity, debt, profitability and market ratios. Historical and Industry Average Ratios HTS Software , Inc. Ratio 2010 2011 Industry2011 Current Ratio 2.6 — 2.7 Quick Ratio 1.8 — 1.75 Inventory Turnover 4.5 — 4.7 Average Collection Period 40days — 42 days Total Asset Turnover 1.2 — 1 Debt Ratio 20% — 21% Times Interest Earned 9 — 8.9 Gross Profit Margin 43% — 44% Operating Profit Margin 30% — 32% Net Profit Margin 20% — 21% Return on total assets 12% — 13% Return on Equity Price/Earnings Ratio…arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forward

- Alex is currently considering to invest his money in one of the companies betweenCompany A and Company B. The summarized final accounts of the companies for theirlast completed financial year are as follows: (refer to the images) Required:a. Calculate the following ratios for Company A and Company B. State clearly theformulae used for each ratio:i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)v. Payables Payment Period (days)vi. Current Ratiovii. Quick Ratiob. Comment on each of the ratios calculated in part (a) above.arrow_forwardREQUIRED Use the information provided below to calculate the ratios for 2021 (expressed to two decimal places) that would reflect each of the following: The time taken by the company to settle its debts with trade The amount of debt that the company uses to finance its The operational effectiveness of the company before considering interest income, interest expense and company tax. The percentage of the profit that has been put back into the What investors are willing to pay for the shares of the company with due consideration given to the profit generated by each share in the company. Comment on the FIVE (5) ratios of Oslo Limited as compared to the industry average provided in the additional information. INFORMATION The information given below was extracted from the books of Oslo Limited:…arrow_forwardThe image uploaded is the calculation of Access Bank's Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License