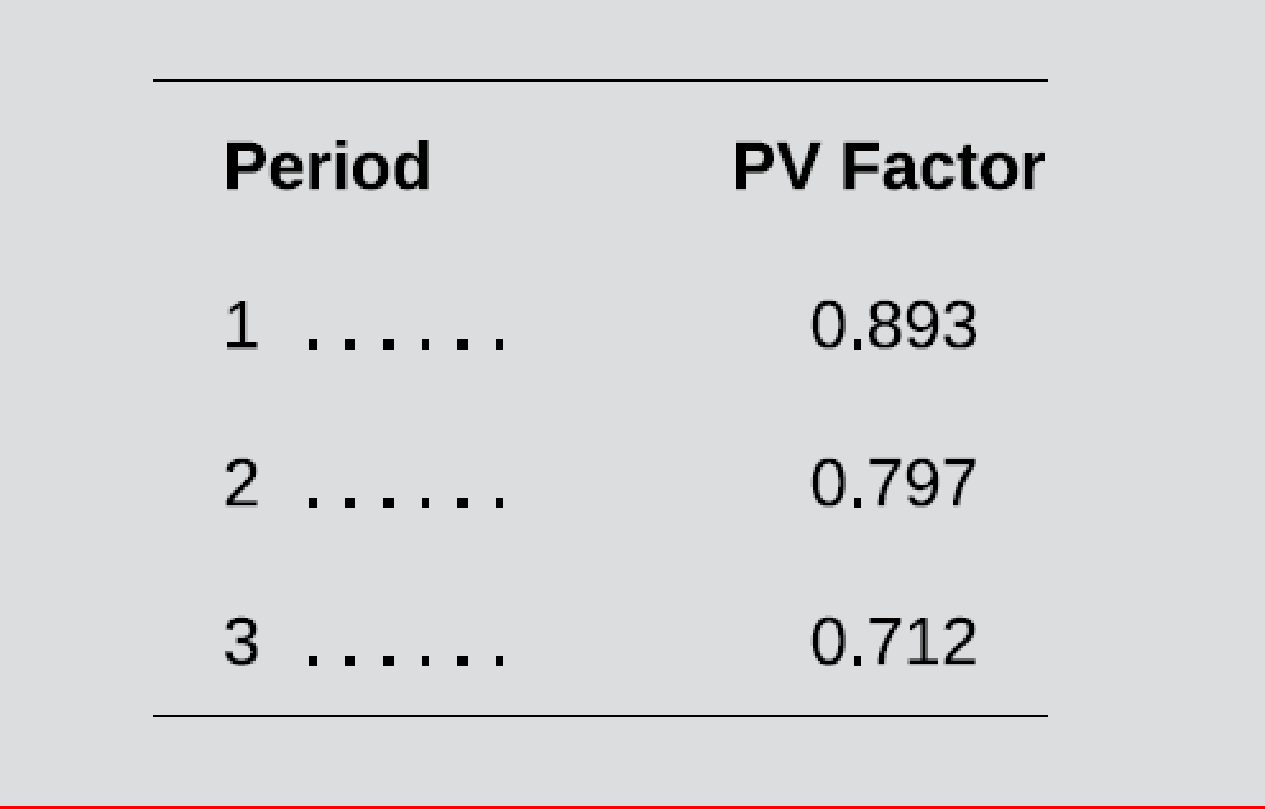

Duncan Street Company (DSC), a British company, is considering establishing an operation in the United States to assemble and distribute smart speakers. The initial investment is estimated to be 25,000,000 British pounds (GBP), which is equivalent to 30,000,000 U.S. dollars (USD) at the current exchange rate. Given the current corporate income tax rate in the United States, DSC estimates that total after-tax annual cash flow in each of the three years of the investment’s life would be US$10,000,000, US$12,000,000, and US$15,000,000, respectively. However, the U.S. national legislature is considering a reduction in the corporate income tax rate that would go into effect in the second year of the investment’s life and would result in the following total annual

The U.S. operation will distribute 100 percent of its after-tax annual cash flow to DSC as a dividend at the end of each year. The terminal value of the investment at the end of three years is estimated to be US$25,000,000. The U.S. withholding tax on dividends is 5 percent; repatriation of the investment’s terminal value will not be subject to U.S. withholding tax. Neither the dividends nor the terminal value received from the U.S. investment will be subject to British income tax.

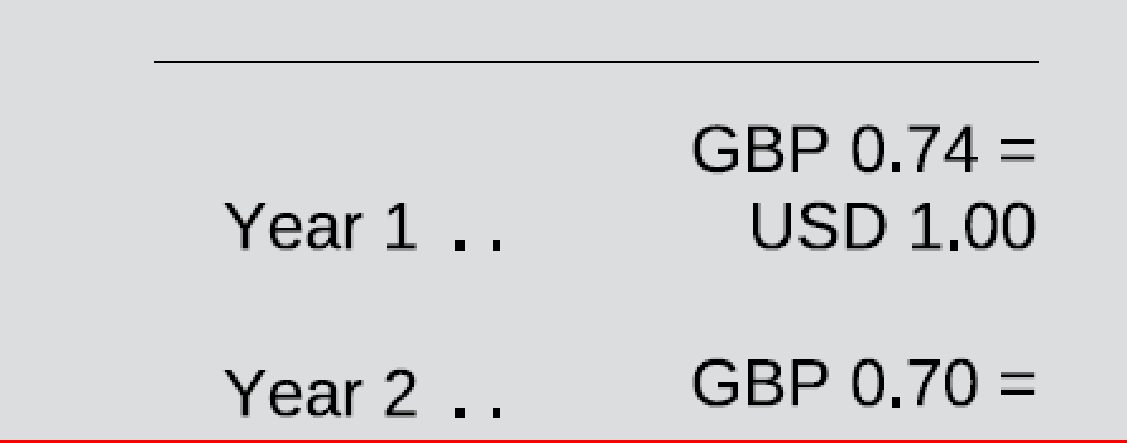

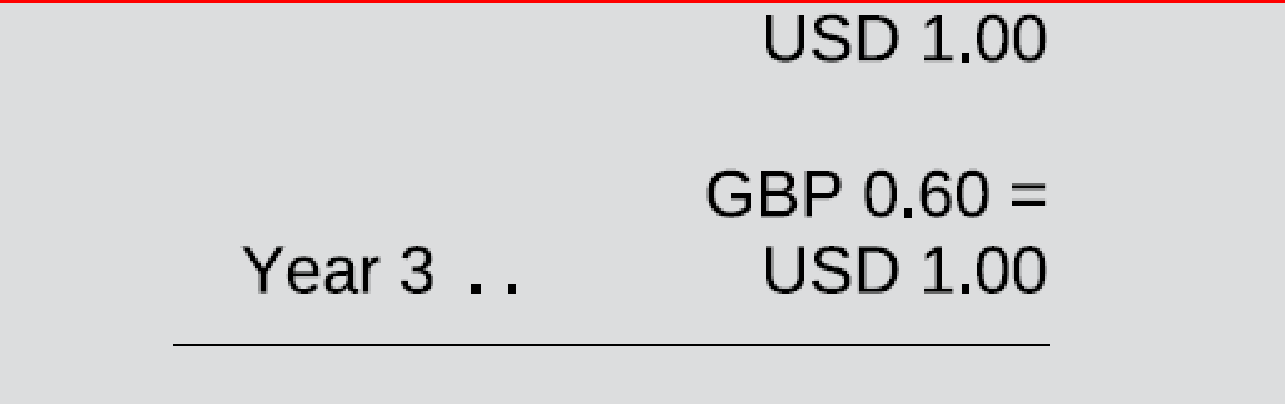

Exchange rates between the GBP and USD are

Required:

- a. Determine the expected

net present value of the potential U.S. investment from a project perspective. - b. Determine the expected net present value of the potential U.S. investment from a parent company perspective.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

International Accounting

- Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the…arrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at…arrow_forwardA U.S. company is considering a high-technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an 18% rate of return in U.S. dollars (after taxes) on any investments in this foreign country. a. Should the project be approved, based on a PW analysis in U.S. dollars, if the devaluation of the T-mark, relative to the U.S. dollar, is estimated to average 12% per year and the present exchange rate is 20 T-marks per dollar? b. What is the IRR of the project in T-marks? c. Based on your answer to (b), what is the IRR in U.S. dollars?arrow_forward

- International Foods Corporation, a U.S.-‐based food company, is considering expanding its soup-‐processing operations in Switzerland. The company plans a net investment of $8 million in the project. The current spot exchange rate is SF6.25 per dollar (SF = Swiss francs). Net cash flows for the expansion project are estimated to be SF5 million for 10years and nothing thereafter. Based on its analysis of current conditions in Swiss capital markets, International Foods has determined that the applicable cost of capital for the project is 16 percent. Calculate the net present value of the proposed expansion project.arrow_forwardDelta Company, a U.S. MNC, is contemplating making a foreign capital expenditure in South Africa. The initial cost of the project is ZAR12,200. The annual cash flows over the five-year economic life of the project in ZAR are estimated to be 3,660, 4,660, 5,650, 6,640, and 7,550. The parent firm's cost of capital in dollars is 9.5 percent. Long-run inflation is forecasted to be 3 percent per annum in the United States and 7 percent in South Africa. The current spot foreign exchange rate is ZAR per USD = 3.75. Required: Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Converting all cash flows from ZAR to USD at purchasing power parity forecasted exchange rates and then calculating the NPV at the dollar cost of capital. Note: Do not round the intermediate calculations. Round the final answer to the nearest whole number. NPV in USD using PPP ratesarrow_forwardDelta Company, a U.S. MNC, is contemplating making a foreign capital expenditure in South Africa. The initial cost of the project is ZAR11,200. The annual cash flows over the five-year economic life of the project in ZAR are estimated to be 3,360, 4,360, 5,350, 6,340, and 7,300. The parent firm’s cost of capital in dollars is 9.5 percent. Long-run inflation is forecasted to be 3 percent per annum in the United States and 7 percent in South Africa. The current spot foreign exchange rate is ZAR/USD = 3.75. Calculating the NPV in ZAR using the ZAR equivalent cost of capital according to the Fisher effect and then converting to USD at the current spot rate. Converting all cash flows from ZAR to USD at purchasing power parity forecasted exchange rates and then calculating the NPV at the dollar cost of capital. Are the two dollar NPVs different or the same? multiple choice Different Same 4.What is the NPV in dollars if the actual pattern of ZAR/USD exchange rates is: S(0) = 3.75, S(1) =…arrow_forward

- International Foods Corporation, a U.S.-based food company, is considering expanding its soup-processing operations in Switzerland. The company plans a net investment of $7 million in the project. The current spot exchange rate is SF5.5 per dollar (SF = Swiss francs). Net cash flows for the expansion project are estimated to be SF6 million for 12 years and nothing thereafter. Based on its analysis of current conditions in Swiss capital markets, International Foods has determined that the applicable cost of capital for the project is 19 percent. Calculate the net present value of the proposed expansion project. Use Table IV to answer the questions below. Enter your answer in millions. For example, an answer of $1.20 million should be entered as 1.20, not 1,200,000. Round your answer to two decimal places.arrow_forwardDelta Company, a U.S. MNC, is contemplating making a foreign capital expenditure in South Africa. The initial cost of the project is ZAR12,600. The annual cash flows over the five-year economic life of the project in ZAR are estimated to be 3,780, 4,780, 5,770, 6,760, and 7,650. The parent firm's cost of capital in dollars is 9.5 percent. Long-run inflation is forecasted to be 3 percent per annum in the United States and 7 percent in South Africa. The current spot foreign exchange rate is ZAR per USD = 3.75. Required: Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculating the NPV in ZAR using the ZAR equivalent cost of capital according to the Fisher effect and then converting to USD at the current spot rate. Note: Do not round the intermediate calculations. Round the final answer to the nearest whole number. NPV in USD using fisher effect a. Calculating the NPV in ZAR using the ZAR equivalent cost of capital…arrow_forwardThe South Korean multinational manufacturing firm, Nam Sung Industries, is debating whether to invest in a 2-year project in the United States. The project's expected dollar cash flows consist of an initial investment of $1 million with cash inflows of $700,000 in Year 1 and $600,000 in Year 2. The risk-adjusted cost of capital for this project is 12%. The current exchange rate is 1,055 won per U.S. dollar. Risk-free interest rates in the United States and S. Korea are: % U.S. S. Korea a. If this project were instead undertaken by a similar U.S.-based company with the same risk-adjusted cost of capital, what would be the net present value generated by this project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would be the rate of return generated by this project? Do not round intermediate calculations. Round your answer to two decimal places. 1-Year 4.0% 3.0% Rate of return: 2-Year 5.25% 4.25% b. What is the expected forward exchange rate 1…arrow_forward

- Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with a salvage value of $12,000,000. This salvage value would be paid by the government in Singapore to Kittle in exchange for ownership of the subsidiary. The expected exchange rate of the Singapore dollar of $0.50 over the life of the project. Kittle managers are worried about the uncertainty of the value of the Singapore dollar. While they expect that the exchange rate will be $0.50, they recognize that this value may fluctuate. Thus, they decide to S$3,000,000 in cash flows per year, while any additional cash flows beyond this threshold would not be hedged. The forward rate that Kittle will use to hedge the S$3,000,000 is $0.48. The following table shows a key subsection of Kittle's capital budgeting analysis…arrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with a salvage value of $12,000,000. This salvage value would be paid by the government in Singapore to Kittle in exchange for ownership of the subsidiary. The expected exchange rate of the Singapore dollar of $0.50 over the life of the project. Kittle managers are worried about the uncertainty of the value of the Singapore dollar. While they expect that the exchange rate will be $0.50, they recognize that this value may fluctuate. Thus, they decide to S$3,000,000 in cash flows per year, while any additional cash flows beyond this threshold would not be hedged. The forward rate that Kittle will use to hedge the S$3,000,000 is $0.48. The following table shows a key subsection of Kittle's capital budgeting analysis…arrow_forwardMicheal’s Machinery is a German multinational manufacturing company. Currently, Micheal’s financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar-denominated cash flows consist of an initial investment of $2000 and a cash inflow the following year of $2400. Micheal’s estimates that its risk-adjusted cost of capital is 12%. Currently, 1 U.S. dollar will buy 0.7 Germany. In addition, 1-year risk-free securities in the United States are yielding 6.5%, while similar securities in Germany’s are yielding 4.5%. If this project was instead undertaken by a similar U.S.-based company with the same risk-adjusted cost of capital, what would be the net present value and rate of return generated by this project? Round your answers to two decimal places. What is the expected forward exchange rate 1 year from now? Round your answer to two decimal places. If Micheal undertakes the project, what is the net present value and rate of return of…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning