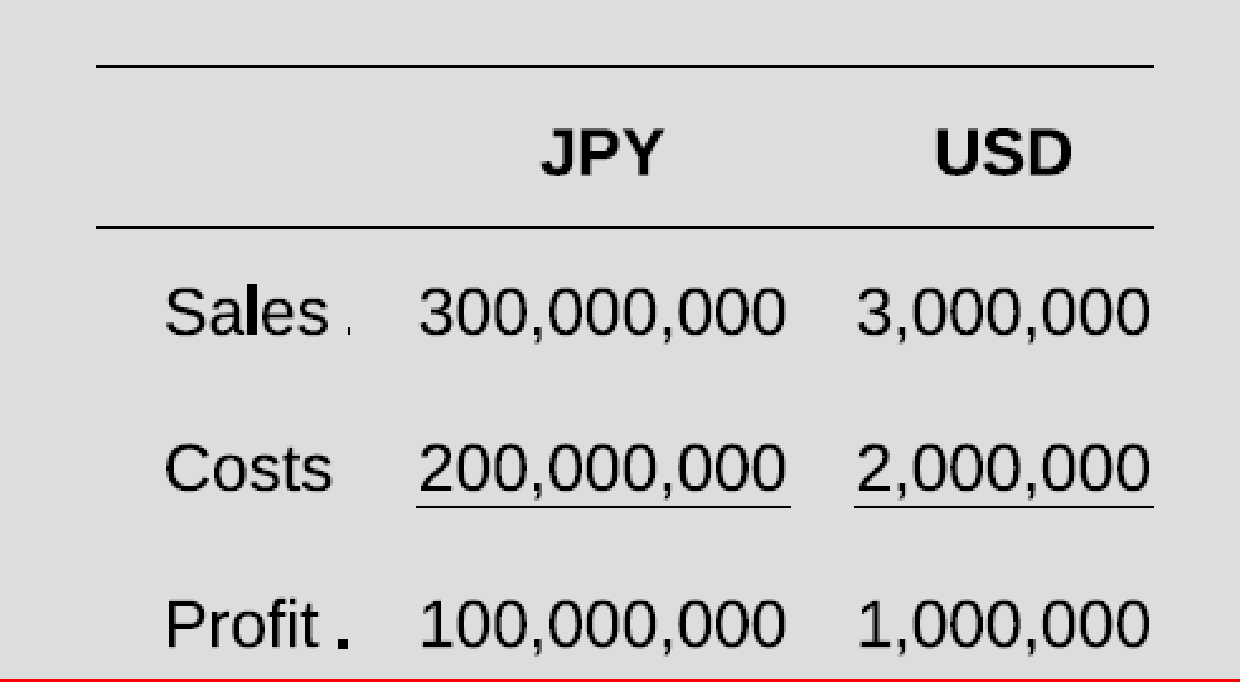

Viking Corporation (a U.S.-based company) has a subsidiary in Japan that imports finished products from unrelated suppliers in China and sells all of its purchases to customers in Japan. Cost of goods sold represents 75 percent of total costs. Budgets in Japanese yen (JPY) and U.S. dollars (USD) using the beginning of period exchange rate of USD 0.010 per JPY 1.00 are as follows:

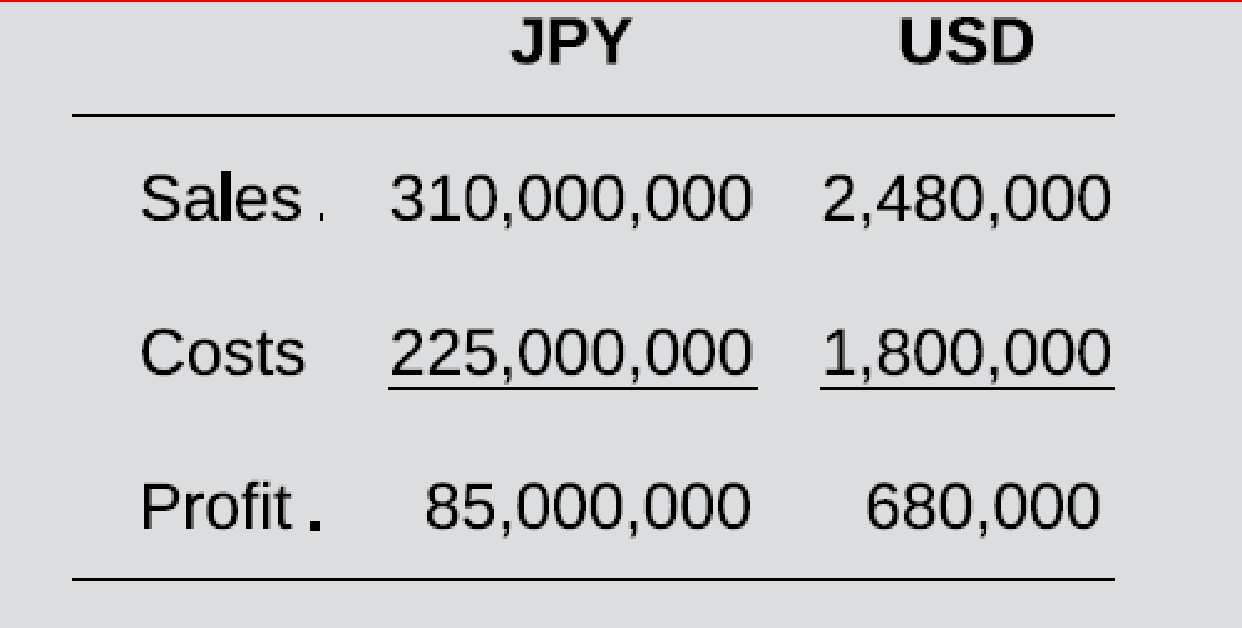

During the budget period, the JPY decreased in value by 20 percent against world currencies, such that the end-of-period exchange rate was USD 0.008 per JPY 1.00. As a result of the increased cost of imports, the manager of the Japanese subsidiary switched to purchasing some of the goods it sells from Japanese manufacturers. Assuming that Viking uses the end-of-period exchange rate to track actual performance, actual results in JPY and USD are as follows:

As a result, there is an unfavorable total

Required:

- a. Determine the amount of the USD 320,000 unfavorable total budget variance caused by the change in the USD/JPY exchange rate.

- b. Taking economic exposure to foreign exchange risk into consideration, estimate what profit would have been (in both JPY and USD) if the Japanese subsidiary’s manager had not taken advantage of the decrease in value of the JPY.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

International Accounting

- A company manufactures a product in the United States and sells it in England. The unit cost of manufacturing is $52. The current exchange rate (dollars per pound) is 1.213. The demand function, which indicates how many units the company can sell in England as a function of price (in pounds) is of the power type, with constant 27556733 and exponent -2.5. A) Develop a model for the company's profit (in dollars) as a function of the price it charges (in pounds). Then use a data table to find the profit-maximizing price to the nearest pound. Assume that the price ranges from £45 to £100 in increments of £1. Round your answer for the maximum profit to the nearest dollar and your answer for the best price to the nearest pound. 1. Maximum profit: $______ 2. Best price: £ ______arrow_forwardThe Japanese yen increases in value relative to the dollar, moving from 120 yento 110 yen to each U.S. dollar. From the perspective of a U.S. firm that produces in the UnitedStates and exports its product to sell in Japan:a. This is bad news.b. It doesn’t matter.c. This is good newsarrow_forwardVoltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: March 1 Bought inventory costing 119,000 pesos on credit. May 1 Sold 60 percent of the inventory for 99,000 pesos on credit. August 1 Collected 79,500 pesos from customers. September 1 Paid 69,500 pesos to suppliers. Currency exchange rates for 1 peso for 2020 are as follows: Date U.S. Dollar per Peso March 1 $ 0.17 May 1 0.18 August 1 0.19 September 1 0.20 December 31 0.21 Assume that all receipts were converted into dollars as soon as they were received. Voltac will report each of the following accounts on its 2020 financial statements. Inventory $8,092 Cost of goods sold $12,138 Sales $17,820 Accounts receivable $4,095 Accounts payable $10,395 Cash $1,205 What are the corresponding journal entries?arrow_forward

- Voltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: March 1 Bought inventory costing 112,000 pesos on credit. May 1 Sold 80 percent of the inventory for 92,000 pesos on credit. August 1 Collected 76,000 pesos from customers. September 1 Paid 66,000 pesos to suppliers. Currency exchange rates for 1 peso for 2020 are as follows: Date U.S. Dollar per Peso March 1 $ 0.21 May 1 0.22 August 1 0.23 September 1 0.24 December 31 0.25 Assume that all receipts were converted into dollars as soon as they were received. For each of the following accounts, what amount will Voltac report on its 2020 financial statements? a. Inventory b.Cost of goods sold c. Salesarrow_forwardVoltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: March 1 Bought inventory costing 118,000 pesos on credit. May 1 Sold 80 percent of the inventory for 98,000 pesos on credit. August 1 Collected 79,000 pesos from customers. September 1 Paid 69,000 pesos to suppliers. Currency exchange rates for 1 peso for 2020 are as follows: Date U.S. Dollar per Peso March 1 $ 0.16 May 1 0.17 August 1 0.18 September 1 0.19 December 31 0.20 Assume that all receipts were converted into dollars as soon as they were received. For each of the following accounts, what amount will Voltac report on its 2020 financial statements? Voltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: March 1 Bought inventory costing 118,000 pesos on credit. May 1 Sold 80 percent of the inventory for 98,000 pesos on…arrow_forwardVoltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: Bought inventory costing 110,000 pesos on credit. Sold 60 percent of the inventory for 90,000 pesos on credit. Collected 75,000 pesos from customers. Paid 65,000 pesos to suppliers. March 1 May 1 August 1 September 1 Currency exchange rates for 1 peso for 2020 are as follows: U.S. Dollar per Peso $ 0.19 Date March 1 May 1 0.20 August 1 September 1 0.21 0.22 0.23 December 31 Assume that all receipts were converted into dollars as soon as they were received. For each of the following accounts, what amount will Voltac report on its 2020 financial statements? Inventory b Cost of goods sold Sales Accounts receivable e Accounts payable f Casharrow_forward

- Toyota manufactures in Japan most of the vehicles it sells in the United Kingdom. The base platform for the Toyota Tundra truck line is ¥1,650,000. The spot rate of the Japanese yen against the British pound has recently moved from 170/E to ¥153,50/E How does this change the price of the Tundra to Toyota's British subsidiary in British pounds? 11.11% 10.39% 10.75% 10.03%arrow_forwardHonesto imported a harvester from the U.S. with a total cost of 1,100,000 before Customs Duties. The importation is subject to 10% Customs duties. What is the VAT on importation?* a. P 158,400 b. P 145,200 c. P 129,600 d. P 0arrow_forwardLalua Co is a US firm has planning to export its products to Singapore since its decision to supplement its declining U.S. sales by exporting there. Furthermore, Lalua Co. also has recently begun exporting to a retailer in United Kingdom. Below are the details of transactions for Lalua Co. through out of the year: - i. Blades has forecasted sales in the United States of 520,000 pairs of Speedos at regular prices which is $115; exports to Singapore of 180,000 pairs of speedos for SGD25 a pair; and exports to the United Kingdom of 200,000 pairs of Speedos for £80 per pair. ii. Cost of goods sold for 800,000 pairs of speedos are incurred in Singapore with the price of SGD 15; the remainder is incurred in the United States, where the cost of goods sold per pair of Speedos runsapproximately $70. iii. Fixed cost are $2 million and variable operating expenses other than costs of goods sold represent approximately 12 percent of U.S. sales. All fixed and variable operating expenses other than…arrow_forward

- KS Inc. produces a product in the United Kingdom at a cost of £0.55 per unit which it then sells in France for €1.25 per unit. If in the currency markets, 1 U.S. dollar = £0.6373 and 1 U.S. dollar = €1.0279, how much profit is realized by KS Inc. on each unit of product sold? * $0.7857 $0.3531 $0.2571 $0.1095 When the supply for money increases and the demand for money reduces, there will be * A fall in the level of prices An increase in the rate of interest A fall in the level of demand A decrease in the rate of interestarrow_forwardVoltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: Bought inventory costing 100,000 pesos on credit. March 1 May 1 August 1 September 1 Sold 60 percent of the inventory for 80,000 pesos on credit. Collected 70,000 pesos from customers. Paid 60,000 pesos to suppliers. Currency exchange rates for 1 peso for 2020 are as follows: Date March 1 May 1 August 1 September 1 December 31 Assume that all receipts were converted into dollars as soon as they were received. For each of the following accounts, what amount will Voltac report on its 2020 financial statements? Inventory Cost of goods sold с Sales d Accounts receivable e Accounts payable Cash U.S. Dollar per Peso $ 0.10 0.12 0.13 0.14 0.15 a barrow_forwardVoltac Corporation (a U.S.-based company) has the following import/export transactions denominated in Mexican pesos in 2020: March 1 Bought inventory costing 113,000 pesos on credit. May 1 August 1 Sold 60 percent of the inventory for 93,000 pesos on credit. Collected 76,500 pesos from customers. September 1 Paid 66,500 pesos to suppliers. Currency exchange rates for 1 peso for 2020 are as follows: Date March 1 May 1 August 1 September 1 December 31 с Assume that all receipts were converted into dollars as soon as they were received. For each of the following accounts, what amount will Voltac report on its 2020 financial statements? a b d Inventory Cost of goods sold Sales U.S. Dollar per Peso $ 0.22 0.23 0.24 0.25 0.26 Accounts receivable e Accounts payable f Casharrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT