Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

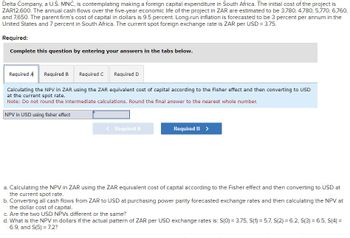

Transcribed Image Text:Delta Company, a U.S. MNC, is contemplating making a foreign capital expenditure in South Africa. The initial cost of the project is

ZAR12,600. The annual cash flows over the five-year economic life of the project in ZAR are estimated to be 3,780, 4,780, 5,770, 6,760,

and 7,650. The parent firm's cost of capital in dollars is 9.5 percent. Long-run inflation is forecasted to be 3 percent per annum in the

United States and 7 percent in South Africa. The current spot foreign exchange rate is ZAR per USD = 3.75.

Required:

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C Required D

Calculating the NPV in ZAR using the ZAR equivalent cost of capital according to the Fisher effect and then converting to USD

at the current spot rate.

Note: Do not round the intermediate calculations. Round the final answer to the nearest whole number.

NPV in USD using fisher effect

<Required A

Required B >

a. Calculating the NPV in ZAR using the ZAR equivalent cost of capital according to the Fisher effect and then converting to USD at

the current spot rate.

b. Converting all cash flows from ZAR to USD at purchasing power parity forecasted exchange rates and then calculating the NPV at

the dollar cost of capital.

c. Are the two USD NPVs different or the same?

d. What is the NPV in dollars if the actual pattern of ZAR per USD exchange rates is: S(0) = 3.75, S(1) = 5.7, S(2) = 6.2, S(3) = 6.5, S(4) =

6.9, and S(5) 7.2?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An MNC is considering establishing a two- year project in New Zealand with a USD$50 million initial investment. The required rate of return on this project is 11%. The project is expected to generate cash flows of NZ$15 million in Year 1 and NZ$35 million in Year 2, excluding the salvage value. Assume a stable exchange rate of USD$.70 per NZ$1 over the next two years. All cash flows are remitted to the parent. What is the break-even salvage value? about NZ$47 million about NZ$21 million about NZ$14 million about NZ$60 million about NZ$36 millionarrow_forwardAnderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow -$590,000 0 1 2 √34 3 220,000 163,000 228,000 207,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 7 percent. Assume Anderson uses a required return of 13 percent on this project. a. What is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR of the project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. X Answer is complete but not entirely correct. NPV IRR $ 17,315.59 x 14.40 × %arrow_forwardThe Bank of China is considering an application from the Government of the Republic of Zambia for a large dam project. Some costs and benefits of the project (in Kwacha values) are as follows: Construction costs: K500 million per year for three years Operating costs: K50 million per year Hydropower to be generated: 3 billion kilowatt hours per year Price of electricity: K0.05 per kilowatt hour Irrigation water available from dam: 5 billion liters per year Price of irrigation water: K0.02 per liter Agricultural product lost from flooded lands: K45 million per year Forest products lost from flooded lands: K20 million per year Assume that the project incurs no ecological and other costs besides the ones stated above. Do a formal cost-benefit analysis encompassing all of the quantifiable factors listed above. Assume that the lifespan of the dam is 10 years and that construction begins in Year 0. All other impacts start once the dam is completed and continue for 10 years. Use 5%…arrow_forward

- A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million expenditure on a large-scale integrated plant that would provide expected cash flows of $6.23 million per year for 20 years. Plan B requires a $12 million expenditure to build a somewhat less efficient, more labor-intensive plant with an expected cash flow of $2.69 million per year for 20 years. The firm's WACC is 10%. Calculate each project's NPV. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. Plan A: $. million Plan B: $ million Calculate each project's IRR. Round your answers to one decimal place. Plan A: % Plan B: % By graphing the NPV profiles for Plan A and Plan B, determine the crossover rate. Round your answer to one decimal place. % Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to one…arrow_forwardSelect- (increases/reduces) please show with steps thanks!arrow_forwarda) watax inc a mining outfit in phoenix intends to engage in mining operations in southern Africa after conducting comprehensive feasibility of the referenced country. Assume that the prevailing interest rate in South Africa is 9 percent. To meet its working capital needs, watax will borrow south African rands, convert them to us dollars, and repay the loan in one year. What will watax effective financing rate if the rand depreciates by 6 perfect or appreciates by 3 percent. Discuss your result. b) given the information and assuming a 50 % probability that either scenario would occur, determinate the expected value of the effective financing rate. c) Assume that the one tear prevailing interest in mexico is 5 percent while that in the US is 8%. What percentage change in the peso would cause a US firm borrowing peso to incur the same effective financing rate as it would it borrowed dollars. Discuss the resultarrow_forward

- CIP Co, a telecommunications company, is considering an investment of $150 million into a wind farm. The wind farm is expected to generate after-tax cash flows of $75 million in Year 1, $120 million in Year 2, and $175 million in Year 3. CIP Co’s WACC is 12% but some members of management believe the project should be assessed using a discount rate of 15% (which is what Major Bank Ltd advises is a typical discount rate for a wind farm project). The company has spent $15 million up to today researching this opportunity. What is NPV?arrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$10,000,000 (Singapore dollars). The required rate of return is expected to be 15.00% for all four years of the project. _____________________________ Year 0 Year 1 Year 2 Year 3 Year 4 Cash Flows to Parent, excluding Salvage Value $2,500,000 $2,500,000 $3,400,000 $3,800,000 Initial Investment $10,000,000 Which of the following most closely approximates the break-even salvage value? $2,938,788 $2,671,625 $2,137,300 $2,404,463arrow_forwardA project costs Can$700,000 and has expected annual cash inflows of Can$300,000 for Years 1 through 3. The Canadian discount rate is 10 percent. The current spot rate is: $1 = Can$1.07. What is the NPV of this project in U.S. dollars using the foreign currency approach?arrow_forward

- Cullumber Inc. is planning to expand operations into South America in 8 years. The first three years, Cullumber will spend on feasibility and marketing studies. Once those studies are complete, Cullumber plans to invest $198000 per year for the remaining five years. What amount will Cullumber have at the end of the eight-year period for the expansion assuming a 11% interest rate? ○ $1431104 $990000 ○ $2348167 ○ $1233104arrow_forwardA company is considering two mutually exclusive expansion plans. Plan A requires a $41 million initial outlay on a large-scale integrated plant that would provide expected cash flows of $6.55 million per year for 20 years. Plan B requires a $13 million Initial outlay to build a somewhat less efficient, more labor-intensive plant with expected cash flows of $2.91 million per year for 20 years. The firm's WACC is 10%. a. Calculate each project's NPV. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. Plan A: Plan B: $ $ million million Calculate each project's IRR. Round your answers to one decimal place. Plan A: Plan B: % % b. By graphing the NPV profiles for Plan A and Plan B, determine the crossover rate. Approximate your answer to the nearest whole number. % c. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to one…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education