International Accounting

5th Edition

ISBN: 9781259747984

Author: Doupnik, Timothy S., Finn, Mark T., Gotti, Giorgio

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 5EP

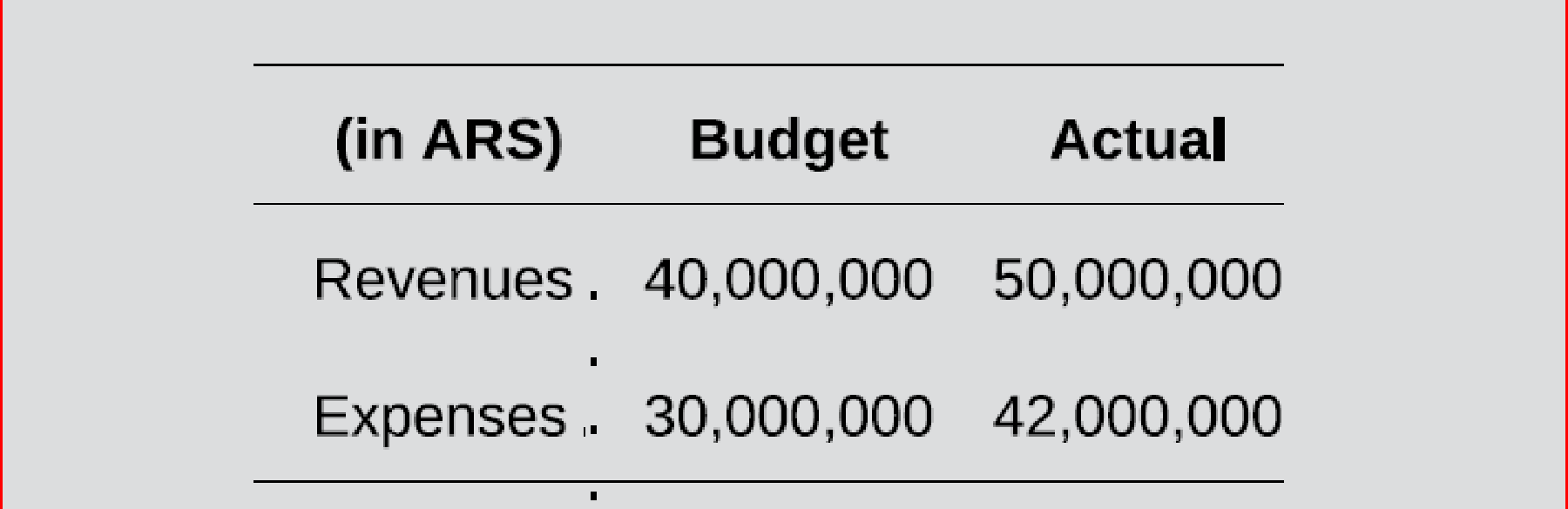

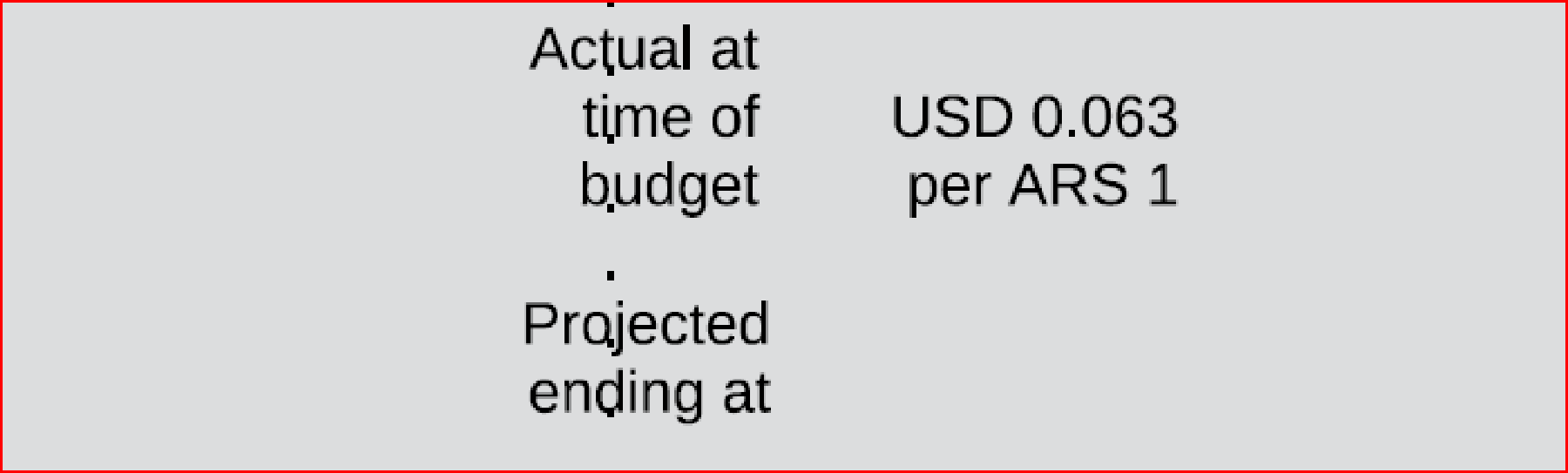

Imogdi Corporation (a U.S-based company) has a wholly-owned subsidiary in Argentina, whose manager is being evaluated on the basis of the variance between actual profit and budgeted profit in U.S. dollars. Relevant information in Argentine pesos (

Current year actual and projected exchange rates between the ARS and the U.S. dollar (USD) are as follows:

Required:

- a. Calculate the total

budget variance for the current year using each of the five combinations of exchange rates for translating budgeted and actual results shown in Exhibit 10.10. - b. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary does not have the authority to hedge against changes in exchange rates.

- c. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary has the authority to hedge against unexpected changes in exchange rates.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

International Capital Budgeting Using the Foreign Currency Approach. ABC Company is considering a capital project with the cash flows as stated below in Euros. The project is in Euros and must be converted back to USD. The exchange rate is 0.83 Euros. The difference in the nominal rates between the two currencies is 2 percent.

The appropriate discount rate for the project is estimated to be 10%, the US cost of capital for the company.

What is the NPV of the project in US Dollars?

NPV

Year Cash Flows in Euro

0 € -2,900,000

1 €1,300,000

2 €1,300,000

3 €1,300,000

Round to the nearest cent and format as "XXX,XXX.XX"

Suppose you observe the following direct spot quotations in New York and Toronto,respectively: USD 0.8000-50 and CAD 1.2500-60. What are the arbitrage pr()fits per USD Imn?

1) The sales budget is based on assumptions about the ___________.

a) Number of units to be sold and selling price per unit.

b) Timing of cash receipts.

c) Contribution margin per unit and the number of units to be sold.

d) Costs of the units produced and the total fixed costs.

2) When constructing the production budget, the desired ending inventory for the period is determined based on:

a) Next period sales

b) Next period production

c) Last period production and sales

d) Credit period

3)Standard time allowed to complete one unit is 2 hours. A worker during a week (48 hours) completed 20 units and drawn a salary of Rs. 6000. The standard rate per day of 8 hours shift is Rs. 1000. Which one of the following is true?

a)Labour efficiency variance is Zero

b)Labour rate variance is zero

c)Labour cost variance is zero

d)None of the above

Chapter 10 Solutions

International Accounting

Ch. 10 - Prob. 1QCh. 10 - What makes calculation of NPV for a foreign...Ch. 10 - How does the evaluation of a potential foreign...Ch. 10 - Prob. 4QCh. 10 - How does an ethnocentric organizational structure...Ch. 10 - Prob. 6QCh. 10 - When might it be appropriate to evaluate the...Ch. 10 - Prob. 8QCh. 10 - Prob. 9QCh. 10 - How can a local currency operating budget and...

Ch. 10 - Prob. 11QCh. 10 - What is the advantage of using a projected future...Ch. 10 - Prob. 3EPCh. 10 - Prob. 4EPCh. 10 - Imogdi Corporation (a U.S-based company) has a...Ch. 10 - Philadelphia, Inc. (a Greek company) has a foreign...Ch. 10 - Fitzwater Limited (an Irish company) has a foreign...Ch. 10 - Prob. 9EPCh. 10 - Viking Corporation (a U.S.-based company) has a...Ch. 10 - Duncan Street Company (DSC), a British company, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company B management had a meeting on 1 October 2012 to discuss the capital expenditure budget for the year 2013. During the meeting, the management decided to purchase equipment for USD1 million on 1 February 2013. Functional currency is SGD. The equipment was delivered on 1 February 2013. In order to hedge the foreign exchange risk, company B entered into a foreign exchange forward contract on 1 October 2012 to buy USD1 million sell SGD with maturity date 1 February 2013. The USD/SGD spot rates and forward rates are as follows: USD/SGD spot USD/SGD forward points for maturity 1 February 2013 rates 1-Oct-12 1.23 -0.0003 31-Dec-12 1.22 -0.0001 1-Feb-13 1.23 Requirements (a) Explain if a hedge exists; if so the type of hedge, hedging instrument and hedged item; if not why. (b) Record the journal entries on 31 December 2012 and 1 February 2013.arrow_forwardWhich of the following statements is not correct? A. The sales budget is computed by multiplying estimated sales by the sales price. B. The production budget begins with the sales estimated for each period. C. The direct materials budget begins with the sales estimated for each period. D. The sales budget is typically the first budget prepared.arrow_forwardCh. 31. International Capital Budgeting Using the Foreign Currency Approach. ABC Company is considering a capital project with the cash flows as stated below in Euros. The project is in Euros and must be converted back to USD. The exchange rate is 0.83 Euros. The difference in the nominal rates between the two currencies is 2 percent. The appropriate discount rate for the project is estimated to be 10%, the US cost of capital for the company. What is the NPV of the project in US Dollars? NPV Year Cash Flows in Euro Year 0 € -2,900,000 Year 1 €1,300,000 Year 2 €1,300,000 Year 3 €1,300,000 Round to the nearest cent and format as "XXX,XXX.XX"arrow_forward

- In budgeting direct labor hours for the coming year, it is important to: * A. multiply production in units by the direct labor hours per unit B. divide production in units by the direct labor hours per unit C. subtract production in units from the direct labor hours per unit D. subtract direct labor hours per unit from production in unitsarrow_forwardThere is an ongoing debate between US and China regarding weather the Chinese Yuan's value should be revalued upward. The cost of labor in china is substantially lower than that in the U.S. Would the U.S. balance of trade deficit in China be eliminated if the Yuan was revalued upward by 20%? by 40%? by 80%?arrow_forwardThe following table contains a hypothetical partial master budget performance report for European Fudge Company. (Click the icon to view the partial master budget performance report.) Fill in the missing amounts. Be sure to indicate whether variances are favorable (F) or unfavorable (U). (Enter the variances as positive numbers. Label each variance as favorable (F) or unfavorable (U). If the variance is 0, make sure to enter in a "0". A variance of zero is considered favorable.) European Fudge Company Flexible Budget Performance Report: Sales and Operating Expenses For Year Ended December 31 Sales volume (number of cases sold) Shipping expense ($4 per case sold) Actual Sales revenue ($34 per case) $ 419,500 $ Less variable expenses: Sales expense ($5 per case sold) Contribution margin 12,500 $ 60,100 49,500 309,900 Flexible Budget Variance Flexible Budget 2200 F 400 U 12,500 5,500 U $425,000 2900 F $ 62,500 50,000 312,500 Volume Variance 40800 F $ 6000 U$ 1200 U 33600 F Master Budget…arrow_forward

- A U.S. company is considering a high-technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an 18% rate of return in U.S. dollars (after taxes) on any investments in this foreign country. a. Should the project be approved, based on a PW analysis in U.S. dollars, if the devaluation of the T-mark, relative to the U.S. dollar, is estimated to average 12% per year and the present exchange rate is 20 T-marks per dollar? b. What is the IRR of the project in T-marks? c. Based on your answer to (b), what is the IRR in U.S. dollars?arrow_forwardA country in Southeast Asia states it's gross domestic product in terms of yen. Last year it's GDP was 50 billion yen when one U.S. dollar could be exchanged into 120 yen. Required : a. Determine the country's GDP in terms of U.S. dollars for last year.arrow_forwardA company manufactures a product in the United States and sells it in England. The unit cost of manufacturing is $52. The current exchange rate (dollars per pound) is 1.213. The demand function, which indicates how many units the company can sell in England as a function of price (in pounds) is of the power type, with constant 27556733 and exponent -2.5. A) Develop a model for the company's profit (in dollars) as a function of the price it charges (in pounds). Then use a data table to find the profit-maximizing price to the nearest pound. Assume that the price ranges from £45 to £100 in increments of £1. Round your answer for the maximum profit to the nearest dollar and your answer for the best price to the nearest pound. 1. Maximum profit: $______ 2. Best price: £ ______arrow_forward

- Kittle estimates it's cash flows from both the U.S., in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. U.S. Canada Sales $310 C$3 -Cost of materials $50 C$200 -Operating expenses $60 -Interest expenses $5 C$10 Cash flows $195 -$C207 Kittle believes that the value of the Canadian dollar will be either $0.80 or $0.90 and seeks to analyze its cash flows under each of these scenarios. The following table shows Kittle's cash flows under each of these exchange rates. Sales (1) U.S. Sales (2) Canadian Sales (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense Exchange Rate Scenario C$1=$0.80 Exchange Rate Scenario C$1=$0.90 (Millions) (Millions) $310 $310 C$3 X $0.80 = $2.40 C$3 X $0.90 = $2.70 $312.40 $312.70 $50 $50 C$200 X $0.80 = $160.00 C$200 X $0.90 = $180.00 $210.00…arrow_forwardCampbell Industries has gathered the following information about the actual sales revenues and expenses for its pharmaceuticals segment for the most recent year. E (Click the icon to view the actual data.) Prepare a segment margin performance report for the pharmaceutical segment. Calculate a variance and a variance percentage for each line in the report. Round to the nearest hundredth for the variance percentages (for example, if your answer is 16.2384%, round it to 16.24%). Budgeted data for the same time period for the pharmaceutical segment are as follows (all data are in millions): E (Click the icon to view the budgeted data.) Begin by preparing the performance report through the contribution margin line. Next, complete the report through the segment margin line, and then, finally, complete the report through the operating income line. (Enter the variances as positive numbers. Round the variance percentages to the nearest hundredth percent, X.XX%.) Performance Report Data table…arrow_forwardA flexible budget variance for November 2023 is the difference between the actual expense incurred in November and the amount budgeted at: The actual level of activity achieved in the previous period (October). The planned static budget for the next period (December). The original expected (planned) level of activity in November. The level of activity when operating at maximum capacity. The actual level of activity achieved in November. The original static budget for the previous period (October).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY