Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1F15

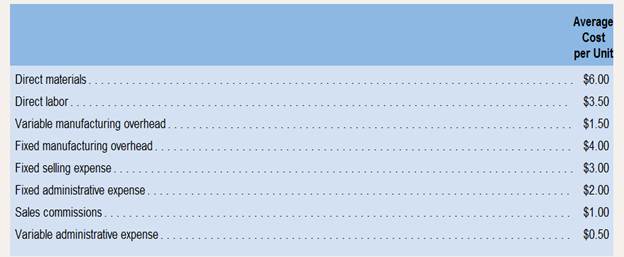

Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows:

Required:

1. For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units?

For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units?

If 8,000 units are sold, what is the variable cost per unit sold?

If 12,500 units are sold, what is the variable cost per unit sold? _

If 8,000 units are sold, what is the total amount of variable costs related to the units sold?

If 12,500 units are sold, what is the total amount of variable costs related to the units sold?

If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced?

If 12,500 units are produced, what is the average fixed manufacturing cost per unit produced?

If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production?

If 12,500 units are produced, what is the total amount of fixed manufacturing…

Bambam Inc. produces BingBong products. Cost data are as follows: Fixed selling cost of 200; variable product cost of 5 per unit; variable selling cost of 2 per unit and fixed overhead cost of 500. If the company will produce 500 units, what is the total cost?

Glisan Corporation's relevant range of activity is 4,300 units to 8,300 units. When it produces and sells 6,300 units, its average costs

per unit are as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Fixed selling expense

Fixed administrative expense

Sales commissions

Variable administrative expense

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 6,300 units?

b. For financial reporting purposes, what is the total amount of period costs incurred to sell 6,300 units?

c. If 5,300 units are sold, what is the total amount of variable costs related to the units sold?

d. If the selling price is $24.35 per unit, what is the contribution margin per unit sold?

Note: Round "Per unit" answer to 2 decimal places.

e. What incremental manufacturing cost will the company incur if it increases production from 6,300 to 6,301 units?

Note: Round "Per unit" answer to 2 decimal places.

a. Total…

Chapter 1 Solutions

Introduction To Managerial Accounting

Ch. 1 - What are the three major types of product costs in...Ch. 1 - Define the following: (a) Direct materials, (b)...Ch. 1 - Explain the difference between a product cost and...Ch. 1 - Distinguish between (a) a variable cost, (b) a...Ch. 1 - What effect does an increase in the activity level...Ch. 1 - Define the following terms: (a) Costbehavior and...Ch. 1 - What is meant by an activity base when dealing...Ch. 1 - Managers often assume a strictly linear...Ch. 1 - Distinguish between discretionary fixed costs and...Ch. 1 - Does the concept of the relevant range apply to...

Ch. 1 - What is the difference between a traditional...Ch. 1 - Prob. 12QCh. 1 - Define the following terms: differential cost,...Ch. 1 - Only variable costs can be differential costs. Do...Ch. 1 - Prob. 1AECh. 1 - This Excel worksheet form is to be used to...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 4F15Ch. 1 - Prob. 5F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 8F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 15F15Ch. 1 - Identifying Direct and Indirect Costs Northwest...Ch. 1 - Prob. 2ECh. 1 - Classifying Costs as Product or Period Costs...Ch. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Traditional and Contribution Format Income...Ch. 1 - Direct and Indirect CostsKubin Company’s relevant...Ch. 1 - Product Costs and Period Costs; Variable and Fixed...Ch. 1 - Fixed, Variable, and Mixed Costs Refer to the data...Ch. 1 - Differential Costs and Sunk Costs Refer to the...Ch. 1 - Cost Behavior; Contribution Format Income...Ch. 1 - Product and Period Cost Flows The Devon Motor...Ch. 1 - Prob. 13ECh. 1 - Cost Classification Wollogong Group Ltd. of New...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Classifications for Decision Making Warner...Ch. 1 - Classifying Variable and Fixed Costs and Product...Ch. 1 - PROBLEM 1—18 Direct and Indirect Costs; Variable...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Variable and Fixed Costs; Subtleties of Direct and...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Terminology; Contribution Format Income...Ch. 1 - Cost Classification Listed below are costs found...Ch. 1 - Different Cost Classifications for Different...Ch. 1 - Traditional and Contribution Format Income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardBaxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 29,000 units are produced, what are the total variable costs? E. If 17,000 units are produced, what are the total manufacturing overhead costs incurred? F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? G. If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred? H. If 15,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- The cost per unit associated with the production of Xen Merchandising are the following: Direct Materials - P1,000; Direct Wages - P200; Variable Overhead - P1,500; and Fixed Overhead - P2,000. Given the data, what is the product cost?arrow_forward1. For financial accounting purposes, what is the total amount of product costs incurred to make 25,000 units? What is the total amount of period costs incurred to sell 25,000 units? 2. If 24,000 units are produced, what is the variable manufacturing cost per unit produced? What is the average fixed manufacturing cost per unit produced? (Round your answers to 2 decimal places.) 3. If 26,000 units are produced, what is the variable manufacturing cost per unit produced? What is the average fixed manufacturing cost per unit produced? (Round your answers to 2 decimal places.) 4. If 27,000 units are produced, what are the total amounts of direct and indirect manufacturing costs incurred to support this level of production? 5. What total incremental manufacturing cost will Hixson incur if it increases production from 25,000 to 25,001 units? (Round your answer to 2 decimal places.) 6. What is Hixson’s contribution margin per unit? What is its contribution margin ratio? (Round "Contribution…arrow_forwardAccel Corp makes two products: C and D. The following data have been summarized (Click the icon to view the data.) Accel Corp desires a 28% target gross profit after covering all product costs. Considering the total product costs assigned to the Products C and D, what would Accel have to charge the customer to achieve that gross profit? Round to two decimal places Begin by selecting the formula to compute the amount that the company should charge for each product Direct labor cost per unit Direct materials cost per unit Indirect manufacturing cost per unit Product cost as a percentage of sales price Target gross profit percentage Total product cost per unit Get more help. Clear all Show work Required sales price per unit Check answerarrow_forward

- Martinez Company's relevant range of production is 9,500 units to 14,500 units. When it produces and sells 12,000 units, its unit costs are as follows: Amount per unit Direct materials $5.60 Direct labor 3.10 Variable manufacturing overhead 1.40 Fixed manufacturing overhead 3.60 Fixed selling expense 2.60 Fixed administrative expense 2.20 Sales commissions 1.20 Variable administrative expense 0.45 For financial accounting purposes, what is the total amount of period costs incurred to sell 12,000 units?arrow_forwardJamison Company produces and sells Product X at a total cost of $1,300 per unit, of which $880 is product cost and $420 is selling and administrative expenses. In addition, the total cost of $1,300 is made up of $740 variable cost and $560 fixed cost. The desired profit is $169 per unit. Determine the markup percentage on total cost.fill in the blank 1 %arrow_forwardUse the information below to answer the following two questions: Ginger Company's relevant range of production is 5,000 units to 13,000 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Q. If 12,500 units are produced, what is the manufacturing overhead cost per unit incurred to support this level of production? A. (Click to select) Q. If 12,500 units are produced and sold, the company will incur $60,000 in total period costs. How much is the variable administrative expense per unit? A. (Click to select) per unit Average Cost $4.80 $ 3.50 $1.30 $3.00 $2.50 $1.00 $0.50 ? ✓per unitarrow_forward

- Sierra Company produces its product at a total cost of $120 per unit. Of this amount, $40 per unit is selling and administrative costs. The total variable cost is $96 per unit, and the desired profit is $24.00 per unit. Determine the markup percentage using the (a) total cost, (b) product cost, and (c) variable cost methods. Round your answers to one decimal place. a. Total cost b. Product cost c. Variable cost % % %arrow_forwardJamison Company uses the total cost method of applying the cost-plus approach to product pricing. Jamison produces and sells Product X at a total cost of $800 per unit, of which $540 is product cost and $260 is selling and administrative expenses. In addition, the total cost of $800 is made up of $460 variable cost and $340 fixed cost. The desired profit is $168 per unit. Determine the markup percentage on total cost. %arrow_forward[The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 23,000 to 27,500 units. When it produces and sells 25,250 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $ 8.30 $ 5.30 Required: 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 25,250 units? b. What is the total indirect manufacturing cost incurred to make 25,250 units? 2. Assume the cost object is the Manufacturing Department and that its total output is 25,250 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? 3. Assume the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License