Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

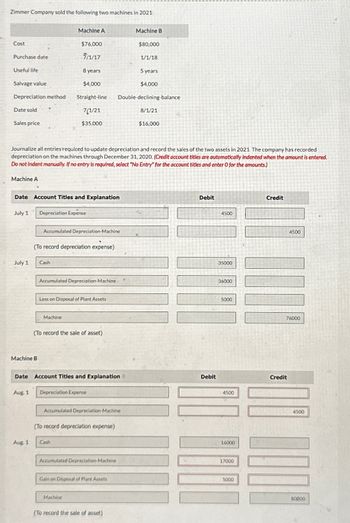

Transcribed Image Text:Zimmer Company sold the following two machines in 2021:

Machine A

Machine B

Cost

$76,000

$80,000

Purchase date

5/1/17

1/1/18

Useful life

8 years

5 years

Salvage value

$4,000

$4,000

Depreciation method

Straight-line

Double-declining-balance

Date sold

Sales price

7/1/21

$35,000

8/1/21

$16,000

Journalize all entries required to update depreciation and record the sales of the two assets in 2021. The company has recorded

depreciation on the machines through December 31, 2020. (Credit account titles are automatically indented when the amount is entered.

Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Machine A

Date Account Titles and Explanation

July 1

Depreciation Expense

July 1

Accumulated Depreciation-Machine

(To record depreciation expense)

Cash

Accumulated Depreciation-Machine

Debit

4500

35000

36000

Loss on Disposal of Plant Assets

5000

Machine

(To record the sale of asset)

Machine B

Date Account Titles and Explanation

Debit

Aug. 1

Depreciation Expense

Accumulated Depreciation-Machine

(To record depreciation expense)

Aug. 1

Cash

4500

16000

Accumulated Depreciation-Machine

17000

Gain on Disposal of Plant Assets

5000

Machine

(To record the sale of asset)

Credit

4500

BOOD

76000

Credit

4500

80000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.arrow_forwardChapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000arrow_forwardSolich Sandwich Shop had the following long-term asset balances as of December 31, 2021: Cost Accumulated Depreciation Book ValueLand $ 95,000 – $ 95,000Building 460,000 $ (165,600) 294,400Equipment 235,000 (50,000) 185,000Patent 250,000 (100,000) 150,000Solich purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a nine-year useful life using the straight-line method with an estimated residual value of $10,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method.…arrow_forward

- Dont uplode image in answer At 1 July 2019 David Ltd acquired the following non-current assets: Machine A Machine B Machine C Cost 48,000 Cost 70,000 Cost 85,000 Useful Life 8 years Useful Life 8 years Useful Life 10 years The firm uses the valuation model for all three assets At 30 June 2020, the fair values of all assets were assessed. Machine A had a fair value of $45,000, and Machine B a fair value of $58,000. The remaining useful lives were assessed to be 5 years for Machine A and 4 years for Machine B. At this time the value of Machine C was unchanged. At 30 June 2021, Machine C was sold for a consideration of $75,000. On the same date the fair values of Machine A and Machine B were reassessed. Machine A had a fair value of $32,000 and Machine B a fair value of $54,000. Required: Prepare the journal entries for David Ltd for the years ending 30 June 2020 and 2021. Assume a tax rate of 30%.arrow_forwardBruce Company acquired a machinery on April 1, 2020. Cost P 1,200,000 Residual Value P 120,000 Estimated Useful Life 8 years What is the depreciation for 2020 using straight line depreciation? A. P150,000 B. P101,250 C. P112,500 D. P125,000 What is the carrying amount of the machinery on December 31, 2022 using straight line depreciation? A. P750,000 B. P817,500 C. P828,750 D. P780,000arrow_forwardFollowing are the details related to fixed assets of Jackson company as at December 31, 2022: Date of Residual Purchase January 1, 2020 $15,000 April 1, 2015 1,000 Asset Machinery Delivery Van September 30, 2018 Furniture 500 December 31, 2012 Building 25,000 Required: Estimated Useful Life 30 Years 12 Years 8 Years 40 Years Cost $ 550,000 45,000 72,000 1,250,000 Value 1. Calculate the annual depreciation for each of the fixed assets given above. 2. Determine the book value of each fixed asset as on December 31, 2022.arrow_forward

- Provide correct answer pleasearrow_forwardTaylor Company purchased a machine for $9,800 on January 1, 2016. The machine has beendepreciated using the straight-line method assuming it has a five-year life with a $1,400residual value. Taylor sold the machine on January 1, 2018, for $7,600.Q7-62. What gain or loss should Taylor record on the sale?a. Gain, $800b. Loss, $1,160c. Loss, $520d. Gain, $1,160arrow_forwardApex Communication purchased equipment on January 1, 2024, for $49,004 Suppose Apex Communication sold the equipment for $36,000 on December 31, 2025. Accumulated Depreciation as of December 31, 2025, was $15,078. Journalize the sale of the equipment, assuming straight-line depreciation was used First, calculate any gain or loss on the disposal of the equipment Market value of assets received Less Book value of asset disposed of Cost Less Accumulated Depreciation Gain or (Loss) 49004 36000arrow_forward

- How do I solve this?arrow_forwardTogo’s Sandwich Shop had the following long-term asset balances as of January 1, 2021: Cost Accumulated Depreciation Book ValueLand $ 85,000 – $ 85,000Building 560,000 $ (201,600) 358,400Equipment 145,000 (30,000) 115,000Patent 125,000 (50,000) 75,000Togo’s purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a nine-year useful life using the straight-line method with an estimated residual value of $10,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and…arrow_forwardCheesesteak's Sandwich Shop had the following long-term asset balances as of January 1, 2024: Cost Accumulated Depreciation Book Value Land $83,000 0 $83,000 Building 558,000 $(106,020) 451,980 Equipment 131,400 (29,600) 101,800 Patent 120,000 (48,000) 72,000 Additional information: Cheesesteak's purchased all the assets at the beginning of 2022. The building is depreciated over a 20-year service life using the double - declining - balance method and estimating no residual value. The equipment is depreciated over a 8-year useful life using the straight-line method with an estimated residual value of $13,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2022 and 2023 (first two years). For the year ended December 31, 2024 (third year), record depreciation expense for buildings and equipment. Land is not depreciated.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT