Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

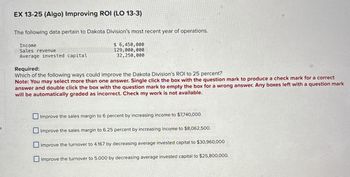

Transcribed Image Text:EX 13-25 (Algo) Improving ROI (LO 13-3)

The following data pertain to Dakota Division's most recent year of operations.

Income

Sales revenue

Average invested capital

Required:

$ 6,450,000

129,000,000

32,250,000

Which of the following ways could improve the Dakota Division's ROI to 25 percent?

Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct

answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark

will be automatically graded as incorrect. Check my work is not available.

Improve the sales margin to 6 percent by increasing income to $7,740,000.

Improve the sales margin to 6.25 percent by increasing income to $8,062,500.

Improve the turnover to 4.167 by decreasing average invested capital to $30,960,000

Improve the turnover to 5.000 by decreasing average invested capital to $25,800,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A7arrow_forwardRequired information Use the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate o on invested capital is 8 percent. Sales revenue Income Average investment Sales margin Capital turnover ROI Residual income Sales revenue Income Average investment Sales margin Capital turnover ROI Residual income Division A ? $ 440,000 ? 40% 2 ? ? Division A $ 8,150,000 $ 1,630,000 $ 8,150,000 20 % 1.00 $ 978,000 20% Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return capital is 8 percent. Note: Round "Capital turnover" answers to 2 decimal places. $ $ $ Division B $ 10,000,000 $ 2,160,000 $ 2,600,000 $ Division B 40,300,000 8,866,000 10,075,000 22 % 4.00 88 % ? ? ? 8,060,000 Division C ? $ ? ? 45% ? 40% $ 139,000 Division C 25 % 20 % 471,000arrow_forwardMemanarrow_forward

- Case 1: ROI You are comparing the performance of two (2) separate divisions, segments A and B, using ROI Analysis. A B Sales P100,000.00 P500,000.00 Operating Expenses 30,000.00 300,000.00 Net Operating income 70,000.00 200,000.00 Average Operating Assets 10,000.00 40,000.00 Required: Using ROI Analysis, which segment is performing better? To answer this question, you need to: Compute the ROI of each segment and Compute the components of ROI of each segmentarrow_forwardgo.4arrow_forwardQ35 Consider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z Sales $ 1,483,000 $ 805,000 $ 5,005,000 Operating Income 216,100 59,700 263,800 Investment in assets 625,600 292,500 3,179,600 The return on sales (ROS) for Division Z is: (Round your percentages to one decimal place.) Multiple Choice 7.4%. 8.3%. 5.3%. 14.6%. 20.4%.arrow_forward

- DONT GIVE ANSWER IN IMAGE FORMATarrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $19,754, invested assets of $83,000, and sales of $282,200. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forwardRequired information Use the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 8 percent. Sales revenue Income Division A ? Division B Division C $ 11,000,000 ? $ 530,000 $ 2,130,000 ? Average investment ? $ 2,500,000 ? Sales margin 30% ? 35% Capital turnover 2 ? ? ROI Residual income ? ? ? 40% ? $ 139,000 Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 10 percent. Note: Round "Capital turnover" answers to 2 decimal places. Division A Division B Division C Sales revenue $ 40,100,000 Income $ 1,650,000 $ 8,822,000 Average investment $ 10,025,000 Sales margin 22 % % 25 % Capital turnover ROI Residual income 1.00 200 % % $ 69 22 % 450,000arrow_forward

- es The Campus Division of All-States Bank has assets of $1,300 million. During the past year, the division had profits of $285 million. All- States Bank has a cost of capital of 6 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Campus Division. (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) Mc Graw Hill Divisional ROI b. Compute the divisional RI for the Campus Division. (Enter your answer in dollars, not in millions.) Divisional RI % Question 11 - Hom....arrow_forwardCalculator Data for Divisions A, B, C, D, and E are as follows: a. Determine the missing items. Round rate of return on investment, profit margin, and investment turnover answers to one decimal place when required. Div. Sales Income from Operations Inv. Assets Rate of Return on Inv. Profit Margin Invest. Turnover A $ $35,000 $200,000 % % 1.6 B $455,000 $ $284,375 16% % C $525,000 $73,500 $ % % 1.2 D $800,000 $ $ % 13.0% 2.5 E $ $ $250,000 % 16.0% 2.0 b. Which division is most profitable in terms of income from operations? c. Which division is most profitable in terms of rate of return on investment?arrow_forwardkai.8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning