College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

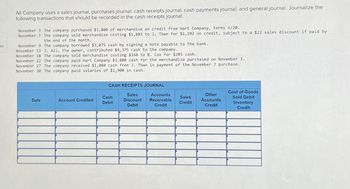

All Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the

following transactions that should be recorded in the cash receipts journal.

November 3 The company purchased $3,800 of merchandise on credit from Hart Company, terms n/20.

November 7 The company sold merchandise costing $1,003 to J. Than for $1,102 on credit, subject to a $22 sales discount if paid by

the end of the month.

November 9 The company borrowed $3,075 cash by signing a note payable to the bank.

November 13 J. Ali, the owner, contributed $4,375 cash to the company.

November 18 The company sold merchandise costing $160 to B. Cox for $285 cash.

November 22 The company paid Hart Company $3,800 cash for the merchandise purchased on November 3.

November 27 The company received $1,080 cash from 3. Than in payment of the November 7 purchase.

November 30 The company paid salaries of $1,900 in cash.

CASH RECEIPTS JOURNAL

Date

Account Credited

Cash

Debit

Sales

Accounts

Discount Receivable

Debit

Credit

Sales

Credit

Other

Accounts

Credit

Cost of Goods

Sold Debit

Inventory

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.arrow_forwardPreston Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year: Required 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used. 2. Total and rule the journals. 3. Prove the equality of the debit and credit totals.arrow_forwardC. R. McIntyre Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year: Required 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used. 2. Total and rule the journals. 3. Prove the equality of the debit and credit totals.arrow_forward

- Gomez Company sells electrical supplies on a wholesale basis. The balances of the accounts as of April 1 have been recorded in the general ledger in your Working Papers and CengageNow. The following transactions took place during April of this year: Apr. 1 Sold merchandise on account to Myers Company, invoice no. 761, 570.40. 5 Sold merchandise on account to L. R. Foster Company, invoice no. 762, 486.10. 6 Issued credit memo no. 50 to Myers Company for merchandise returned, 40.70. 10 Sold merchandise on account to Diaz Hardware, invoice no. 763, 293.35. 14 Sold merchandise on account to Brooks and Bennett, invoice no. 764, 640.16. 17 Sold merchandise on account to Powell and Reyes, invoice no. 765, 582.12. 21 Issued credit memo no. 51 to Brooks and Bennett for merchandise returned, 68.44. 24 Sold merchandise on account to Ortiz Company, invoice no. 766, 652.87. 26 Sold merchandise on account to Diaz Hardware, invoice no. 767, 832.19. 30 Issued credit memo no. 52 to Diaz Hardware for damage to merchandise, 98.50. Required 1. Record these sales of merchandise on account in the sales journal. If using Working Papers, use page 39. Record the sales returns and allowances in the general journal. If using Working Papers, use page 74. 2. Immediately after recording each transaction, post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month: Accounts Receivable 113, Sales 411, Sales Returns and Allowances 412. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable controlling account with the total of the schedule of accounts receivable.arrow_forwardToby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to Osbourne, Inc., invoice no. 1128, 563.17. 14Sold merchandise on account to Ortiz Company, invoice no. 1129, 823.50. 20Sold merchandise on account to Bailey Corporation, invoice no. 1130, 2,350.98. 24Sold merchandise on account to Shannon Corporation, invoice no. 1131, 1,547.07. Assume that Toby Company had beginning balances on March 1 of 3,569.80 (Sales 411) and 2,450.39 (Accounts Receivable 113). Record the sales of merchandise on account in the sales journal (page 24) and then post to the general ledger.arrow_forwardThe following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3Received cash from J. Smith in payment of June 29 invoice of 350, less cash discount. 6Issued Ck. No. 1718, 742.50, to Designer, Inc., for invoice. no. 2256, recorded previously for 750, less cash discount of 7.50. July 9Sold merchandise in the amount of 250 on a credit card. Sales tax on this sale is 6%. The credit card fee the bank deducted for this transaction is 5. 10Issued Ck. No. 1719, 764.40, to Smart Style, Inc., for invoice no. 1825, recorded previously on account for 780. A trade discount of 25% was applied at the time of purchase, and Smart Style, Inc.s credit terms are 2/10, n/30. 12Received 180 cash in payment of June 20 invoice from R. Matthews. No cash discount applied. 18Received 1,575 cash in payment of a 1,500 note receivable and interest of 75. 21Voided Ck. No. 1720 due to error. 25Received and paid utility bill, 152; Ck. No. 1721, payable to City Utilities Company. 31Paid wages recorded previously for the month, 2,586, Ck. No. 1722. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forward

- Shirleys Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Shirleys Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 3Bought 30 Mango Bath and Shower Gels from Madden, Inc., 660, invoice no. 3487, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 125.43 (total 785.43). 4Bought ten Beauty Candle Travel Sets from Calhoun Candles, Inc., 420, invoice no. 4513, dated January 1; terms net 45; FOB destination. 12Sold four Mango Bath and Shower Gels on account to R. Kielman, sales slip no. 1456, 120, plus sales tax of 9.60, total 129.60. 13Received credit memo no. 8715 from Calhoun Candles, Inc., for merchandise returned, 84. 21Bought five Winter Skin Essentials Kits from Whitney and Waters, 197.50, invoice no. A875, dated January 18; terms 2/15, n/45; FOB destination. 25Sold three Winter Skin Essentials on account to A. Benner, sales slip no. 1457, 135.75, plus sales tax of 10.86, total 146.61. 27Issued credit memo no. 33 to A. Benner for merchandise returned, 45.25 plus 3.62 sales tax, total 48.87. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: A. Benner, 45.77; R. Kielman, 175.39. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Calhoun Candles, Inc., 355.23; Madden, Inc., 573.15; Whitney and Waters, 50.25. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 221.16; Accounts Payable 212 controlling account, 978.63; Sales Tax Payable 214, 128.45. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 25. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.arrow_forwardThe following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forwardSandren Co. purchased inventory on credit from Acto Supply Co. for $4,000. Sandren Co. would record this transaction in the ________. A. general journal B. cash receipts journal C. cash disbursements journal D. purchases journal E. sales journalarrow_forward

- The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms on sales on account are 2/10, n/30, FOB shipping point. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payment journal as appropriate. Assume the periodic inventory method is used. 2. Total and rule the journals. 3. Prove the equality of debit and credit totals.arrow_forwardMays Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Mays Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 2Bought nine Matte Nail Color Kits from Mejia, Inc., 450, invoice no. 4521, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 87.50 (total 537.50). 5Bought 30 Perfume Cocktail Rings from Braun, Inc., 1,200, invoice no. 37A, dated January 3; terms 2/10, n/30; FOB destination. 8Sold two Matte Nail Color Kits on account to J. Herbert, sales slip no. 113, 110, plus sales tax of 8.80, total 118.80. 11Received credit memo no. 455 from Braun, Inc., for merchandise returned, 315.25. 18Bought 15 Eye Palettes from Vargas, Inc., 660, invoice no. 910, dated January 14; terms net 30; FOB destination. 23Sold four Eye Palettes on account to T. Cantrell, sales slip no. 114, 200, plus sales tax of 16, total 216. 26Issued credit memo no. 12 to T. Cantrell for merchandise returned, 50 plus 4 sales tax, total 54. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: T. Cantrell, 86.99; J. Hebert, 63.47. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Braun, Inc., 513.20; Mejia, Inc., 113.40; Vargas, Inc., 67.15. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 150.46; Accounts Payable 212 controlling account, 693.75; Sales Tax Payable 214, 237.89. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 17. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.arrow_forwardJOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND POSTING TO GENERAL LEDGER AND ACCOUNTS PAYABLE LEDGER Using page 3 of a general journal and the following general ledger and accounts payable ledger accounts, journalize and post the following transactions: July 7Returned merchandise to Starcraft Industries, 700. 15Returned merchandise to XYZ, Inc., 450. 27Returned merchandise to Datamagic, 900.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage