FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Zachary Company has provided the following for the year.

| Budget | |||

| Sales | $ | 508,000 | |

| Variable product costs | 186,000 | ||

| Variable selling expense | 42,000 | ||

| Other variable expenses | 3,000 | ||

| Fixed product costs | 16,400 | ||

| Fixed selling expense | 24,200 | ||

| Other fixed expenses | 1,600 | ||

| Interest expense | 660 | ||

| Variances | |||

| Sales | 8,100 | U | |

| Variable product costs | 4,700 | F | |

| Variable selling expense | 2,200 | U | |

| Other variable expenses | 1,200 | U | |

| Fixed product costs | 300 | F | |

| Fixed selling expense | 480 | F | |

| Other fixed expenses | 110 | U | |

| Interest expense | 140 | F | |

Required

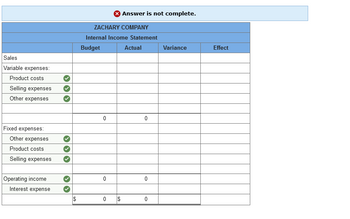

- a. Prepare in good form a

budgeted and actual income statement for internal use. Separate operating income from net income in the statements and indicate whether each variance is favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)

Transcribed Image Text:Sales

Variable expenses:

Product costs

Selling expenses

Other expenses

Fixed expenses:

Other expenses

Product costs

Selling expenses

Operating income

Interest expense

$

ZACHARY COMPANY

Internal Income Statement

Budget

0

0

0

Answer is not complete.

$

Actual

0

0

0

Variance

Effect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rooney Company produces two products. Budgeted annual income statements for the two products are provided as follows. Power Lite Total Budgeted Per Budgeted Budgeted Per Budgeted Budgeted Budgeted Number Unit Amount Number Unit Amount Number Amount @ $ 700 @ 380 $ 319,200 (168,000) 151,200 $ 487,200 (259,200) 228,000 (114,000) $ 114,000 Sales 240 $168,000 560 @ $ 570 800 Variable cost (91,200) 76,800 |(19,000) $ 57,800 240 560 @ 300 = 800 %3D Contribution margin 240 320 560 @ 270 800 Fixed cost (95,000) Net income $ 56,200 Required: a. Based on budgeted sales, determine the relative sales mix between the two products. b. Determine the weighted-average contribution margin per unit. c. Calculate the break-even point in total number of units. d. Determine the number of units of each product e. Verify the break-even point by preparing an income statement for each product as well as an income statement for the combined products. f. Determine the margin of safety based on the combined sales…arrow_forward(J)arrow_forwardRockets and More Ltd. Is concerned about the uncertain nature of its market for the upcoming year and has prepared budgeted results on 90%, 100% and 105% activity as follows: Output Revenue Less: Materials 337,500 Labour Costs 440,000 Production overhead costs 217,500 Administrative Costs 120,000 Selling and distribution cost 70,000 1,185,000 Revenue Less: Expenses Materials costs Labour costs Prod. Overhead costs Administration costs Selling and distribution costs Net profit 90% 45,000 Required: A. $ 1,350,000 Net Profit 165,000 200,000 Only 37,500 units have been sold with the following results: S B. 100% 50,000 S 1,500,000 375,000 485,000 235,000 130,000 75,000 1,300,000 311,750 351,500 171,250 117,500 66,500 105% 52, 500 $ 1,575,000 393,750 507,500 243,750 135,000 77,500 1,357,500 217,500 $ 1,075,000 1,018,500 56,500 i. The budgeted selling price is $30 per unit ii. All production is sold iii. The fixed element of the budgeted costs will remain unchanged at all levels of production…arrow_forward

- Reflector Glass Company prepared the following static budget for the year: Static Budget Units/Volume Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income/(Loss) 5,000 Per Unit $3 $15,000 1.5 7,500 7,500 3,000 $4,500 If a flexible budget is prepared at a volume of 8,500 units, calculate the amount of operating income. The production level is within the relevant range. OA. $9,750 B. $12,750 OC. $3,000 OD. $4,500arrow_forwardDuo, Incorporated, carries two products and has the following year-end income statement (000s omitted): Product AR-10 Product ZR-7 Budget Actual Budget Actual Units 4,000 5,600 10,000 9,300 Sales $ $ 28,000 $ 15,120 $ 20,000 $ 19,530 Variable costs 3,200 5,600 10,000 9,770 Fixed Costs 1,800 1,900 2,400 2,400 Total Costs $ 5,000 $ 7,500 $ 12,400 $ 12,170 Operating income $ 23,000 $ 7,620 $ 7,600 $ 7,360 The net effect of AR-10's sales volume variance on profit is: Multiple Choice $4,960 favorable. $5,660 favorable. $7,330 favorable. $8,030 favorable. $9,920 favorable. THE ANSWER IS NOT 8030 and I am not sure whyarrow_forwardGarcia Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. DensityGauge ThicknessGauge Total Sales $ 150,000 $ 80,000 $ 230,000 Less variable expenses 80,000 46,000 126,000 Contribution margin $ 70,000 $ 34,000 $ 104,000 Less direct fixed expenses* 20,000 38,000 58,000 Segment margin $ 50,000 $ (4,000) $ 46,000 Less common fixed expenses 30,000 Operating income $ 16,000 * Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for $25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Garcia is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: Direct materials $2 Direct labor 3…arrow_forward

- Benson Company has provided the following Year 2 data. Budget Sales Variable product costs Variable selling expense Other variable expenses Fixed product costs Fixed selling expense Other fixed expenses Interest expense Variances Sales Variable product costs Variable selling expense Other variable expenses Fixed product costs Fixed selling expense Other fixed expenses Interest expense BENSON COMPANY Internal Income Statement for Year 2 Budget Required Prepare a budgeted and actual Income statement for Internal use. Sales Variable expenses: Product costs $504,000 186,000 46,000 3,300 16,500 23,400 1,900 700 Selling expenses Other expenses Contribution margin Fixed expenses: Product costs Selling expenses Other expenses Operating income (loss) Interest expense Net income (loss) 8,600 Unfavorable 4,200 Favorable 2,300 Unfavorable 1,700 Unfavorable 310 Favorable 490 Favorable 190 Unfavorable 90 Favorable Actualarrow_forwardThe following dashboard shows information from a company's fixed budget for 12,000 units of production and sales, and actual results for 12,500 units of production and sales. Budgeted sales Actual sales Budgeted variable costs Actual variable costs Budgeted fixed costs $48,000 Actual fixed costs $46,000 Enter answers in the tabs below. Required 1 Required 2 $108,000 $137,500 Compute the flexible budget income at the actual production and sales level of 12,500 units. ------Flexible Budget------ ------Flexible Budget at ------ Variable Amount per Unit Total Fixed Cost 12,500 units Contribution margin $ 0 $ 0 0 $180,000 $195,000arrow_forwardRequired Information [The following information applies to the questions displayed below.] The fixed budget for 21,500 units of production shows sales of $559,000; variable costs of $64,500; and fixed costs of $142,000. If the company actually produces and sells 26,500 units, calculate the flexible budget Income. Sales Variable costs Contribution margin Fixed costs Income ------Flexible Budget-..... Variable Amount Total Fixed per Unit Cost $ 689,000 689,000 ------Flexible Budget at 21,500 units $ $ 0 0 26,500 units $ $ 0 0arrow_forward

- Jordan Company nas provided the following year data. Budget Sales Variable product costs Variable selling expense Other variable expenses Fixed product costs Fixed selling expense Other fixed expenses Interest expense Variances Sales Variable product costs. Variable selling expense Other variable expenses Fixed product costs Fixed selling expense Other fixed expenses Interest expense JORDAN COMPANY Internal Income Statement for Year 2 Budget Sales Variable expenses: Product costs Selling expenses Other expenses Contribution margin $ 519,000 202,000 Required Prepare a budgeted and actual income statement for Internal use. Fixed expenses: Product costs Selling expenses Other expenses Operating income (loss) Interest expense Net income (loss) 49,000 3,200 16,000 24,000 1,400 688 8,200 Unfavorable 5,000 Favorable 2,200 Unfavorable 1,100 Unfavorable 290 Favorable 460 Favorable 140 Unfavorable 100 Favorable Actualarrow_forward(1) Compute the total variable cost per unit.(2) Compute the total fixed costs.(3) Compute the income from operations for sales volume of 12,000 units.(4) Compute the income from operations for sales volume of 16,000 units.arrow_forwardSheridan Sports sells volleyball kits that it purchases from a sports equipment distributor. The following static budget based on sales of 2,200 kits was prepared for the year. Fixed operating expenses account for 75% of total operating expenses at this level of sales. Sales Cost of goods sold (all variable) Gross margin Operating expenses Operating income Unit Sales Sales revenue $ 220,000 Cost of goods sold $ 140,800 Assume that Sheridan Sports actually sold 1,900 volleyball kits during the year at a price of $102 per kit. Calculate the sales volume variance for sales revenue and cost of goods sold. (If variance is zero, select "Not Applicable" and enter O for the amounts.) Flexible Budget 79,200 70,000 9,200 LA Sales Volume Variance LA Static Budgetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education