FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

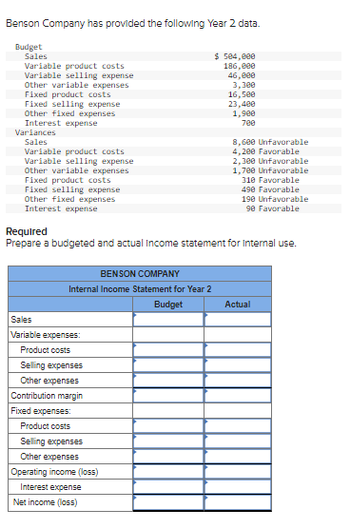

Transcribed Image Text:Benson Company has provided the following Year 2 data.

Budget

Sales

Variable product costs

Variable selling expense

Other variable expenses

Fixed product costs

Fixed selling expense

Other fixed expenses

Interest expense

Variances

Sales

Variable product costs

Variable selling expense

Other variable expenses

Fixed product costs

Fixed selling expense

Other fixed expenses

Interest expense

BENSON COMPANY

Internal Income Statement for Year 2

Budget

Required

Prepare a budgeted and actual Income statement for Internal use.

Sales

Variable expenses:

Product costs

$504,000

186,000

46,000

3,300

16,500

23,400

1,900

700

Selling expenses

Other expenses

Contribution margin

Fixed expenses:

Product costs

Selling expenses

Other expenses

Operating income (loss)

Interest expense

Net income (loss)

8,600 Unfavorable

4,200 Favorable

2,300 Unfavorable

1,700 Unfavorable

310 Favorable

490 Favorable

190 Unfavorable

90 Favorable

Actual

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject : Accountingarrow_forwardComplete each of the following contribution format income statements by supplying the missing numbers. a. b. c. d. Sales revenue $enter the sales revenue amount in dollars $504,696 $enter the sales revenue amount in dollars $671,472 Variable expenses 236,284 enter the variable expenses amount in dollars 123,704 enter the variable expenses amount in dollars Contribution margin 150,052 156,624 enter the contribution margin in dollars 490,336 Fixed expenses enter the fixed expenses amount in dollars 87,320 138,084 enter the fixed expenses amount in dollars Operating income 20,502 enter the operating income amount in dollars enter the operating income amount in dollars enter the operating income amount in dollars Income taxes enter the income tax amount in dollars 20,791 20,278 63,805 Net income $14,351 $enter the net income amount in dollars $60,834 $191,415arrow_forwardby its June contribution format income statement below: Sales (4,000 pools) Variable expenses: Variable cost of goods sold* Variable selling expenses Total variable expenses Contribution margin Fixed expenses: Manufacturing overhead Selling and administrative Total fixed expenses Net operating income (loss) Flexible Budget $ 275,000 Actual $ 275,000 74,720 90,040 27,000 27,000 101,720 117,040 173,280 157,960 68,000 68,000 93,000 93,000 161,000 161,000 $ 12,280 $ (3,040) *Contains direct materials, direct labor, and variable manufacturing overhead. Janet Dunn, who has just been appointed general manager of the Westwood Plant, has been given instructions to "get things under control." Upon reviewing the plant's income statement, Ms. Dunn has concluded that the major problem lies in the variable cost of goods sold. She has been provided with the following standard cost per swimming pool: Direct materials Direct labor Variable manufacturing overhead Total standard cost per unit Standard…arrow_forward

- Absorption Costing Income Statement On October 31, the end of the first month of operations Maryville Equipment Company prepared the following income statement, based on the variable costing conce Maryville Equipment Company Variable Costing Income Statement For the Month Ended October 31 Sales (8,700 units) Variable cost of goods sold: Variable cost of goods manufactured Inventory, October 31 (2,600 units) Total variable cost of goods sold Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating income Company Absorption Costing Income Statement For the Month Ended October 31 $293,800 (67,600) Cost of goods sold: $56,500 34,800 $556,800 Prepare an income statement under absorption costing Round all final answers to whole dollars. Maryville Equipment (226,200) $330,600 (147,900) $182,700 (91,300) $91,400arrow_forwardNeed help with these two problems. Thanks!arrow_forwardPrepare Income statement for the month of December 2020 assuming absorption Costing and Variable Costing and state the reason for difference in income computed between absorption costing and variable costing.arrow_forward

- Gadubhaiarrow_forwardContribution Margin Ratio a. Young Company budgets sales of $1,240,000, fixed costs of $41,900, and variable costs of $186,000. What is the contribution margin ratio for Young Company? % b. If the contribution margin ratio for Martinez Company is 62%, sales were $567,000, and fixed costs were $274,200, what was the operating income?arrow_forwardAbsorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 33,900 hats, of which 32,200 vwere sold. Operating data for the month are summarized as follows: Sales $296,240 Manufacturing costs: Direct materials $176,280 Direct labor 47,460 Variable manufacturing cost 20,340 Fixed manufacturing cost 20,340 264/420 Selling and administrative expenses: Variable $16,100 Fixed 11,750 27,850 During August Head Gear Inc, manufectured 30,500 hats and sold 32,200 hats. Operating data for August are summarized as folovsi Sales $296,240 Manufacturing costs: Direct materials $158,600 Direct labor 42.700 Variable manufacturing cost 18,300 20,340 239,940 Fixed manufacturing cost Selling and administrative expenses: $16.100 Variable 11.750 27 850 Fixed Required:arrow_forward

- please helparrow_forwardContribution Margin Ratio a. Young Company budgets sales of $1,150,000, fixed costs of $80,200, and variable costs of $356,500. What is the contribution margin ratio for Young Company? % b. If the contribution margin ratio for Martinez Company is 62%, sales were $517,000, and fixed costs were $240,410, what was the operating income?arrow_forwardRobinson Company has two products, A and B. Robinson's budget for August follows: Master Budget Sales Variable cost Contribution margin Fixed cost Operating income Selling price Sales Variable cost Contribution margin Fixed cost On September 1, these operating results for August were reported: Operating Results Operating income Units sold Product A $ 330,000 180,000 $ 150,000 120,000 $ 30,000 $ 110 a. Flexible-budget variance b. Sales volume variance c. Sales quantity variance d. Sales mix variance Product B $ 450,000 270,000 $ 180,000 90,000 $ 90,000 $ 50 Product A $ 112,500 68,750 $ 43,750 120,000 $ (76,250) 1,250 Required: 1. For each product, determine the following variances measured in dollars of contribution margin: Product B $ 585,000 393,750 $ 191,250 90,000 $ 101,250 11,250 Product A Product Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education