FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

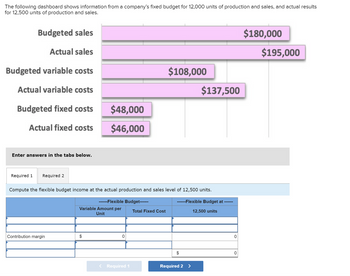

Transcribed Image Text:The following dashboard shows information from a company's fixed budget for 12,000 units of production and sales, and actual results

for 12,500 units of production and sales.

Budgeted sales

Actual sales

Budgeted variable costs

Actual variable costs

Budgeted fixed costs

$48,000

Actual fixed costs

$46,000

Enter answers in the tabs below.

Required 1

Required 2

$108,000

$137,500

Compute the flexible budget income at the actual production and sales level of 12,500 units.

------Flexible Budget------

------Flexible Budget at ------

Variable Amount per

Unit

Total Fixed Cost

12,500 units

Contribution margin

$

0

$

< Required 1

Required 2 >

0

0

$180,000

$195,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that a company provided the following excerpts of information from its flexible budget performance report: Actual Flexible Planning Results Budget Budget Flights (q) 52 ? ? Expenses: Wages and salaries ($4,000 + $88.00q) $ 8,510 ? $ 8,400 What is the spending variance for wages and salaries expense? $66 U $176 F $176 U $66 Farrow_forwardanswer in text form please (without image)arrow_forwardanswer must be correctarrow_forward

- Zachary Manufacturing Company established the following standard price and cost data. Sales price $ 8.60 per unit Variable manufacturing cost 4.00 per unit Fixed manufacturing cost 2,900 total Fixed selling and administrative cost 800 total Zachary planned to produce and sell 2,100 units. Actual production and sales amounted to 2,300 units. Required Prepare the pro forma income statement in contribution format that would appear in a master budget. Prepare the pro forma income statement in contribution format that would appear in a flexible budget. Prepare the pro forma income statement in contribution format that would appear in a master budget. ZACHARY MANUFACTURING COMPANY Pro Forma Income Statement Master Budget 0 $0 Prepare the pro forma income statement in contribution format that would appear in a flexible budget.…arrow_forwardes Required information [The following information applies to the questions displayed below.] Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates for budgeting purposes and the actual results for May as shown below. Revenue Employee salaries and wages Travel expenses Other expenses Fixed Element per Month $ 50,000 $ 36,000 Variable Element per Customer Served $ 5,000 $ 1,100 Actual Total for May $ 160,000 $ 88,000 $ 600 $ 19,000 $ 34,500 When preparing its planning budget, the company estimated it would serve 30 customers per month; however, during May the company actually served 35 customers. Required: 1. What amount of revenue would be included in Adger's flexible budget for May?arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] The fixed budget for 20,400 units of production shows sales of $550,800; variable costs of $61,200; and fixed costs of $142,000. QS 21-4 (Algo) Flexible budget performance report LO P1 The company's actual sales were 26,700 units at $674,900. Actual variable costs were $113,300 and actual fixed costs were $137,000. Prepare a flexible budget performance report. Indicate whether each variance is favorable or unfavorable. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Sales Variable costs Contribution margin Fixed costs Income $ Flexible Budget Performance Report Flexible Budget Actual Results 0 0 $ 0 0 Variances Favorable/ Unfavorable Unfavorable Unfavorable Unfavorable Favorable Unfavorablearrow_forward

- The following data have been extracted from the budgets of Kelvin Ltd,a company that manufacture and sells a single product $per unit Selling price Direct material cost Direct wages Variable overhead Fixed overhead 45 10 4 2.50 1.50 Fixed production overhead costs are budgeted at $400,000 per annum. Normal production levels are expected to be 200,000 units per annum. Actual Fixed Production overheads are $120,000 Budgeted administration costs are $120,000 per annum. The following pattern of sales and production is expected during 2003: Sales (units) Production (units) 60,000 70,000 You are required a. To prepare budgeted profit statements for the year using (i) (ii) Marginal Costing Absorption Costing b. To reconcile the profits for the yeararrow_forwardThe following information was drawn from the accounting records of Smith Company Static Budget Flexible Budget Actual Results Sales $ 12,000 $ 16,000 $ 17,500 Cost of Goods Sold (6,400 ) (8,000 ) (7,100 ) Gross Margin 5,600 8,000 10,400 Variable Cost (2,400 ) (3,000 ) (3,600 ) Fixed Cost (1,400 ) (1,400 ) (1,700 ) Net Income $ 1,800 $ 3,600 $ 5,100 Based on this information the Multiple Choice sales price flexible budget variance is a $5,500 unfavorable variance. sales price flexible budget variance is a $1,500 favorable variance. sales price flexible budget variance is a $5,500 favorable variance. sales price flexible budget variance is a $4,000 favorable variance.arrow_forwardExplain botharrow_forward

- Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] The fixed budget for 21,300 units of production shows sales of $511,200; variable costs of $63,900; and fixed costs of $142,000. QS 21-4 (Algo) Flexible budget performance report LO P1 The company's actual sales were 26,000 units at $576,000. Actual variable costs were $113,900 and actual fixed costs were $136,000. Prepare a flexible budget performance report. Indicate whether each variance is favorable or unfavorable. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Contribution margin Flexible Budget Performance Report Flexible Budget Actual Results Variances Favorable/ Unfavorablearrow_forwardYour managerial accountant provided you with information comparing the actual results to the budgeted amounts for the period: Static Flexible Actual Quantity 3,200 DL hours 2,900 hours 2,900 hours Price $15 per hour $15 per hour $18 per hour Total Costs $48,000 $43,500 $52,200 Based on the information provided, select all of the true statements from the following options: Your managerial accountant provided you with information comparing the actual results to the budgeted amounts for the period: Static Flexible Actual Quantity 3,200 DL hours 2,900 hours 2,900 hours Price $15 per hour $15 per hour $18 per hour Total Costs $48,000 $43,500 $52,200 Based on the information provided, select all of the true statements from the following options: The price variance is $8,700, favorable The price variance is $8,700, unfavorable The total budget variance is $42,000, favorable The price variance is $3.00, favorable The…arrow_forwardThe following information was drawn from the accounting records of Ashton Company. Budgeted Actual Sales $ 10,000 $ 13,000 Cost of Goods Sold (5,000 ) (6,600 ) Gross Margin 5,000 6,400 Variable Cost (2,000 ) (2,700 ) Fixed Cost (2,500 ) (1,900 ) Net Income $ 500 $ 1,800 Based on this information Ashton Company has a Multiple Choice $1,300 favorable sales variance $1,300 unfavorable sales variance $3,000 favorable sales variance $3,000 unfavorable sales variancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education