Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

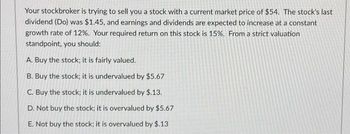

Transcribed Image Text:Your stockbroker is trying to sell you a stock with a current market price of $54. The stock's last

dividend (Do) was $1.45, and earnings and dividends are expected to increase at a constant

growth rate of 12%. Your required return on this stock is 15%. From a strict valuation

standpoint, you should:

A. Buy the stock; it is fairly valued.

B. Buy the stock; it is undervalued by $5.67

C. Buy the stock; it is undervalued by $.13.

D. Not buy the stock; it is overvalued by $5.67

E. Not buy the stock; it is overvalued by $.13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. You consider buying a share of stock at a price of $25. The stock is expected to pay a dividend of $1.50 next year, and your advisory service tells you that you can expect to sell the stock in 1 year for $30. The stock's beta is 1.1, rf is 6%, and market risk premium is 10%. What is the stock's alpha?arrow_forwardA stock is currently selling for $40.00 a share. What is the gain or loss on the following transactions? Use a minus sign to enter the amount as a negative value. Round your answers to the nearest cent. a. You take a long position and the stock's price declines to $37.35. -10.65 b. You sell the stock short and the price declines to $37.35. 10.65 c. You take a long position and the price rises to $50.65. $ 2.65 d. You sell the stock short and the price rises to $50.65. -2.65arrow_forwardYou are evaluating a company's stock. The stock just paid a dividend of $1.75. Dividends are expected to grow at a constant rate of 5 percent for a long time into the future. The required rate of return (Rs) on the stock is 12 percent. What is the fair present value? Please show all the steps, including the equation(s).arrow_forward

- You purchased a stock at the beginning of the year for $32 and have just received a dividend of $2. You are now thinking of selling the stock for $24. What was your realized return?arrow_forwardb) Your broker has advised you to buy shares of Fast repair computer repair shop, which has paid a dividend of $2 per share annually and will (according to the broker) continue to do so for many years. The stock is currently priced at $18. You have good reason to think that the appropriate rate of return for this stock is 13% per year. Is the stock's present price a good approximation for the true financial value? What would you like to pay for the share and should you buy or sell now?arrow_forwardSuppose you are thinking of purchasing the Moore Co.’s common stock today. If you expect Moore to pay $2.5, $2.625, $2.73, and $2.81 dividends at the end of year one, two, three, and four respectively and you believe that you can sell the stock for $40.97 at the end of year four. If you required return on this investment is 9%, how much will you be willing to pay for the stock today?arrow_forward

- Melissa Cutt is thinking about buying some shares of EZLawn Equipment, at $48.97 per share. She expects the price of the stock to rise to $58 35 over the next 3 years. During that time she also expects to receive annual dividends of $3.51 per share. a. What is the intrinsic worth of this stock, given a required rate of return of 9%? b. What is its expected return? a. The intrinsic worth of this stock is $. (Round to the nearest cent.)arrow_forwardYou are considering the purchase of a new stock. The stock is expected to grow at 2.52% for the foreseeable future and just paid a $2.88 dividend (D0). The required return is 8.2%. Based on this, what is the value of the stock? Round calculations to the nearest cent.arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forward

- By investing in a particular stock, a person can make a profit in one year of $3900 with probability 0.4 or take a loss of $800 with probability 0.6. What is this person's expected gain?arrow_forwardA stock has a holding period return (HPR) of 8% and a CAPM return of 9%. Which of the following is true? Select one: a. You should buy it since the actual return is greater than the fair return. b. You should not buy it since the fair return is greater than the actual return. c. You should buy it since the actual return is greater than the fair return. d. You should not buy it since the fair return is less than the actual return.arrow_forwardcan someone help me with this please and no excelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education