Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

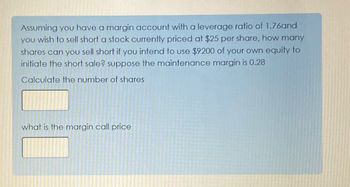

Transcribed Image Text:Assuming you have a margin account with a leverage ratio of 1.76and

you wish to sell short a stock currently priced at $25 per share, how many

shares can you sell short if you intend to use $9200 of your own equity to

initiate the short sale? suppose the maintenance margin is 0.28

Calculate the number of shares

what is the margin call price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardStock Price to Profit You buy an “at the money” April call option on M&M Corp. common stock, which has a strike price of $40 and a premium of $3.15. What must happen to the price of M&M Corp. stock for you to make a profit?arrow_forwardSuppose that an investor purchases the common stock at the current market price of $58/share and simultaneously sells for $12 a call to buy the shares at the strike price of $50. At the expiration of the call, price of stock is $77. What is the net profit on the position for this investor? (Round your answer the nearest dollar, do not enter with the dollar sign)arrow_forward

- Want accurateanswerarrow_forwardAssume you sell short 100 shares of common stock at $30 per share, with initial margin at 50%. The maintenance margin is 35%. How far does the price of the stock rise for you to get a margin call? a) $33.33 b) $34.62 c) $32.14 d) $38.74 e) $40.50arrow_forwardhello, I need help pleasearrow_forward

- An investor opens a margin account with an initial deposit of $5500. He then purchases 870 shares of a stock at $44. His margin account has a maintenance margin requirement of 30%. Ignoring commissions and interest, IF the price changed to 27 WHAT IS YOUR NEW EQUITY The correct answer is AT WHAT PRICE YOU WILL GET A MARGIN CALL PRICE?arrow_forwardBhaarrow_forwardYou write a put with a strike price of $60 on stock that you have shorted at $60 (this is a “covered put”). What are the expiration date profits to this position for stock prices of $50, $55, $60, $65, and $70 if the put premium is $1.80? (A negative value should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock price Short profit Put payoff Put profit Net profit $50.00 $55.00 $60.00 $65.00 $70.00arrow_forward

- Assume that if M launches a new e-trading platform, its price will go up to $261. Else, M price will go down to $62. You are aware that M shares are being traded at $162. You also know that the risk-free rate is 5%.What is the probability that M price will go down?***Please round your answer to the nearest three decimals (i.e. 0.512)arrow_forwardThe current market price for common shares of Delta Company is $30. Call options on these shares currently trade at $2.35, and come with a $46.35 exercise price. If the stock’s market price rose to $51 what would be the percentage rate of return? give a rounded number looking like this 100.4 that is not the right answerarrow_forwardPlease do not give image format and dont use chatgptarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education