Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

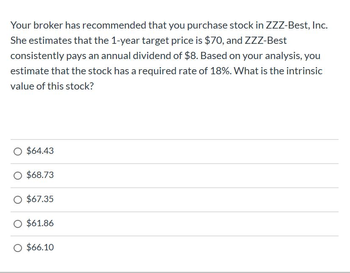

Transcribed Image Text:Your broker has recommended that you purchase stock in ZZZ-Best, Inc.

She estimates that the 1-year target price is $70, and ZZZ-Best

consistently pays an annual dividend of $8. Based on your analysis, you

estimate that the stock has a required rate of 18%. What is the intrinsic

value of this stock?

O $64.43

O $68.73

O $67.35

O $61.86

O $66.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain how to find the value of a stock given itslast dividend, its expected growth rate, and itsrequired rate of return.arrow_forwardSuppose that the initial dividend on a stock is £1. The interest rate is 3 percent and the growth rate of dividends is constant at 2 percent. What Is the prics of the stock?arrow_forward9. 10. Use the information below and the P/E as an Earnings Multiplier Model to find this stock's intrinsic value and determine whether it's over or under valued if its current price is $71.32. 2020 2021 2022 2023 2024 61.57 39.25 60.93 73.70 9.70 4.56 26.68 6.80 1.34 16.52 4.30 7.00 .60 .70 .80 .65 39.55 45.00 95.00 93.00 97.19 15.0 Bold figures are 21 .86 Value Line estimates 1.1% 1.2% 50 .80 64 76.35 70.79 124.24 107.76 37.7 3.9 1.94 1.2% VALUE LINE PUB. LLC 77.95 Revenues per sh 11.70 "Cash Flow" per sh 8.50 Earnings per sh A .88 Div'ds Decl'd per sh C .65 Cap'l Spending per sh 51.35 Book Value per sh Common Shs Outst'g B Avg Ann'l P/E Ratio Relative P/E Ratio Avg Ann'l Div'd Yield A stock selling for $20 has an intrinsic value of $10. Is it over or under valued?arrow_forward

- Stock A has a capital gains yield of 6.5% and a dividend yield of 1.5%. Stock B has a capital gains yield of 8.5% and a dividend yield of 3.5%. Which stock has the higher required return? S en O A O They have the same required return.arrow_forwardA stock hasn HPR of 16%. The stock's beta is 0.83. The risk-free rate is 1% and the market risk premium is 5.25%. What is the stock's alpha? Answer as a percent.arrow_forwardA stock has a market price of $33.45 and pays a $.95 dividend. What is the dividend yield?arrow_forward

- An investor expects a14% return on a $ 50 stock that pays a dividend of $ 2.50. Was is the implied capital gain rate on the price appreciation?arrow_forwardHow will the change in required return influence the price of a stock? How will the dividend growth rate influence the price of a stock?arrow_forwardA stock's internal rate of return (IRR) is the discount rate that cause the present value of future dividends and the price at which a stock is expected to be sold to equal the current price of the stock. O True O False Carrow_forward

- If the risk premium on the stock market was 6.69 percent and the risk-free rate was 2.51 percent, what is the stock market return? Multiple Choice 4.18% 9.20% 7.36% 10.04% 6.69%arrow_forwardWhat is the required return on preferred stock, rPS, if the stock has an annual dividend of $9 and a price of $100?arrow_forwardLet's explore the difference between "expected" and "actual" return of a stock. 1) How might we calculate what the expected return of a stock should be? 2) How might we calculate the "actual" return of a stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education