Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

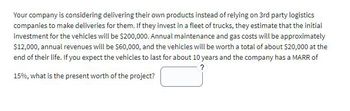

Transcribed Image Text:Your company is considering delivering their own products instead of relying on 3rd party logistics

companies to make deliveries for them. If they invest in a fleet of trucks, they estimate that the initial

investment for the vehicles will be $200,000. Annual maintenance and gas costs will be approximately

$12,000, annual revenues will be $60,000, and the vehicles will be worth a total of about $20,000 at the

end of their life. If you expect the vehicles to last for about 10 years and the company has a MARR of

?

15%, what is the present worth of the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Fantastic Footwear can invest in one of two different automated clicker cutters. The first, A, has a $150,000 first cost. A similar one with many extra features, B has a $579,000 first cost. A will save $50,000 per year over the cutter currently in use. B will save $160,000 per year. Each clicker cutter will last five years. If the MARR is 8 percent, which alternative is better? Use an IBB comparison should be chosen percent. For the increment from cutter A to cutter B, the IRR is percent. Therefore, For the increment from the do-nothing alternative to cutter A. the IRR is (Type integers or decimals rounded to one decimal place as needed.)arrow_forwardMr. Maillet has contributed $216.00 at the end of each month into an RRSP paying 3% per annum compounded quarterly. How much will Mr. Maillet have in the RRSP after 15 years? (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) How much of the above amount is interest? (Round the final answer to the nearest centas needed. Round all intermediate values to six decimal places as needed.)arrow_forwardPlease solve by hand or using formulasarrow_forward

- You are evaluating a 20 year project. Using a discount rate of 10%, you have calculated the project's NPV as $200. Part 1 After completing your project estimation, the sales group of another division in the company notes that your project will probably cannibalize the sales of their products. They estimate that their after-tax profits will decrease by $27 per year for the 20-year life of the project. What is the new NPV of your project after taking this into account?arrow_forwardYour company is deciding whether to purchase a high-quality printer for your office or one of lesser quality. The high-quality printer costs $45 000 and should last five years. The lesser quality printer costs $25 000 and should last two years. If the cost of capital for the company is 12 per cent, then what is the equivalent annual cost for the best choice for the company?arrow_forwardZipCar auto parts store has $88,000 to invest in a project to detect and reduce insier theft in their stores. They have considering investing in one of two alternatives, identified as Y and Z. Z is the higher first-cost alternative, and the incremental initial investment between the two is $22,000 and will exhibit a rate of return of 12% per year. Z requires an investment of $88,000. They expect a rate of return on the $88,000 investment of 49 percent. Answer the following questions; (a) what is the size of the investment required in Y?, and, (b) what is the rate of return on Y? The size of the investment required in Y is $ The rate of return on Y is %.arrow_forward

- Assume that you are thinking about starting your own small business. You have made the following estimates regarding this opportunity: You can rent a location for your business at a cost of $36, 000 per year. The equipment costs incurred to start the business would total $250,000. The equipment would have a 5-year useful life and a salvage value of S 25,000. Your company's estimated sales per year would equal $350,000 and its variable cost of goods sold would be 30% of sales. Other operating costs would include $56, 000 per year in salaries, S4, 000 per year for insurance, $25, 000 per year for utilities, and a 3% sales commission. The payback period for this investment opportunity is closest to: Multiple Choice 4.08 years, 2.20 years. 3.80 years. 3.08 years.arrow_forwardWebmasters.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year’s projected sales; for example, NWC0 10% Sales1. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company’s non-variable costs would be $1 million in Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forwardAssume that you are thinking about starting your own small business. You have made the following estimates regarding this opportunity: • You can rent a location for your business at a cost of $36,000 per year. The equipment costs incurred to start the business would total $250,000. The equipment would have a 5-year useful life and a salvage value of $25,000 Your company's estimated sales per year would equal $350,000 and its variable cost of goods sold would be 30% of sales. • Other operating costs would include $58,000 per year in salaries, $4,000 per year for insurance, $25,000 per year for utilities, and a 3% sales commission The simple rate of return for this investment opportunity is closest to: Multiple Choice 22.0% 19.0% 26.6% 15.7%arrow_forward

- A manufacturing company is considerign the purchase of new machinery to increase its production capacity. The company has identified a new machine that costs $500,000 and is expected to increase production by 20%. The company expects to sell the additional products for $600,000, resulting in a net profit of $100,000. The company can finance the purchase through a bank loan with an interest rate of 5% over a five year term. What is the expected return on investment (ROI) for the purchase of the new machinery 5% 10% 20% 25%arrow_forwardYou are considering buying a machine to produce widgets (again!). It takes you one year to finetune the machine so that it produces exactly the kind of widgets you want. The machine costs $40,000 today and produces 100,000 widgets in year 2. (You cannot produce in year 1 because you have to fine-tune the machine first.) Expected revenues are $1 per widget. The cost of producing widgets depends on the type of gas the machine uses. The machine uses one unit of gas per widget produced. In its current version the machine runs on a gas called "Gas A". The price of "Gas A" in year 2 is uncertain and will be known only at the beginning of year 2. This price will be either $0.75 or $0.25 per unit of gas with equal probability. All revenues and costs (except the cost of the machine) accrue at the end of year 2. The discount rate is 10%. a) What is the NPV of the project? b) The manufacturer of the machine offers you a device that can be attached to the machine. You will have to buy the device…arrow_forwardA computer call center is going to replace all of its incandescent lamps with more energy efficient fluorescent lighting fixtures. The total energy savings are estimated to be $2,084 per year, and the cost of purchasing and installing the fluorescent fixtures is $4,500. The study period is four years, and terminal market values for the fixtures are negligible. a. What is the IRR of this investment? b. What is the simple payback period of the investment? c. Is there a conflict in the answers to Parts (a) and (b)? List your assumptions. d. The simple payback "rate of return" is 1/0. a. The IRR of the investment is%. (Round to one decimal place.) b. The simple payback period of the investment is years. (Round up to the next whole number.) c. Select all the correct assumptions below. A. The value of 0 may indicate a poor project in terms of liquidity. B. The value of 0 may indicate the best project in terms of liquidity. C. The IRR will signal an acceptable (profitable) project if the MARR…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education