Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

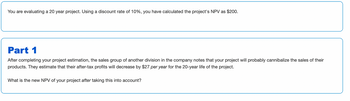

Transcribed Image Text:You are evaluating a 20 year project. Using a discount rate of 10%, you have calculated the project's NPV as $200.

Part 1

After completing your project estimation, the sales group of another division in the company notes that your project will probably cannibalize the sales of their

products. They estimate that their after-tax profits will decrease by $27 per year for the 20-year life of the project.

What is the new NPV of your project after taking this into account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- B&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 55 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $875,000. By going through research, B&B will be able to better target potential customers and will increase the probability of success to 70 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $16.5 million. If unsuccessful, the present value payoff is $7.5 million. The appropriate discount rate is 13 percent. Calculate the NPV for the firm if it conducts customer segment research and if it goes to market immediately. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. Should the firm conduct customer segment research or go to the market immediately? multiple choice…arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.05 million per year. Your upfront setup costs to be ready to produce the part would be $7.98 million. Your discount rate for this contract is 7.8%. a. What is the IRR? b. The NPV is $5.08 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forwardAssume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice O 0.95. 1.01. 1.05. 1.11.arrow_forward

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.97 million. Your discount rate for this contract is 8.1%. a. What is the IRR? b. The NPV is $5.05 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $86,000 immediately. If your cost of capital is 7.3%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $. (Round to the nearest dollar)arrow_forwardAssume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice C O 0.95. 1.01. 1.05. 1.11.arrow_forward

- Your company is analyzing purchase of a machine costing $5,900 today. The investment promises to add $18,500 to sales one year from today, $14,500 two years from today, and $18,000 three years from today. Incremental cash costs should consume 75% of the incremental sales. The tax rate is 30% and the company’s financing rate is 8.2%. The investment cost is depreciated to zero over a 3-year straight-line schedule. What is the IRR for the project?arrow_forwardFabco, Inc., is considering purchasing flow valves that will reduce annual operating costs by $10,000 per year for the next 12 years. Fabco’s MARR is 7%/year. Using an internal rate of return approach, determine the maximum amount Fabco should be willing to pay for the valves. $arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.02 million per year. Your upfront setup costs to be ready to produce the part would be $7.99 million. Your discount rate for this contract is 7.6%. a. What is the IRR? b. The NPV is $5.04 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forward

- A business is considering purchasing a piece of new equipment for $200,000. The equipment will generate the following revenues: Year 1: $50,000Year 2: $50,000Year 3: $50,000Year 4: $60,000The machine can be sold at the end of the year four for $25,000. Assume a discount of 8%. 2. What is the compounded return(IRR) for this project?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.09 million per year. Your upfront setup costs to be ready to produce the part would be $7.92 million. Your discount rate for this contract is 8.3%. a. What is the IRR? b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.) b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? (Select from the drop-down menu.) The IRR rule with the NPV rule.arrow_forwardYour company is planning to add a piece of equipment with 7 years of expected life for its production line. There will be no salvage value at the end of its life. The company has set its MARR to 11%. Your manager asks you to use incremental analysis to evaluate the alternatives and let him know which one of them should be chosen. Below is the data provided to you with the investment cost, annual income and IRR for each of the five alternatives. A B C D E Capital investment $14,000 $16,000 $16,500 $17,200 $20,000 Net annual income $3,000 $3,500 $3,700 $3,750 $4,300 IRR 11.30% 11.95% 12.73% 11.84% 11.41%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education