Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

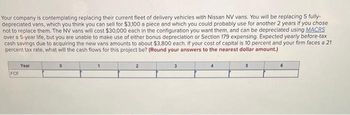

Transcribed Image Text:Your company is contemplating replacing their current fleet of delivery vehicles with Nissan NV vans. You will be replacing 5 fully-

depreciated vans, which you think you can sell for $3,100 a piece and which you could probably use for another 2 years if you chose

not to replace them. The NV vans will cost $30,000 each in the configuration you want them, and can be depreciated using MACRS

over a 5-year life, but you are unable to make use of either bonus depreciation or Section 179 expensing. Expected yearly before-tax

cash savings due to acquiring the new vans amounts to about $3,800 each. If your cost of capital is 10 percent and your firm faces a 21

percent tax rate, what will the cash flows for this project be? (Round your answers to the nearest dollar amount.)

FCF

Year

1

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Amazon is considering using high capacity drones that would make its product deliveries more efficient. For this project, $113,000 would need to be spent right away to buy the required fleet of drones. The drones will be losing their economic value in equal amount each year, fully over their 5-year economic lives. Once the drones' economic life is over, they would all be sold for $8,500 selling price to a new owner, and Amazon would then immediately purchase the same but brand-new drones for the same price as what it paid for the initial fleet of drones. When those drones' life is over, they would again be sold and, again, brand-new ones would be purchased - all for the same prices as for the initial drones, and so on, over and over. Additional information: • Amazon expects $9,200 in annual operating costs. • All future cash flows are year-end cash flows. ● Amazon pays 25 percent tax rate on all taxable income. Amazon requires an annual discount rate of 9 percent, and the rate is not…arrow_forwardConsider a project to supply 70 units of a product for the next five years. As the center of operations, you can use a building you own that cost $380 five years ago. Selling the building today would give you $330 after tax. If you start the project, you will not be able to sell the building until the project is over. You estimate that selling the building in 5 years will give you $800 after tax. You will also need to install $2,000 in new equipment at the beginning of the project; the equipment will be depreciated straight-line to zero over the project's five-year life. The equipment can be sold for $1,500 at the end of the project. You will also need $35 in initial net working capital for the project, and an additional investment of $33 annually. All net working capital will be recovered when the project ends. Your variable costs are $28 per unit, and you have fixed costs of $560 per year. Your tax rate is 35% and your required return on this project is 10%. If you were to submit a…arrow_forwardA firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,654.00 to install, $5,060.00 to operate per year for 7 years at which time it will be sold for $7,020.00. The second, RayCool 8, costs $41,774.00 to install, $2,009.00 to operate per year for 5 years at which time it will be sold for $9,022.00. The firm’s cost of capital is 6.27%. What is the equivalent annual cost of the AC360? Assume that there are no taxes.arrow_forward

- A delivery company is looking at converting their fleet of gasoline vans to electric vehicles. The all electric vans cost $75,000.00 today, minus an electric vehicle tax credit $7,500.00 and the reduced maintenance and fuel cost of $5,000. This brings today's MRC to $62,500.00 for each new electric van. The newer vans are expected to increase future MRP by $12,000.00 each year and have a productive life for five years. At the end of the fifth year, the firm expects to sell the used vans for a salvage value of $30,000.00. This firm is borrowing funds at 6% interest. The table indicates the possible investment for one electric vehicle.arrow_forwardmni.9arrow_forwardYou are evaluating a new project for Globex Corporation as the company is planning to launch a new and very efficient mobile device named Meta-5050. The new product is expected to run for 5 years. To produce this new product, Globex needs to purchase new equipment that will cost $750,000. The company needs to spend another $10,000 for shipping and installation. You estimate the sales price of Meta-5050 to be $650 per unit and sales volume to be 800 units in year 1; 1,400 units in years 2-4; and 500 units in year 5. The cost of the contents, packaging and shipping are expected to be $225 per unit and the annual fixed costs for this project are $150,000 per year. The equipment will be depreciated straight-line to zero over the 5-year project life. The actual market value (salvage value) of these assets at the end of year 5 is expected to be $35,000. If this project is taken up, inventory will increase by $72,000, accounts receivable will increase by $36,850, and accounts payable will…arrow_forward

- A new furnace for your small factory is being installed right now, will cost $27,000, and will be completed in one year. At that point, it will require ongoing maintenance expenditures of $1,500 a year. But it is far more fuel-efficient than your old furnace and will reduce your consumption of heating oil by 2,400 gallons per year. Heating oil this year costs $3 a gallon; the price per gallon is expected to increase by $0.50 a year for the next 3 years and then to stabilize for the foreseeable future. The furnace will last for 20 years from initial use, at which point it will need to be replaced and will have no salvage value. (Specifically, the firm pays for the furnace at time 0 and then reaps higher net cash flows from that investment at the end of years 1-20.) The discount rate is 8%. a. What is the net present value of the investment in the furnace? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What is the IRR? Note: Do not round…arrow_forwardPlease answer fast i give you upvote.arrow_forwardA new furnace for your small factory is being installed right now, will cost $38,000, and will be completed in one year. At that point, it will require ongoing maintenance expenditures of $1,200 a year. But it is far more fuel-efficient than your old furnace and will reduce your consumption of heating oil by 3,500 gallons per year. Heating oil this year costs $2 a gallon; the price per gallon is expected to increase by $0.50 a year for the next 3 years and then to stabilize for the foreseeable future. The furnace will last for 20 years from initial use, at which point it will need to be replaced and will have no salvage value. (Specifically, the firm pays for the furnace at time 0 and then reaps higher net cash flows from that investment at the end of years 1 – 20.) The discount rate is 8%. What is the net present value of the investment in the furnace? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar. What is the IRR? Note: Do not round…arrow_forward

- You are considering adding a new item to your company’s line of products. The machine required to manufacture the item costs $200000, and it depreciates straight-line over 4 years. The new item would require a $30000 increase in inventory and a $15000 increase in accounts payable. You plan to market the items for four years and then sell the machine for $40000. You expect to sell 2000 items per year at a price of $300. You expect manufacturing costs to be $220 per item and the fixed cost to be $3,000 per year. If the tax rate is 30% and your weighted average cost of capital is 12% per year, what is the net present value of selling the new item? ) $159,744 2) $73,903 3) $191,692 4) -$159,744 5) -$191,692arrow_forwardBilly Bob's Crab & Oyster Shack wants to reduce the cost of labour by replacing some labour with machines. If Billy Bob's were to purchase a machine to shuck the oysters, it can save $50,000 a year for 10 years. The new machine will cost $650,000 and it will be worth $50,000 at the end of the 10 year period. The firm believes it will need $10,000 in spare parts inventory (increase in NWC), which it can sell for the $5,000 at the end of the project. The machine has a 20% CCA rate and the firm has a 15% tax rate. If they want a 20% return on their investment what is the NPV? Round your answer to the nearest dollar, no dollar sign, no commas, put negative sign if needed.arrow_forwardA new furnace for your small factory will cost $47,000 and a year to install, will require ongoing maintenance expenditures of $1,500 a year. But it is far more fuel-efficient than your old furnace and will reduce your consumption of heating oil by 4,400 gallons per year. Heating oil this year will cost $2 a gallon; the price per gallon is expected to increase by $0.50 a year for the next 3 years and then to stabilize for the foreseeable future. The furnace will last for 20 years, at which point it will need to be replaced and will have no salvage value. The discount rate is 8%. a. What is the net present value of the investment in the furnace? (Do not round intermediate calculations. Round your answer to the nearest whole dollar.) b. What is the IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is the payback period? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education