Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

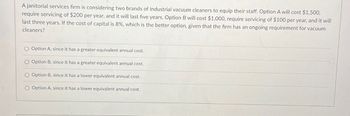

Transcribed Image Text:A janitorial services firm is considering two brands of industrial vacuum cleaners to equip their staff. Option A will cost $1,500,

require servicing of $200 per year, and it will last five years. Option B will cost $1,000, require servicing of $100 per year, and it will

last three years. If the cost of capital is 8%, which is the better option, given that the firm has an ongoing requirement for vacuum

cleaners?

O Option A, since it has a greater equivalent annual cost.

O Option B, since it has a greater equivalent annual cost.

O Option B, since it has a lower equivalent annual cost.

O Option A, since it has a lower equivalent annual cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- es United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $150,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.50 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $500,000. Finally, the project requires an immediate investment in working capital of $400,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $5.20 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing…arrow_forwardYou are considering whether to replace an existing flow meter. The existing meter can be sold now for $50 or it can be sold in 1 year for $10. It costs $30 per year to operate and maintain. A new meter costs $400 and has a 10-year life. It could be sold for $40 at the end of its life. The new meter costs $14 per year to operate and maintain. What do you recommend if the cost of capital is 12% (Use the EAC method to identify which of the three decisions is most viable)?arrow_forwardThe CFO of HairBrain stylists is evaluating a project that costs $42,000. The project will generate $11,000 each of the next five years. If HairBrains's required rate of return is 9 percent, should the project be purchased?arrow_forward

- Labco Scientific sells high-purity chemicals to universities, research laboratories, and pharmaceutical companies. The company wants to invest in new equipment that will reduce shipping costs by better matching the size of the completed products with the size of the shipping container. The new equipment is estimated to cost $450,000 to purchase and install. How much must Labco save each year for 3 years in order to justify the investment at an interest rate of 10% per year?arrow_forwardUnited Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $195,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.77 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $590,000. Finally, the project requires an immediate investment in working capital of $445,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $6.10 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs…arrow_forwardCrow Corporation, a company that specializes in precision metal fabrication, is conducting a study to determine if it should update equipment now or later. If the cost 2 years from now is estimated to be $260,000, how much can the company afford to spend now if its minimum attractive rate of return is 12% per year compounded monthly?arrow_forward

- You are evaluating a new project for Globex Corporation as the company is planning to launch a new and very efficient mobile device named Meta-5050. The new product is expected to run for 5 years. To produce this new product, Globex needs to purchase new equipment that will cost $750,000. The company needs to spend another $10,000 for shipping and installation. You estimate the sales price of Meta-5050 to be $650 per unit and sales volume to be 800 units in year 1; 1,400 units in years 2-4; and 500 units in year 5. The cost of the contents, packaging and shipping are expected to be $225 per unit and the annual fixed costs for this project are $150,000 per year. The equipment will be depreciated straight-line to zero over the 5-year project life. The actual market value (salvage value) of these assets at the end of year 5 is expected to be $35,000. If this project is taken up, inventory will increase by $72,000, accounts receivable will increase by $36,850, and accounts payable will…arrow_forwardRaghubhaiarrow_forwardeEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000 to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $62,000 per year. The firm’s cost of capital (discount rate) is 10%. Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.) 1a. The firm is not yet profitable and therefore pays no income taxes. 1b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. 1c. The firm is in the 30% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB…arrow_forward

- Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC = 10% (Sales). The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forwardLabco Scientific sells high-purity chemicals to universities, research laboratories, and pharmaceutical companies. The company wants to invest in new equipment that will reduce shipping costs by better matching the size of the completed products with the size of the shipping container. The new equipment is estimated to cost $560,000 to purchase and install. How much must Labco save each year for 3 years in order to justify the investment at an interest rate of 6% per year? Labco must save $ 35616 * each year.arrow_forwardUnited Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $125,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.35 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $450,000. Finally, the project requires an immediate Investment in working capital of $375,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $4.70 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education