Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

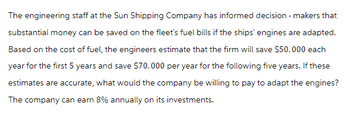

Transcribed Image Text:The engineering staff at the Sun Shipping Company has informed decision-makers that

substantial money can be saved on the fleet's fuel bills if the ships' engines are adapted.

Based on the cost of fuel, the engineers estimate that the firm will save $50,000 each

year for the first 5 years and save $70,000 per year for the following five years. If these

estimates are accurate, what would the company be willing to pay to adapt the engines?

The company can earn 8% annually on its investments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jax Inc is considering the purchase of a new machine for the production of computers. Machine A costs $7,000,000 and will last for six years. Variable costs are 25% of sales, and fixed costs are $500,000 annually. Machine B costs $10,000,000 and will last for ten years. Variable costs for the machine are 15% of sales, and fixed costs are $750,000 annually. The sales for each machine will be $4,000,000 per year. The required rate of return is 9%, the tax rate is 21%, and both machines will be depreciated using straight-line depreciation with no salvage value. Calculate the equivalent annual annuity for Machine B. (Round to 2 decimals) What is the Net Present Value for Machine B? (round to 2 decimals)arrow_forwardFor your new laboratory, you plan to purchase energy efficient freezers. There are two models in the market: Model X costs $100,000, and you need two units of model X for your project. Maintaining costs would be $50,000 and decreasing by $10,000 for each unit per year. Each freezer can be used for four years. At the end of which time, you estimate that the salvage value will be $70,000 for both freezers. Model Y costs $250,000 each. The maintaining cost of this model would be $10,000 per year and it would be decreasing by $5,000 starting in year 4. The salvage value of both model Y at the end of seven years is $60,000. Once again, two units of model Y is required for your project. Since you must complete your project in two years, you estimated that, the model X could be sold for $50,000 each and the model Y for $125,000 each after two years. Find the present worth difference between two models using MARR=10%. a) Between $52,640 and $54,800 O b) Between $35,640 and $37,800 c) Between…arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance expenses. It is considering purchasing a machine instead and is comparing two options: a. Purchase the machine it is currently renting for $155,000. This machine will require $23,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $260,000. This machine will require $17,000 per year in ongoing maintenance expenses and will lower bottling costs by $14,000 per year. Also, $36,000 will be spent up front to train the new operators of the machine. Suppose the appropriate discount rate is 9% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the cost of the rental machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The marginal corporate tax rate is 20%. Should Beryl's Iced…arrow_forward

- JDAR Enterprises needs someone to supply it with 156000 cartons of machine screws per year to support its manufacturing needs over the next 4years, and you've decided to bid on the contract. It will cost you $1750000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that in five years this equipment can be salvaged for $220000. Your fixed production costs will be $281,000 per year, and your variable production costs should be $9 per carton. You also need an initial investment in net working capital of $146,000. If your tax rate is 0.32 percent and you require a return of 0.16 percent on your investment, what bid price per carton should you submit What is the initial investment 1896000 what is the terminal value? (hint, discounted) 163257.76 what is the discounted cash flow 4564795.86 what is the bid price 4.73 Finish review Aarrow_forwardAbhaliyaarrow_forwardBlossom Corp. management is investigating two computer systems. The Alpha 8300 costs $2,341,725 and will generate cost savings of $ 1,309, 125 in each of the next five years. The Beta 2100 system costs $ 2,812,500 and will produce cost savings of $843, 750 each year in the first three years and then $2 million each year for the next two years. The company's discount rate for similar projects is 14 percent.What is the NPV of each system? (Enter negative amounts using negative sign, e.g -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.)NPV of Alpha systemSNPV of Beta system$Which one should be chosen based on the NPV? Blossom should choose the# system.arrow_forward

- Nikularrow_forwardThe company would like you to look at a new project. This project involves the purchase of a new $2,000,000 fully auto mated plasma cutter that can be used in our metal works division. The products manufactured using the new technol ogy are expected to sell for an average price of $300 per unit, and the company analyst expects that the firm can sell 20,000 units per year at this price for a period of five years. The cutter will have a residual or savage value of $200,000. at the end of the project's five-year te. The firm also expects to have to invest an additional $300,000 in working capital to support the new business. Other pertinent Information concerning the business venture is as follows: (look at the picture attached) a) Estimate the cash flows for the investment under the listed base-case assumptions. Calculate the project NPV for these cash flows. b) Evaluate the NPV of the investment under the worst-case and best-case assumptions.arrow_forwardEsquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following: Machine A could be purchased for $33,000. It will last 10 years with annual maintenance costs of $1,100 per year. After 10 years the machine can be sold for $3,465. Machine B could be purchased for $27,500. It also will last 10 years and will require maintenance costs of $4,400 in year three, $5,500 in year six, and $6,600 in year eight. After 10 years, the machine will have no salvage value. Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Ignore income tax considerations. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education