FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

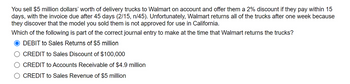

Transcribed Image Text:You sell $5 million dollars' worth of delivery trucks to Walmart on account and offer them a 2% discount if they pay within 15

days, with the invoice due after 45 days (2/15, n/45). Unfortunately, Walmart returns all of the trucks after one week because

they discover that the model you sold them is not approved for use in California.

Which of the following is part of the correct journal entry to make at the time that Walmart returns the trucks?

DEBIT to Sales Returns of $5 million

CREDIT to Sales Discount of $100,000

CREDIT to Accounts Receivable of $4.9 million

CREDIT to Sales Revenue of $5 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3) A newly opened grocery store, to attract customers, started giving 5 loyalty points for each dollar spent in the store. These points can be redeemed in blocks of 5000 and customers are eligible to receive a winter jacket. Since it was newly opened it did not have any past record of how many customers will exercise this offer, but because of the winter season round the corner, it is hoping that 90% of the people will make use of this redemption offer. The store purchases these jackets directly from the manufacturer at $40 per each. In the month of October, the total sales of the store were $480,000. Please calculate the loyalty redemption amount that the store needs to provide for October in its books of accounts.arrow_forwardTom&Dick sells computer software. All credittransactions are done through credit cards, so there is a100% probability of receiving the money, but there is await of up to 10 days while the transaction is beingprocessed. When Tom&Dick prepares financialstatements at the end of its first business year, it should*a. exclude accounts receivable, because customersmay not pay b. include accounts receivable as an assetbecause of the matching principle c. exclude accountsreceivable as the amount is variable with interest ratesd. include accounts receivable as an asset because ofthe cost principle e. none of the abovearrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $20.00 each with a minimum order of 220 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 220 Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $40.00 each. Hooper would pay the students a commission of $600 for each shirt sold Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $12.320? 2.…arrow_forward

- Please answer 1,2,3,4.it would be a great help. upvote confirmarrow_forwardPosting third time... Please do it correctly. Thank youarrow_forwardBill Norman comes to you for advice. He just purchased a large amount of inventory with the terms 2/10, n/30. The amount of the invoice is $310,000. He is currently short of cash nut has a decent credit. He can borrow te money from needed to settle the account payable at an annual interest rate of 7 %. Bill is sure he will have the necessary cash by the due date of the invoice but not by the last day of the discount period. a. Convert the dscount rate into an annual interest rate (Use 365 days a year. Do not round intermediate calculations. Round you answer to 2 decimal places.). b. Make a recommendation regarding whether Bill should borrow the money and pay off the account payable within the discount period.arrow_forward

- Cullumber Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30% of an order at the retailer's expense. Sales are made only to retailers who have good credit ratings. Past experience indicates that the normal return rate is 12% and the average collection period is 72 days. The company follows IFRS. On August 8, 2020, Cullumber shipped books invoiced at $28,000,000 (cost $22,000,000). Prepare the journal entry to record this transaction, including the expected returns. Cullumber follows ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date August 8, 2020 August 8, 2020 August 8, 2020 Account Titles and Explanation (To record sale on account) (To…arrow_forwardFreesure Company manufactures and sells commercial refrigerators. It is currently running a promotion in which it pays a $500 rebate to any customer that purchases a refrigeration unit from one of its participating dealers. The rebate must be returned within 90 days of purchase. Given its historical experience and the ease of obtaining a rebate, Freesure expects all qualifying customers to receive the rebate. Required: Prepare the journal entry to record the sale of a refrigerator to a participating dealer for $6,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education